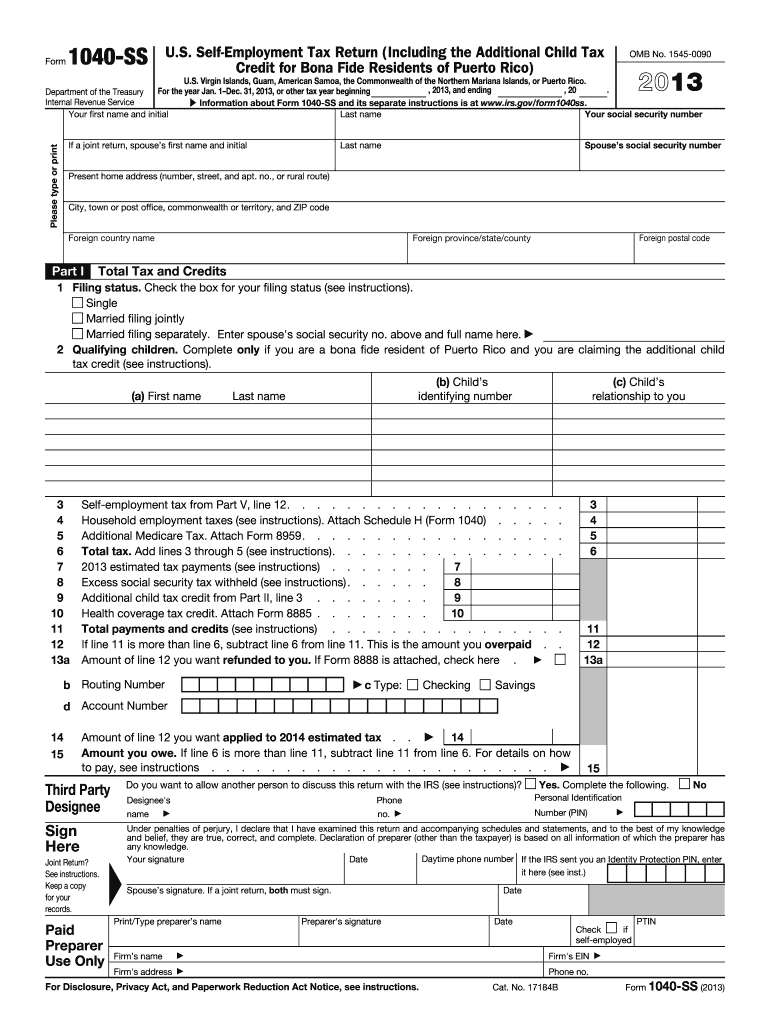

IRS 1040-SS 2013 free printable template

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

How to fill out IRS 1040-SS

About IRS 1040-SS 2013 previous version

What is IRS 1040-SS?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-SS

How do I make changes in [SKS]?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your [SKS] to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit [SKS] on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing [SKS], you need to install and log in to the app.

How do I fill out [SKS] on an Android device?

Use the pdfFiller Android app to finish your [SKS] and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is IRS 1040-SS?

IRS 1040-SS is a tax form used by self-employed individuals who work in the United States but live in American Samoa, to report their income and calculate their self-employment taxes.

Who is required to file IRS 1040-SS?

Individuals who are self-employed and have net earnings of $400 or more or who owe special taxes must file IRS 1040-SS.

How to fill out IRS 1040-SS?

To fill out IRS 1040-SS, carefully read the instructions, provide personal details, report income and deductions, and calculate the self-employment tax, ensuring accuracy before submitting it to the IRS.

What is the purpose of IRS 1040-SS?

The purpose of IRS 1040-SS is to facilitate the filing of self-employment taxes and reporting of income for self-employed individuals living in American Samoa.

What information must be reported on IRS 1040-SS?

IRS 1040-SS requires reporting of personal information, income from self-employment, allowable deductions, and computed self-employment tax.

See what our users say