What are Irs Forms?

An IRS form is a document that taxpayers use to report financial information to the Internal Revenue Service (IRS), the government agency responsible for collecting taxes. These forms are used to report various types of income, claim deductions and credits, and calculate the amount of tax owed or refunded. It is important to fill out the correct IRS form accurately and submit it by the deadline to avoid penalties or delays in processing.

What are the types of Irs Forms?

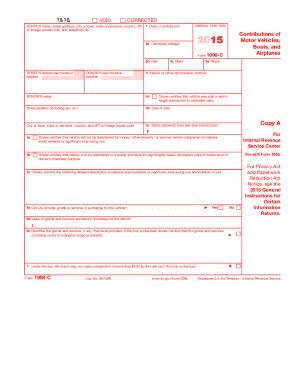

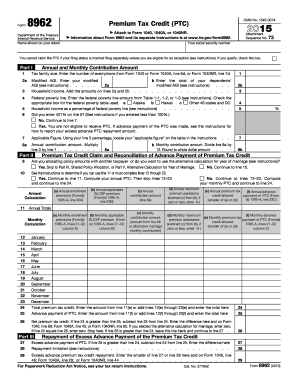

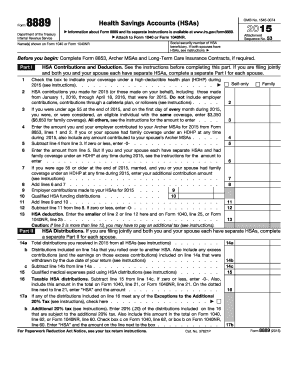

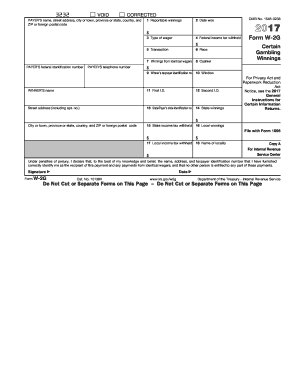

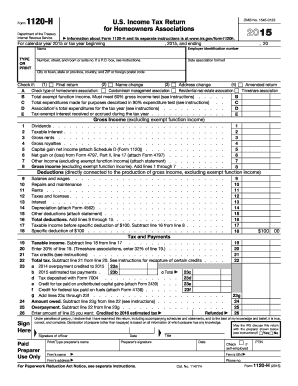

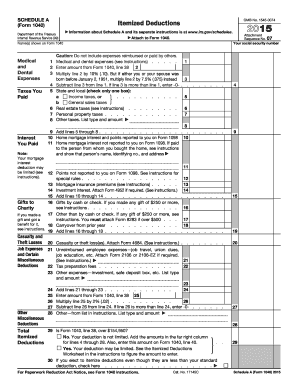

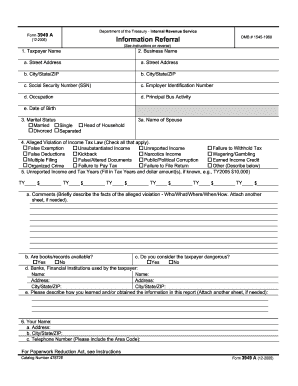

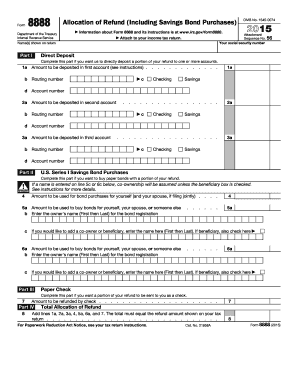

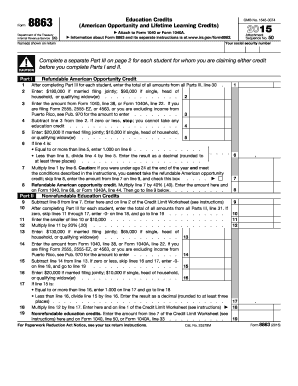

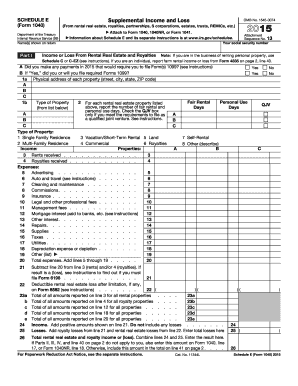

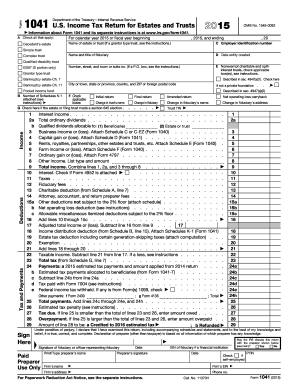

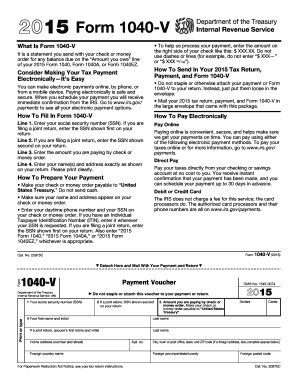

The IRS offers a wide range of forms to accommodate different tax situations. Some common types of IRS forms include:

Form 1040 - U.S. Individual Income Tax Return

Form 1099 - Miscellaneous Income

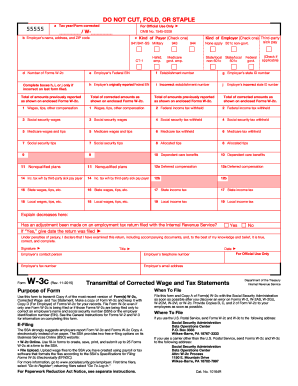

Form W-2 - Wage and Tax Statement

Form 941 - Employer's Quarterly Federal Tax Return

Form 8862 - Information to Claim Earned Income Credit After Disallowance

Form 4506-T - Request for Transcript of Tax Return

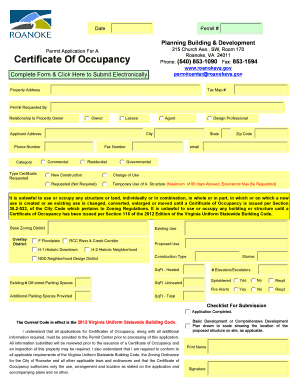

How to complete Irs Forms

Completing IRS forms may seem daunting, but with the right guidance, it can be a straightforward process. Here are some steps to help you complete IRS forms accurately:

01

Gather all necessary information and documents, such as income statements, receipts, and relevant tax records.

02

Read the instructions provided with the IRS form carefully to understand the requirements and ensure you have all the needed information.

03

Fill out the form using either manual entry or an online tool like pdfFiller. Provide accurate and complete information for each field.

04

Double-check your entries for accuracy and make sure you have included all necessary attachments, signatures, and supporting documents.

05

Submit the completed form to the IRS by the specified deadline. Consider using certified mail or electronic filing for faster and secure delivery.

06

Keep a copy of the completed form for your records and retain any related documents in case of future audits or inquiries.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.