AL DoR A-4 2000 free printable template

Show details

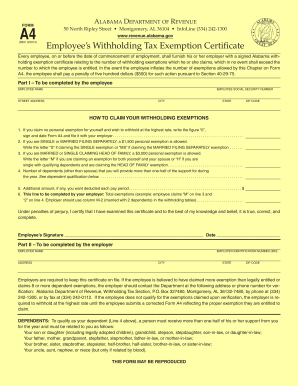

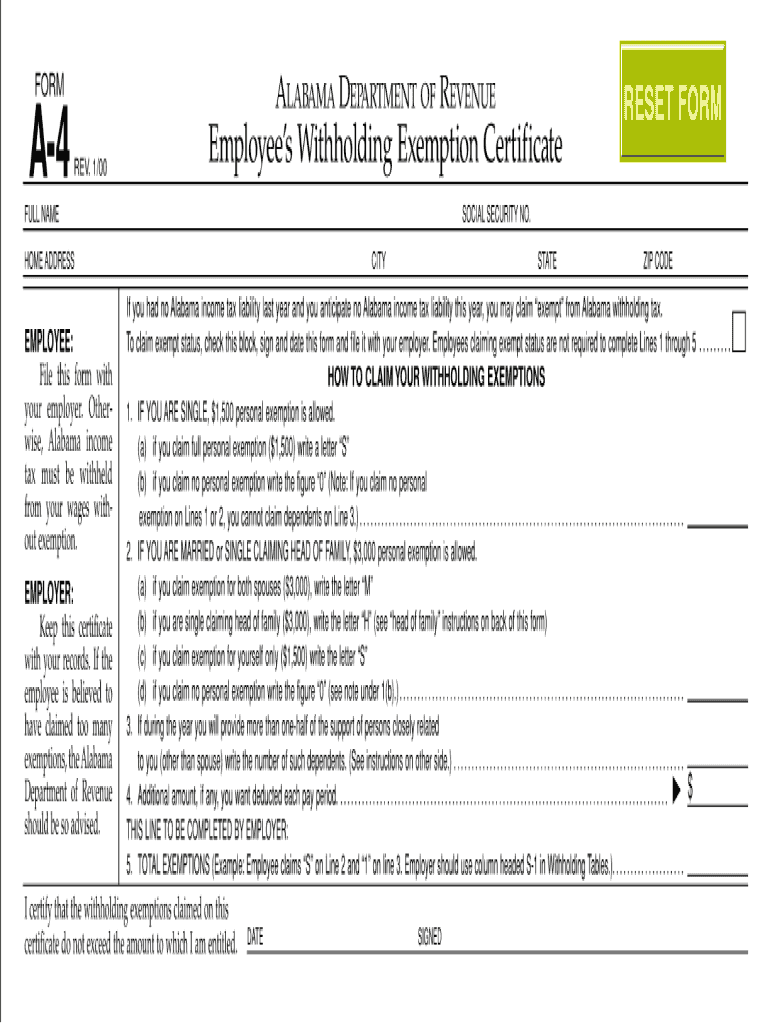

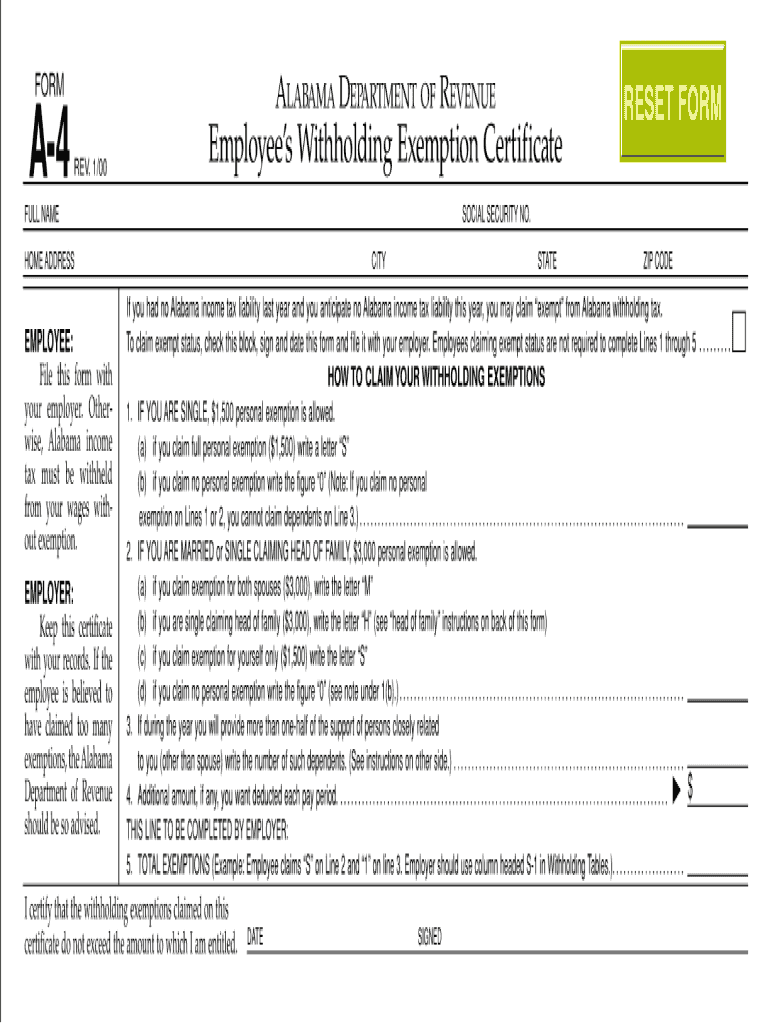

FORM A-4 FULL NAME ALABAMA DEPARTMENT OF REVENUE REV. 1/00 Employee's Withholding Exemption Certificate SOCIAL SECURITY NO. CITY STATE RESET FORM HOME ADDRESS ZIP CODE EMPLOYEE: File this form with

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your alabama a 4 2000 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama a 4 2000 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama a 4 2000 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alabama a 4 2000. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

AL DoR A-4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out alabama a 4 2000

01

To fill out Alabama A 4 2000, start by gathering all the required information and documents. This may include personal identification details, such as your name, address, Social Security number, and date of birth. Additionally, you might need information about any dependents you may have.

02

Once you have all the necessary information, obtain a copy of the Alabama A 4 2000 form. This form is typically available on the official website of the Alabama Department of Revenue or through your employer's payroll department.

03

Read the instructions provided with the form carefully. These instructions will guide you through the process of filling out the form correctly. Familiarize yourself with the specific requirements and guidelines outlined in the instructions.

04

Begin by entering your personal information in the appropriate sections of the form, such as your name and address. Ensure that you provide accurate and up-to-date information.

05

Move on to the section where you report your withholding allowances. This section allows you to claim exemptions that can reduce the amount of tax withheld from your paycheck. carefully review the instructions to determine the number of allowances you are eligible to claim.

06

If you have dependents, fill out the necessary sections to claim any additional withholding allowances or exemptions related to them.

07

Double-check all the information you entered to ensure its accuracy. Mistakes or omissions on the form could lead to issues with your tax withholding.

08

Sign and date the form at the designated areas, certifying that the information provided is correct to the best of your knowledge.

09

If required, submit the completed Alabama A 4 2000 form to your employer's payroll department. They will use this information to determine the appropriate amount of Alabama state income tax to withhold from your paycheck.

Who needs Alabama A 4 2000?

01

Any individual who earns income in the state of Alabama and wants to ensure accurate tax withholding from their paycheck needs to fill out Alabama A 4 2000. This form is used to provide information to employers for proper state income tax withholding.

02

Individuals with Alabama as their state of residence, who are employed and have a liability for Alabama state income tax, must complete this form.

03

If you have recently started a new job, it is essential to fill out Alabama A 4 2000 to ensure your employer withholds the correct amount of state income tax from your earnings. This helps avoid tax penalties and ensures compliance with Alabama tax laws.

Fill form : Try Risk Free

People Also Ask about alabama a 4 2000

What is an A4 form Alabama?

How to fill out Alabama withholding form?

What is the personal exemption for Alabama A4?

How do I become exempt on Alabama state taxes?

How do I fill out a w4 in Alabama?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is alabama a 4 form?

Alabama is a four-letter word.

Who is required to file alabama a 4 form?

The Alabama A-4 form is required to be filed by all Alabama residents who are employed and earning wages in the state of Alabama. This form is used to report the amount of state income tax that must be withheld from an employee’s wages.

How to fill out alabama a 4 form?

To fill out an Alabama A-4 form, you will need the following information:

• Your name

• Your Social Security number

• Your address

• Your employer’s name and address

• Your occupation

• Your wages for the current year and for the year prior

• Any federal, state, or local taxes withheld from your wages

• Any other income you received, such as interest or dividends

• Any deductions you are claiming, such as retirement contributions

• Your filing status

• Your dependents, including their names, Social Security numbers, and ages

• Any credits you are claiming, such as the Earned Income Credit

• Your signature and date

Once you have all of this information, you can fill out the form. Make sure to double-check your entries and sign the form before submitting it.

What is the purpose of alabama a 4 form?

There is no specific term "Alabama A 4 form" that is widely recognized or referred to. It is possible that you may be referring to a specific form or document related to the state of Alabama, but without further clarification or context, it is difficult to provide a specific purpose for it.

If you can provide more details or specify the purpose or context of the form, I'll be happy to assist you.

What information must be reported on alabama a 4 form?

The Alabama A-4 form, also known as the Employee's Withholding Exemption Certificate, requires the following information to be reported:

1. Personal Information: This includes the employee's full name, social security number, address, and date of birth.

2. Marital Status: The employee must indicate their marital status as single, married, or head of household.

3. Exemptions: The employee must state the number of exemptions they are claiming, which generally represents the number of dependents they have.

4. Additional Withholding: If the employee wants to specify an additional amount to be withheld from their paycheck, they must include this amount on the form.

5. Signature and Date: The form must be signed and dated by the employee, certifying that the information provided is accurate.

It is important for employees to review and update their A-4 form whenever there are changes in their personal or financial circumstances that may affect their withholding status.

When is the deadline to file alabama a 4 form in 2023?

The deadline to file Alabama Form A-4 in 2023 is typically April 15th. However, it is recommended to check with the Alabama Department of Revenue or a tax professional for the most accurate and up-to-date information, as the deadline could be subject to change.

What is the penalty for the late filing of alabama a 4 form?

The penalty for the late filing of the Alabama A-4 form, also known as the Employee's Withholding Exemption Certificate, may vary depending on the specific circumstances and the discretion of the Alabama Department of Revenue. However, as of my knowledge cutoff in September 2021, the penalty for late filing typically amounts to $50 or 10% of the tax amount due, whichever is greater. It is advisable to consult the Alabama Department of Revenue or a tax professional for the most accurate and updated information regarding penalties for late filing.

How do I modify my alabama a 4 2000 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign alabama a 4 2000 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Where do I find alabama a 4 2000?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the alabama a 4 2000 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit alabama a 4 2000 on an Android device?

You can edit, sign, and distribute alabama a 4 2000 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your alabama a 4 2000 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.