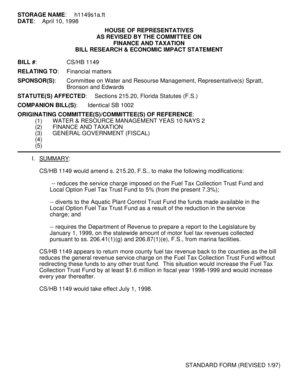

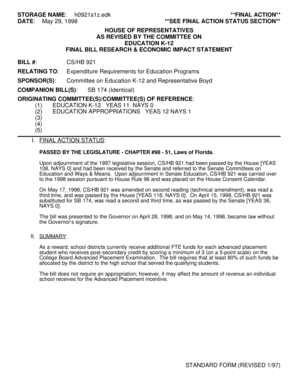

Get the free virginia sales tax exemption form st 11

Show details

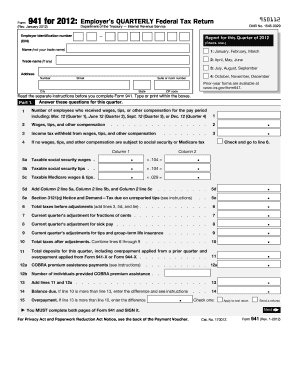

FORM ST-11 COMMONWEALTH OF VIRGINIA SALES AND USE CERTIFICATE OF EXEMPTION TO: Date: (Name of Supplier) (Number and Street or Rural Route), Virginia City, Town, or Post Office (ZIP code) The Virginia

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign virginia sales tax exemption

Edit your virginia sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your virginia sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit virginia sales tax exemption online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit virginia sales tax exemption. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out virginia sales tax exemption

How to Fill Out Virginia Sales Tax Exemption:

01

Obtain the necessary forms: To fill out the Virginia sales tax exemption form, you will first need to acquire the appropriate form from the Virginia Department of Taxation. The most commonly used form is the ST-12, which can be found on their official website.

02

Provide your business information: Start filling out the form by entering your business name, address, and contact details. This information helps the Department of Taxation identify the business for which the exemption is being claimed.

03

Indicate exemption type: Next, you need to specify the type of exemption you are claiming. Virginia offers various exemptions such as manufacturing, resale, nonprofit, and agricultural exemptions. Select the category that applies to your situation.

04

Include supporting documentation: Depending on the type of exemption, you may be required to submit additional documentation to support your claim. For example, if claiming a manufacturing exemption, you might need to provide proof of equipment purchases or production records. Ensure that all required supporting documents are properly attached to the form.

05

Complete purchase details: Provide a detailed description of the purchases for which you are seeking exemption. Include the date, description of the item or service, and the amount. Be specific and accurate to avoid any discrepancies or delays in processing the exemption.

06

Sign and date the form: Once you have filled out the form completely, review all the information to ensure accuracy. Then, sign and date the form to certify that the information provided is true and accurate to the best of your knowledge.

Who Needs Virginia Sales Tax Exemption:

01

Businesses engaged in manufacturing: Manufacturers in Virginia can qualify for a sales tax exemption on materials and machinery used directly in the manufacturing process. This exemption encourages growth in the manufacturing sector and helps reduce production costs.

02

Resellers: Businesses that sell products for resale may also be eligible for a sales tax exemption. This exemption allows resellers to avoid paying sales tax on the inventory they purchase, helping them maintain competitive pricing.

03

Nonprofit organizations: Certain nonprofits, such as charities and religious institutions, may qualify for sales tax exemption on purchases made for their nonprofit activities. This exemption helps support the valuable work done by these organizations by reducing their financial burden.

04

Agricultural businesses: Farmers and agricultural businesses can often claim sales tax exemption on items used for farming purposes. This exemption aims to support the agricultural industry by reducing costs for farmers.

By correctly filling out the Virginia sales tax exemption form, eligible businesses and organizations can benefit from a reduction in sales tax liabilities, ultimately saving money and promoting economic growth in the state.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify virginia sales tax exemption without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your virginia sales tax exemption into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit virginia sales tax exemption on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign virginia sales tax exemption right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete virginia sales tax exemption on an Android device?

On Android, use the pdfFiller mobile app to finish your virginia sales tax exemption. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is tax exempt form va?

Tax exempt form va is a document used to claim exemption from paying certain taxes in the state of Virginia.

Who is required to file tax exempt form va?

Non-profit organizations, government agencies, and individuals with specific eligibility criteria are required to file tax exempt form va.

How to fill out tax exempt form va?

Tax exempt form va can be filled out by providing information about the entity seeking exemption, the reason for exemption, and any supporting documentation.

What is the purpose of tax exempt form va?

The purpose of tax exempt form va is to allow eligible entities to claim exemption from certain taxes in Virginia.

What information must be reported on tax exempt form va?

Information such as the entity's name, address, tax identification number, and the specific taxes from which exemption is being claimed must be reported on tax exempt form va.

Fill out your virginia sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Virginia Sales Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.