IRS 12333 2003 free printable template

Show details

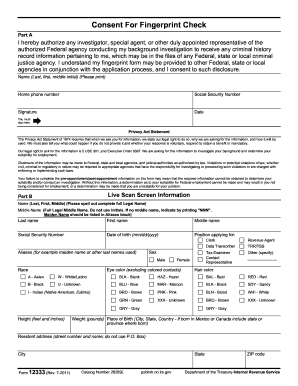

O. Box City Form 12333 Rev. 1-2003 Scars Marks Tattoos State Catalog Number 28289L Other specify Contact Representative Hair color Eye color excluding colored contacts Race TRR/TSS Tax Examiner Sex Aliases for example maiden name or other last names used Revenue Agent Data Transcriber publish.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign form 12333 - jobs

Edit your form 12333 - jobs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 12333 - jobs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 12333 - jobs online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 12333 - jobs. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 12333 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 12333 - jobs

How to fill out IRS 12333

01

Download IRS Form 12333 from the official IRS website.

02

Read the instructions carefully to understand the requirements.

03

Fill out personal information in the appropriate fields, including your name, address, and taxpayer identification number.

04

Provide any necessary financial information as requested on the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the form as directed, either electronically or via mail, ensuring you keep a copy for your records.

Who needs IRS 12333?

01

Individuals or entities who are required to certify certain taxpayer information.

02

Taxpayers seeking to resolve issues with the IRS regarding specific tax benefits.

03

Those who need to disclose foreign bank accounts or financial interests.

04

Taxpayers who need to verify their identity to prevent fraud.

Fill

form

: Try Risk Free

People Also Ask about

Can you use someone else's EFIN number?

This can be confusing, and if you have questions certainly call us at the e-help desk again at 866-255-0654. Please remember that EFINs are not transferable so if you purchase someone else's business or they have purchased yours, you must obtain your own EFIN and undergo that suitability process.

Why do US immigration take fingerprints?

Upon entry into the US, passengers' fingerprints are taken to match those in the database and against other databases to differentiate between legitimate and fraudulent entries. The US Department of State seeks to identify potential security risks to the country.

How do I order a fingerprint card from the IRS?

Call 1-866-255-0654 to obtain fingerprint cards.

What procedures do officials like the police use to record fingerprints?

Fingerprints can be recorded utilizing the following methods: Standard Fingerprint Card (e.g., FD-249 and FD-258)—Use ink to record fingerprint images on standard fingerprint cards. Live Scan—Fingerprint images can be submitted electronically using a live scan device.

Where do your fingerprints come from?

A person's fingerprints are based on the patterns of skin ridges (called dermatoglyphs) on the pads of the fingers. These ridges are also present on the toes, the palms of the hands, and the soles of the feet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 12333 - jobs from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including form 12333 - jobs. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send form 12333 - jobs for eSignature?

When you're ready to share your form 12333 - jobs, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for signing my form 12333 - jobs in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form 12333 - jobs and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is IRS 12333?

IRS 12333 is a form used by organizations and businesses to report certain information to the Internal Revenue Service. It may pertain to specific tax or financial reporting requirements.

Who is required to file IRS 12333?

Organizations and businesses that meet certain criteria specified by the IRS are required to file IRS 12333. This typically includes those involved in activities that require reporting of specific financial information.

How to fill out IRS 12333?

To fill out IRS 12333, you need to provide accurate information as required in the form, including identifying details of the entity, financial data, and any other disclosures mandated by the IRS instructions related to the form.

What is the purpose of IRS 12333?

The purpose of IRS 12333 is to ensure compliance with tax laws and regulations by providing a structured way for relevant organizations and businesses to report necessary financial information to the IRS.

What information must be reported on IRS 12333?

Information that must be reported on IRS 12333 typically includes the entity's identifying details, the nature of the information being reported, financial amounts, and any other specific data required by the IRS for that reporting period.

Fill out your form 12333 - jobs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 12333 - Jobs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.