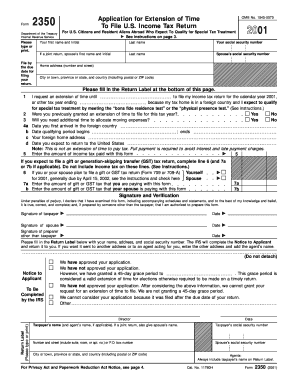

Form 2350

What is form 2350?

Form 2350 is a document that allows taxpayers who are U.S. citizens or residents living abroad to request an extension for filing their federal income tax return. This form is specifically designed for individuals who require additional time to meet their tax obligations due to living outside of the United States.

What are the types of form 2350?

Form 2350 comes in two types: the regular form for those who want to request an extension to file their return, and the form for individuals who want to request an extension to pay their taxes. Both types provide taxpayers with the opportunity to prolong their deadlines, giving them the necessary time to fulfill their tax requirements.

How to complete form 2350

Completing form 2350 is a straightforward process. In order to successfully complete the form, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.