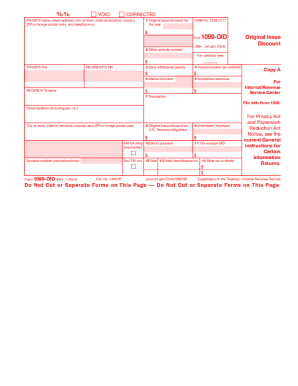

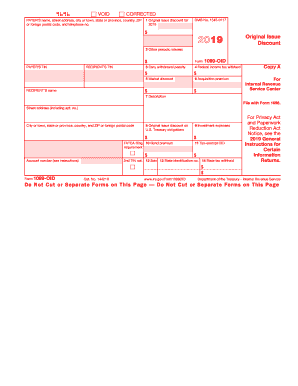

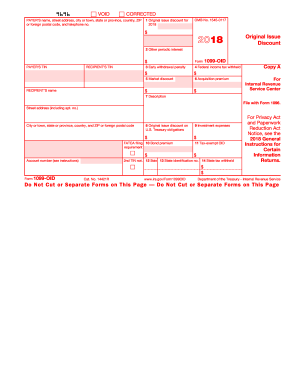

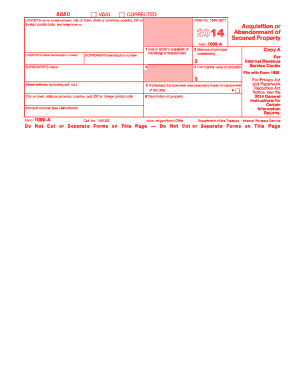

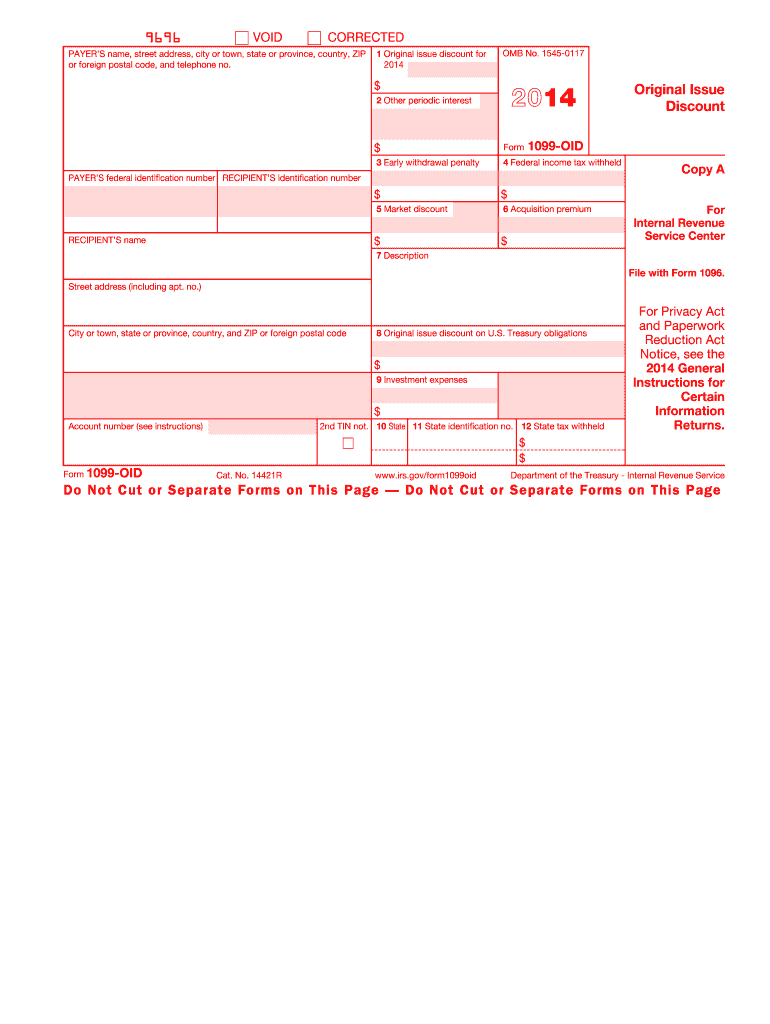

IRS 1099-OID 2014 free printable template

Instructions and Help about IRS 1099-OID

How to edit IRS 1099-OID

How to fill out IRS 1099-OID

About IRS 1099-OID 2014 previous version

What is IRS 1099-OID?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

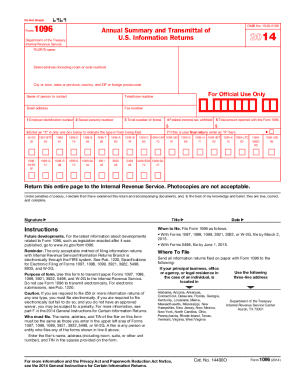

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-OID

What should I do if I realize I made an error on my submitted govform1099oid?

If you discover a mistake after you have submitted your govform1099oid, you will need to file an amended form to correct the information. Ensure all changes are accurately documented to maintain compliance with IRS requirements. In some cases, you may face penalties for late corrections, so acting quickly is advisable.

How can I track the status of my filed govform1099oid?

Tracking your filed govform1099oid can be done through the IRS online portal or by contacting the relevant state agency, if applicable. Be prepared with your submission details as you may need them to verify the status or resolve any issues. Monitoring promptly will help you address any potential processing setbacks.

Are electronic signatures acceptable for submitting a govform1099oid?

Yes, electronic signatures are generally acceptable for the submission of govform1099oid, provided that they comply with IRS regulations regarding authenticity and integrity. Ensure that the e-signature method you choose meets the legal standards to avoid complications during processing.

What are the common errors encountered when filing govform1099oid, and how can I prevent them?

Common errors when filing govform1099oid include inaccurate taxpayer identification numbers and incorrect amounts reported. To prevent these mistakes, double-check information prior to submission and ensure that you are using the most recent form version. Familiarizing yourself with common rejection codes can also help streamline the filing process.

What should I do if I receive a notice from the IRS regarding my govform1099oid?

Receiving a notice from the IRS about your govform1099oid requires prompt attention. Carefully read the notice to understand the issue and gather all relevant documentation to respond. Depending on the notice, you might need to provide additional information or amend your filing to rectify discrepancies.