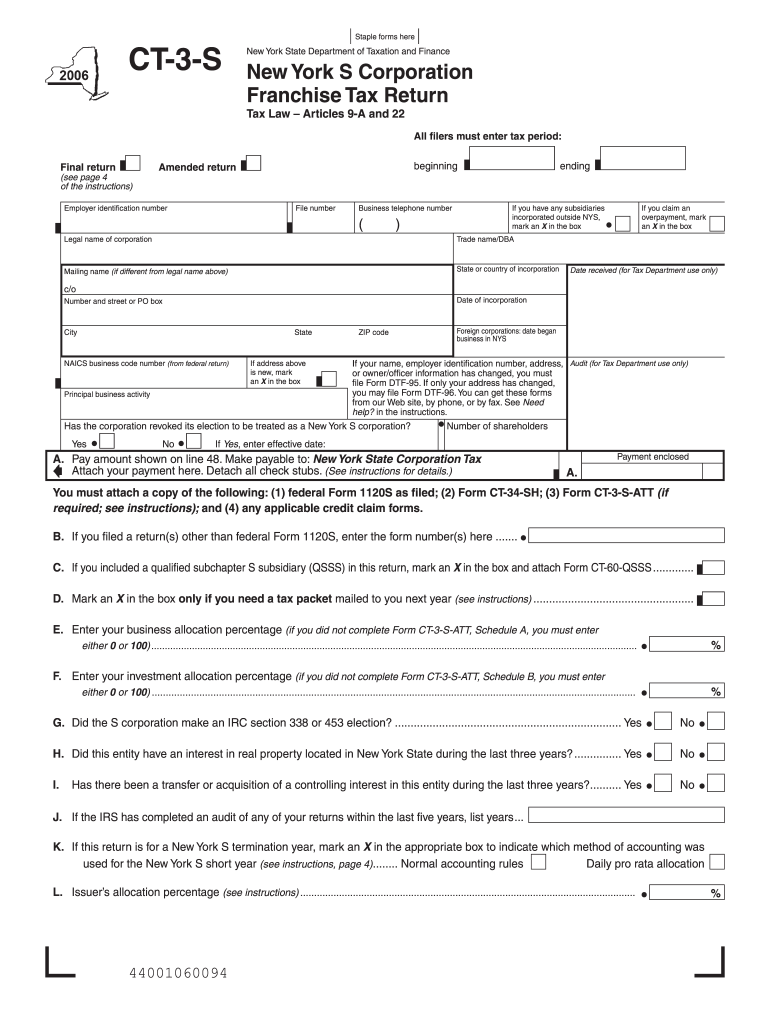

Who needs Form CT-3-S?

New York business corporations that are qualified as small businesses can file their state franchise tax with a CT-3-S form.

What is Form CT-3-S for?

In general, this is a usual tax return that provides all necessary information on the financial status of the submitter and which is used to evaluate the amount of money that must be taxed.

Is Form CT-3-S accompanied by other forms?

The following documents must be attached and filed along with this particular Return:

-

Federal Form 1120S — U.S. Income Tax Return for an S Corporation as it was filed;

-

Form CT-34-CH — New York S Corporation Shareholders’ Information Schedule;

-

Form CT-3-S-ATT (if required) — Attachment to Form CT-3-S;

When is Form CT-3-S due?

Article 9-A corporations are not responsible for the penalty on the underpayment of estimated tax for tax periods beginning on or after January 1, of the current year, and before January 1, of the next year.

How do I fill out Form CT-3-S?

The following information must be provided in order to complete the form:

-

Indication whether this document is a Final or Amended return;

-

Indication of the tax period;

-

Business information (including Employer Identification Number; File number; Legal name of corporation; Address, etc.)

-

The information for the corresponding income lines from submitter’s federal Form 1120S, Schedule K;

-

The information for the corresponding income lines from submitter’s federal Form 1120S, Schedule M-2;

-

Information on the tax computation (final amounts);

-

Information on amended return;

Once completed, this form must be certified with the sign of the authorized person.

Where do I send Form CT-3-S?

Once completed and signed, this form must be directed to the appropriate office. For the address please see the instructions — https://www.tax.ny.gov/forms/corp_up_to_date_info.htm#CT-3-S-I