Get the free Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partn...

Show details

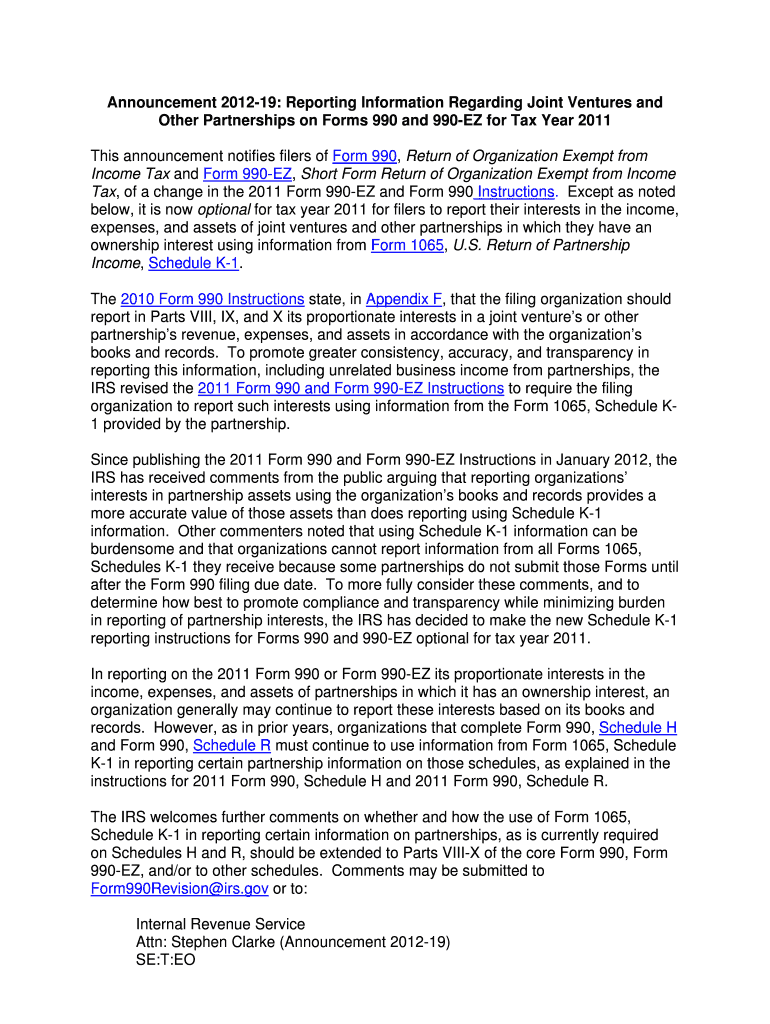

This announcement informs filers of Form 990 and Form 990-EZ about the optional reporting change regarding joint ventures and partnerships for the 2011 tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign announcement 2012-19 reporting information

Edit your announcement 2012-19 reporting information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your announcement 2012-19 reporting information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing announcement 2012-19 reporting information online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit announcement 2012-19 reporting information. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out announcement 2012-19 reporting information

How to fill out Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011

01

Review the guidelines outlined in Announcement 2012-19.

02

Gather all necessary financial information regarding joint ventures and partnerships you participated in during Tax Year 2011.

03

Complete Form 990 or Form 990-EZ, making sure to include information regarding each joint venture and partnership.

04

Ensure that you specify the nature of the partnership or joint venture and report relevant financial data, including income and expenses.

05

Double-check for accuracy and completeness before submission.

06

Submit Form 990 or 990-EZ to the IRS by the due date.

Who needs Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

01

Organizations required to file Forms 990 and 990-EZ and have engaged in joint ventures or partnerships during Tax Year 2011.

02

Tax-exempt organizations that report their financial activities to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Which schedule must be filed with IRS Form 990 to collect information regarding the provision of charity care by not for profit hospitals?

Purpose of Schedule Hospital organizations use Schedule H (Form 990) to provide information on the activities and policies of, and community benefit provided by, its hospital facilities and other non-hospital health care facilities that it operated during the tax year.

What is a Schedule J on a 990?

Purpose of Schedule Schedule J (Form 990) is used by an organization that files Form 990 to report compensation information for certain officers, directors, individual trustees, key employees, and highest compensated employees, and information on certain compensation practices of the organization.

What qualifies as a joint venture?

Both spouses must elect qualified joint venture status on Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors by dividing the items of income, gain, loss, deduction, credit, and expenses in ance with their respective interests in such venture.

What is the Schedule F of the 990?

Purpose of Schedule Schedule F (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, to provide information on its activities conducted outside the United States by the organization at any time during the tax year.

What is the Schedule B of the 990?

Contributions reportable on Schedule B (Form 990) are contributions, grants, bequests, devises, and gifts of money or property, whether or not for charitable purposes. For example, political contributions to section 527 political organizations are included.

What is the Schedule D of the 990?

Schedule D (Form 990) is used by an organization that files Form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information.

What form should income from qualified joint ventures be reported on?

Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file Form 990 to provide the IRS with the information required by section 6033.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

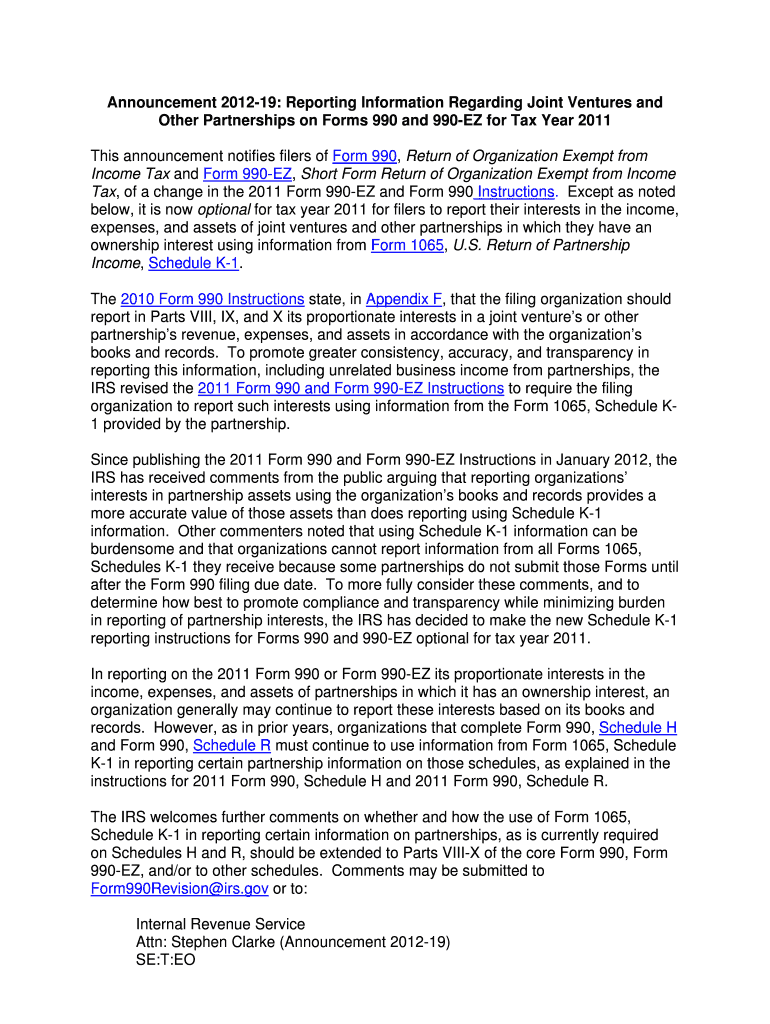

What is Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

Announcement 2012-19 provides guidance on the reporting of information regarding joint ventures and other partnerships by tax-exempt organizations on Forms 990 and 990-EZ for the tax year 2011. It outlines the requirements and instructions for compliance.

Who is required to file Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

Organizations that are exempt from federal income tax under section 501(c)(3) and other relevant sections, which have participated in joint ventures or partnerships during the tax year 2011, are required to file this announcement.

How to fill out Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

To fill out the forms, organizations must follow the specific instructions provided in the announcement. They need to report the names of joint ventures, the nature of their involvement, and the financial information as required in the relevant sections of Forms 990 and 990-EZ.

What is the purpose of Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

The purpose of the announcement is to ensure transparency and compliance in the reporting of financial activities related to joint ventures and partnerships by tax-exempt organizations, helping maintain accountability.

What information must be reported on Announcement 2012-19: Reporting Information Regarding Joint Ventures and Other Partnerships on Forms 990 and 990-EZ for Tax Year 2011?

Organizations must report details such as the names of the joint ventures or partnerships, the type of activities conducted, the percentage of ownership interest, and financial contributions made, among other specified information.

Fill out your announcement 2012-19 reporting information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Announcement 2012-19 Reporting Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.