What is irs extension 2017?

An IRS extension 2017 is a provision that allows taxpayers to extend the deadline for filing their tax returns. It provides individuals and businesses with extra time to gather necessary documents and accurately complete their tax forms. By filing for an extension, taxpayers can avoid penalties for late filing and have until October 15th to submit their tax returns.

What are the types of irs extension 2017?

There are two types of IRS extensions for the year 2017: automatic and discretionary. The automatic extension allows taxpayers to receive a six-month extension without having to provide a reason. This extension is available to all taxpayers, regardless of their situation or circumstances. On the other hand, a discretionary extension is granted on a case-by-case basis and requires a valid reason for the extension, such as a natural disaster or serious illness.

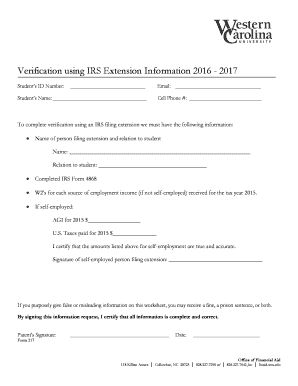

How to complete irs extension 2017

Completing an IRS extension for the year 2017 is a straightforward process. Follow these steps to successfully file for an extension:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and hassle-free.