Get the free st 105 fillable form

Show details

Form ST-105 Indiana Department of Revenue. State Form 49065 R4/I B-05 General Sales Tax Exemption Cert came purchase of, VEI IE, or Purchaser ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st 105 form

Edit your st 105 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st 105 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st 105 form online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit st 105 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st 105 form

How to fill out st 105 form?

01

Gather all necessary information and documents, such as personal details, income records, and relevant tax forms.

02

Carefully read and review the instructions provided with the st 105 form to ensure understanding of the requirements and guidelines.

03

Begin filling out the form by entering your name, address, Social Security number, and other requested personal information.

04

Follow the prompts on the form to accurately report your income, deductions, and credits. Be sure to double-check all entered figures for accuracy.

05

If applicable, provide any additional information or explanations as requested on the form.

06

Sign and date the completed st 105 form before submitting it to the appropriate tax authority.

Who needs st 105 form?

01

Individuals who are required to file their state income taxes.

02

Taxpayers who have earned income in the state where the st 105 form is applicable.

03

Those who need to report their income, deductions, and credits to the respective tax authority in compliance with the state's tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How much is a Texas resale certificate?

How much does a Resale Certificate cost in Texas? There is no cost for a resale certicate in Texas.

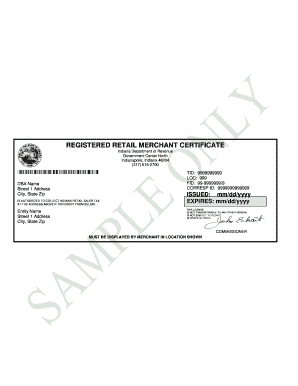

How do I get a reseller permit in NY?

Quick List of Requirements to Apply for a General Vendor License Basic Individual License Application. Proof of Eligibility to Apply for a General Vendor License. Current Color Passport-size Photograph of License Applicant. Certificate of Authority. General Vendor Questionnaire. General Vendor Residence Form.

How do I get tax exemption?

Tax exemptions can be availed by investing in the following tools: Senior Citizen Savings Scheme (SCSS) Sukanya Samriddhi Yojana (SSY) National Pension Scheme (NPS) Public Provident Fund (PPF) National Pension Scheme (NPS)

What is a resale certificate New York?

A New York Resale Certificate (also called a sales tax exemption certificate) is a document that allows businesses to purchase items for resale without paying sales tax. Resale certificates are issued by the NY Department of Revenue and Taxation.

What is reseller certificate in USA?

A resale certificate is a document proving that you are a legitimate retailer or purchaser and are buying products to either resell or use as component parts of products you plan to resell. To use a resale certificate, you generally need to be registered to collect sales tax in at least one US state.

How do I get a resale certificate?

But how do you get a resale certificate? You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an address—not the state in which you are incorporated, if it's different.

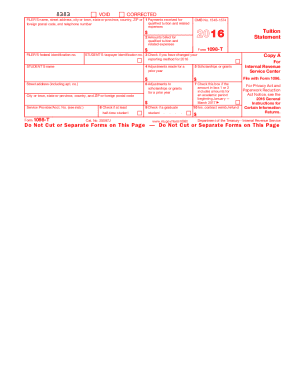

Does Indiana form ST 105 expire?

To get a resale certificate in Indiana, you will need to fill out the Indiana General Sales Tax Exemption Certificate (ST-105). How often should this certificate be renewed? It appears that a blanket certificate in Indiana does not expire.

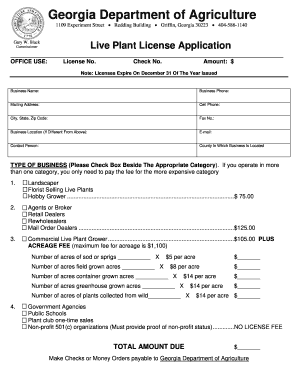

How much is a resellers license in Florida?

Florida does not charge a fee for applying for a seller's permit, and your license won't expire unless you don't use it for more than a year. If your Florida seller's permit has been canceled for any reason, you need to obtain a new one before resuming sales in the state.

What is an Indiana ST 105 form?

Indiana Form ST-105, General Sales Tax Exemption Certificate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my st 105 form in Gmail?

st 105 form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out the st 105 form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign st 105 form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out st 105 form on an Android device?

Use the pdfFiller app for Android to finish your st 105 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

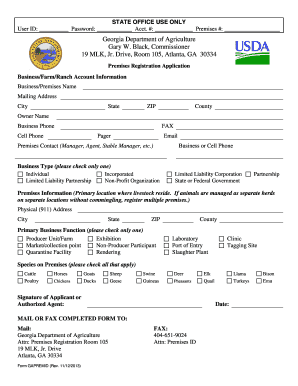

What is st 105 form?

The ST-105 form is a sales tax exemption certificate used in the state of New York. It allows purchasers to buy certain goods without paying sales tax, declaring that the goods are being purchased for resale or for a specific exempt purpose.

Who is required to file st 105 form?

Businesses or individuals who make tax-exempt purchases, typically for resale or specific exempt uses, are required to complete and provide the ST-105 form to sellers.

How to fill out st 105 form?

To fill out the ST-105 form, you need to provide your name, address, seller's name, the type of goods being purchased, and the reason for the tax exemption. It's important to sign and date the form to validate it.

What is the purpose of st 105 form?

The purpose of the ST-105 form is to document tax-exempt purchases and to inform sellers that they should not charge sales tax on qualifying transactions.

What information must be reported on st 105 form?

The ST-105 form requires information such as the purchaser's name and address, seller's information, a description of the property or services being purchased, the exempt purpose, and the signature of the purchaser.

Fill out your st 105 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St 105 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.