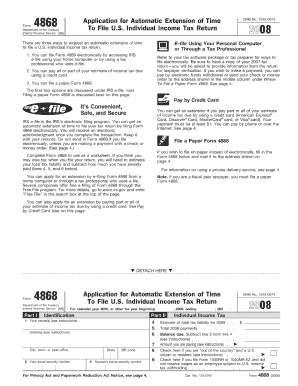

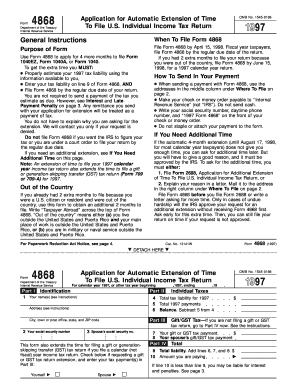

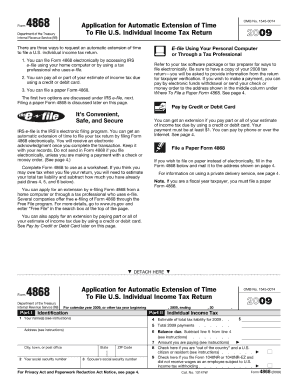

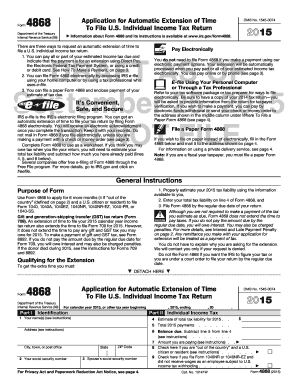

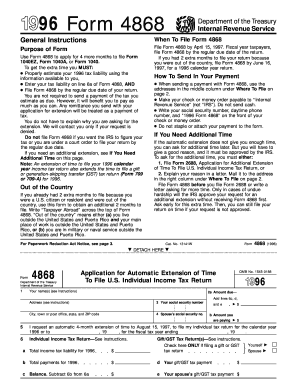

Irs Form 4868

What is Irs Form 4868?

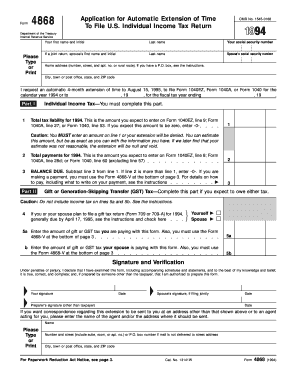

Irs Form 4868 is a document issued by the Internal Revenue Service (IRS) in the United States. It is officially called the "Application for Automatic Extension of Time to File U.S. Individual Income Tax Return." This form is used by individuals who need additional time to file their federal income tax return beyond the April 15th deadline. Filing this form grants them an automatic extension until October 15th to submit their tax return without incurring any late filing penalties.

What are the types of Irs Form 4868?

There is only one type of Irs Form 4868, which is the standard form used for requesting an extension of time to file individual income taxes.

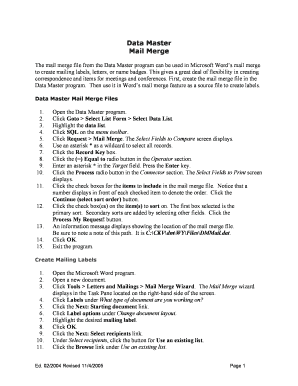

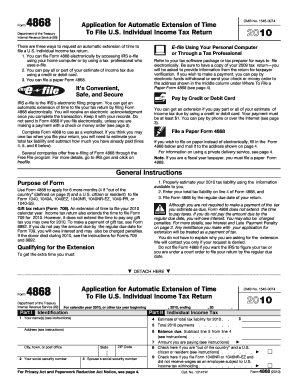

How to complete Irs Form 4868

Completing Irs Form 4868 is a straightforward process. Here are the steps to follow:

Remember that filing Irs Form 4868 does not grant an extension for paying any taxes owed. If you expect to owe taxes, it is recommended to include a payment with the form to avoid potential penalties and interest. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.