IRS W-4 1990 free printable template

Show details

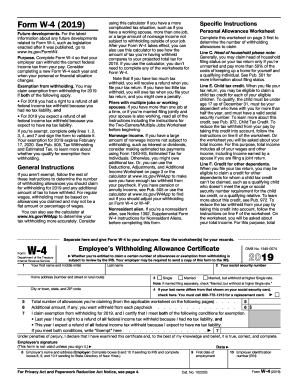

For details obtain Form W-5 from your employer. Check Your Withholding. After your W-4 takes effect you can use PublIcation 919 Is My Withholding Correct for 1990 to see how the dollaramountyou are havingwithheld compares to your estimated total annual tax. Employee s signature 8 Employer s name and address Employer Complete 8 and 10 only if sending to IRS Date 9 Office code 10 Employer identification number optional T12907-2816 Page 2 Form w-4 1990 Deductions and Adjustments Worksheet Note Use...this worksheet only ifyou plan to itemize deductions or claim adjustments to income on your 1990 tax return. 1 Enter an estimate of your 1990 itemized deductions. D Department of the Treasury Internal Revenue Service 1090 Form W-4 Purpose. Complete Form W-4 so that your employer can withhold the correct amount of Federal incometax from your pay. Exemption From Withholding. Read line 6 of the certifcate befow to see if you can claim exempt status. If exempt complete line 6 but do not complete...lines 4 and 5. No Federal income tax will be withheld from your pay. This exemption expires February 15. 1991. Basic Instructions. Employees who are not exempt should complete the Personal Allowances Worksheet. Additional worksheets are provided on page 2 for employees to adjust their withholding allowances based on itemized deductions adjustments to income or two-earner/two-job situations. Complete all worksheets that apply to your situation* The worksheets will help you figure the number of...withholding allowances you are entitled to claim* However you may claim fewer allowances than this. Head of Household. Generally you may claim only if you are unmarried and pay more than 50 of the costs of keeping up a home for yourself and your dependent s or other qualifying individuals. Nonwage Income. If you have a large amount of nonwage income such as interest or dividends you should consider making estimated tax payments using Form 1040-ES* Otherwise you may find that you owe additional...tax atthe end of the year. Two. Earner/Two-Jobs* If you have a working spouse or more than one job figure the total number of allowances you are entitled to claim on all jobs using worksheets from only one Form W-4. Thistotal should be divided amongall jobs* Your withholding will usually be most accurate when all allowances are claimed on the W-4 filed for the highest paying job and zero allowances are claimed for the others. Advance Earned Income Credit. If you are eligible for this credit you...can receive it added to your paycheck throughout the year. Call 1-800424-3676 in Hawaii and Alaska check your local telephone directory to order this publication* Check your local telephone directory for the IRS assistance number if you need further help* Personal Allowances Worksheet A Enter 1 for yourself if no one else can claim you as a dependent. A 1. You are single and have only one job or Enter 1 if 2. You are married have only one job and your spouse does not work or. B 3. Your wages...from a second job oryour spouse s wages orthe total of both are 2 500 or less. more than one job this may help you avoid having too little tax withheld.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-4

How to edit IRS W-4

How to fill out IRS W-4

Instructions and Help about IRS W-4

How to edit IRS W-4

To edit the IRS W-4 form, securely access the already completed version and make necessary changes to your personal information, withholding allowances, or additional amounts. This may be done easily using pdfFiller's online editing tools. Ensure you save any revisions before submitting the updated form to your employer to avoid errors in your withholding calculations.

How to fill out IRS W-4

Filling out IRS W-4 involves a few straightforward steps. First, gather your personal details including your name, address, and Social Security number. Next, follow these steps:

01

Complete the personal information section.

02

Determine your filing status and allowances based on your tax situation.

03

If applicable, indicate any additional amount to be withheld.

04

Sign and date the form.

Make sure all information is accurate to ensure correct withholding from your paycheck.

About IRS W-4 1990 previous version

What is IRS W-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-4 1990 previous version

What is IRS W-4?

IRS W-4, officially known as the Employee's Withholding Certificate, is a tax form used by employees in the United States to instruct their employer on the amount of federal income tax to withhold from their paycheck. Proper completion of the W-4 form is essential to ensure that you pay the correct amount of tax throughout the year.

What is the purpose of this form?

The purpose of the IRS W-4 form is to allow employees to specify their tax withholding preferences, which helps in accurately calculating the amount to be withheld from wages for federal income tax. This is to prevent underpayment or overpayment of taxes, which can lead to penalties or tax refunds at year-end.

Who needs the form?

Any employee in the United States who receives a salary and wishes to adjust the amount of federal taxes withheld from their paycheck must fill out the IRS W-4 form. This includes new hires, employees who want to change their withholding, and those who have experienced life changes, such as marriage or the birth of a child, that affect their tax situation.

When am I exempt from filling out this form?

You may be exempt from filling out IRS W-4 if you had no tax liability in the previous year and expect to have none in the current year. Additionally, if you are a non-resident alien, your tax situation might differ, and you may require a different form.

Components of the form

The IRS W-4 consists of several key components, including personal information, filing status, withholding allowances, additional withholding amounts, and a signature section. Each part plays a role in determining how much tax is withheld from your paychecks.

What are the penalties for not issuing the form?

If you do not submit a completed IRS W-4 form to your employer, they are required to withhold tax as if you are a single filer with no allowances, which may lead to over-withholding. This could result in significant cash flow issues throughout the year, as you might receive a large tax refund instead of keeping that money in your paychecks.

What information do you need when you file the form?

When filing the IRS W-4, you will need personal identification information, including your name, address, Social Security number, filing status details, and the number of dependents you have. Additionally, if you want any additional amounts withheld, be prepared to enter that figure as well.

Is the form accompanied by other forms?

The IRS W-4 form does not typically require accompanying forms when filed with your employer. However, if other tax circumstances apply to your situation, other forms may be necessary for accurate tax reporting. Always consult with a tax advisor for further guidance based on your specific situation.

Where do I send the form?

After completing the IRS W-4, submit the form directly to your employer, not the IRS. Your employer will use the information provided to adjust your withholding in their payroll system. Ensure that you keep a copy of the completed form for your records.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy to understand and user friendly for myself and the receiver of the document

Excellent company. Not only does the PDF Filler work great, but when I asked for the annual fee to be refunded after I neglected to cancel my subscription, it was done so immediately and graciously.

Great Customer Service & Turnaround Time

pdfFiller is a great tool and they have a great Customer centred approach in their services. I recommend them and thumbs up on the work that are doing really.

Excellent customer service

Extremely fast response. It didn't work out for me, but they were very friendly and helpful.

No special revew

No special rewvew

Statement of Impact

OK Enjoyed Will recommend to friends

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.