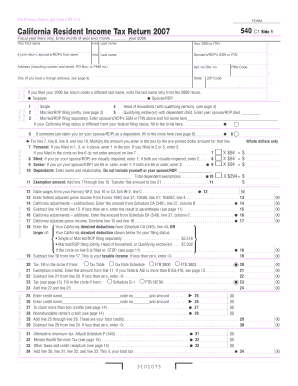

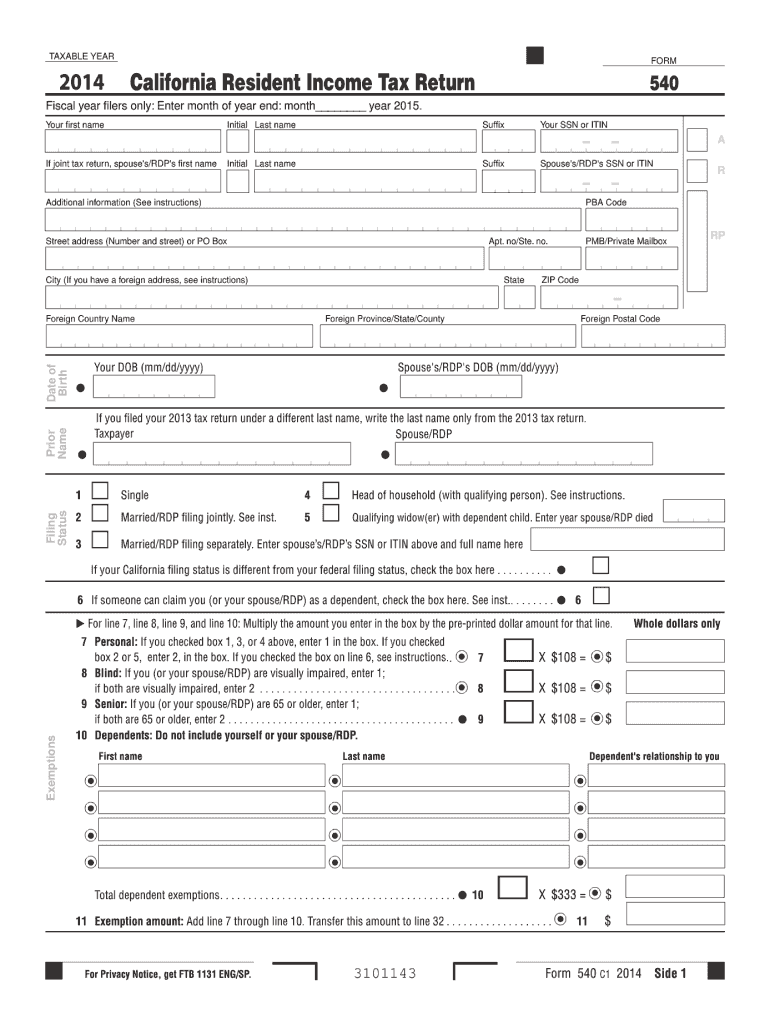

CA FTB 540 2014 free printable template

Instructions and Help about CA FTB 540

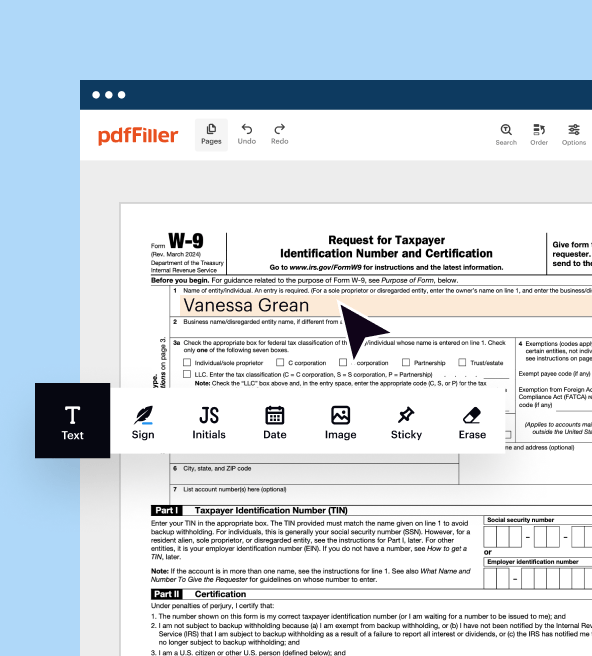

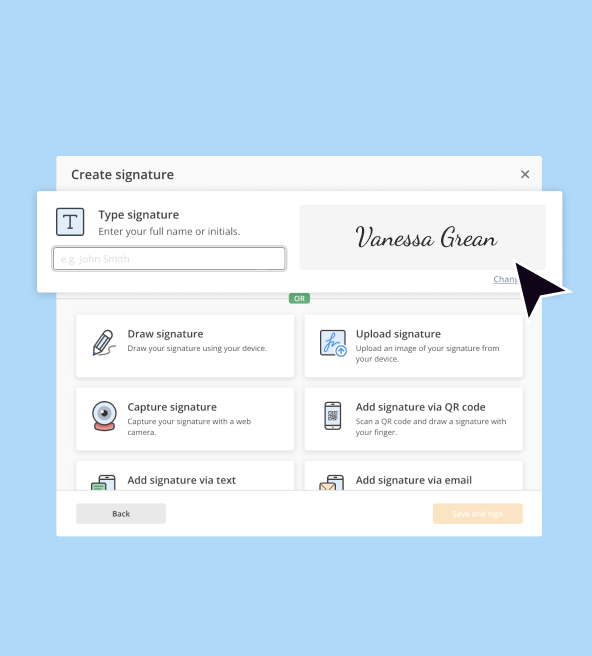

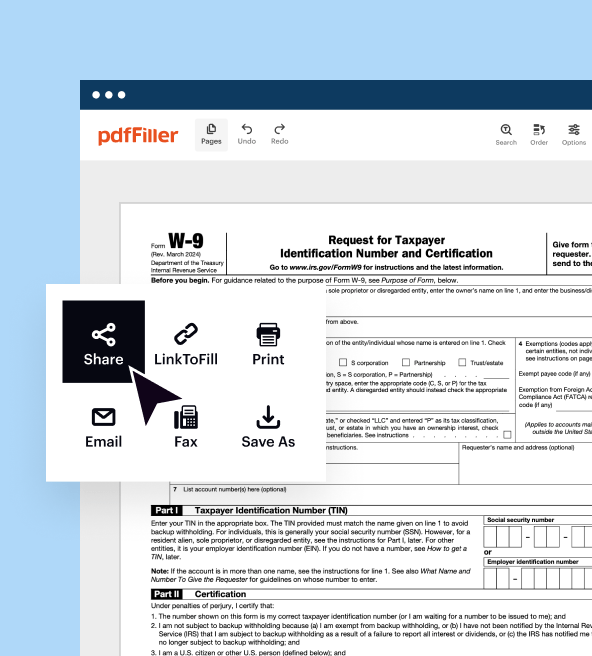

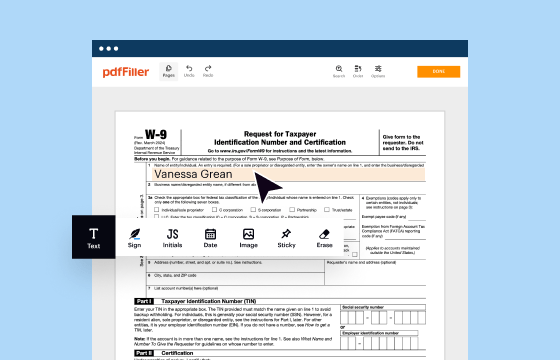

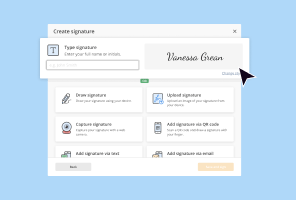

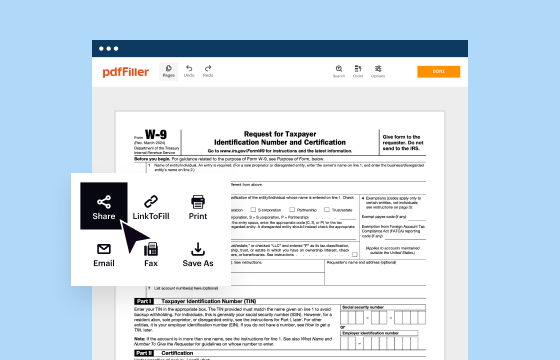

How to edit CA FTB 540

How to fill out CA FTB 540

About CA FTB previous version

What is CA FTB 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

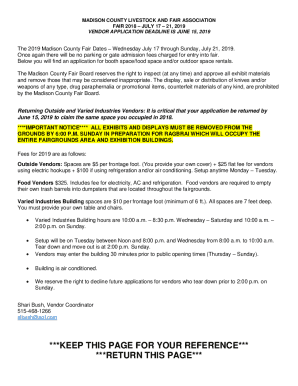

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CA FTB 540

What should I do if I made a mistake on my CA FTB 540?

If you discover an error on your CA FTB 540 after submission, you can file an amended return to correct it. Ensure to indicate clearly which sections of the form are being amended and provide any necessary documentation supporting your changes. Keep in mind the specific deadlines for submitting amendments to avoid penalties.

How can I track the status of my CA FTB 540 after filing?

You can verify the status of your CA FTB 540 by using the California Franchise Tax Board's online tools designed for tracking return processing. You'll need basic details like your Social Security number and the exact amount of your refund or payment to access this information. Familiarize yourself with common rejection codes if you filed electronically and need to troubleshoot any issues.

Are there special considerations for nonresidents filing CA FTB 540?

Nonresidents filing the CA FTB 540 must be aware of specific regulations regarding their income sources. Only income earned from California sources is taxable. It's vital to review the specific guidelines that outline how to report this income accurately while complying with state laws, as additional documentation may be required.

What if I receive a notice or letter from the California FTB regarding my CA FTB 540?

If you receive a notice or letter from the California FTB concerning your CA FTB 540, it is crucial to read and understand the message thoroughly. Prepare any supporting documentation requested and respond by the specified deadline to avoid penalties. Consulting a tax professional may also be beneficial for clarification and assistance in addressing the issue.

See what our users say