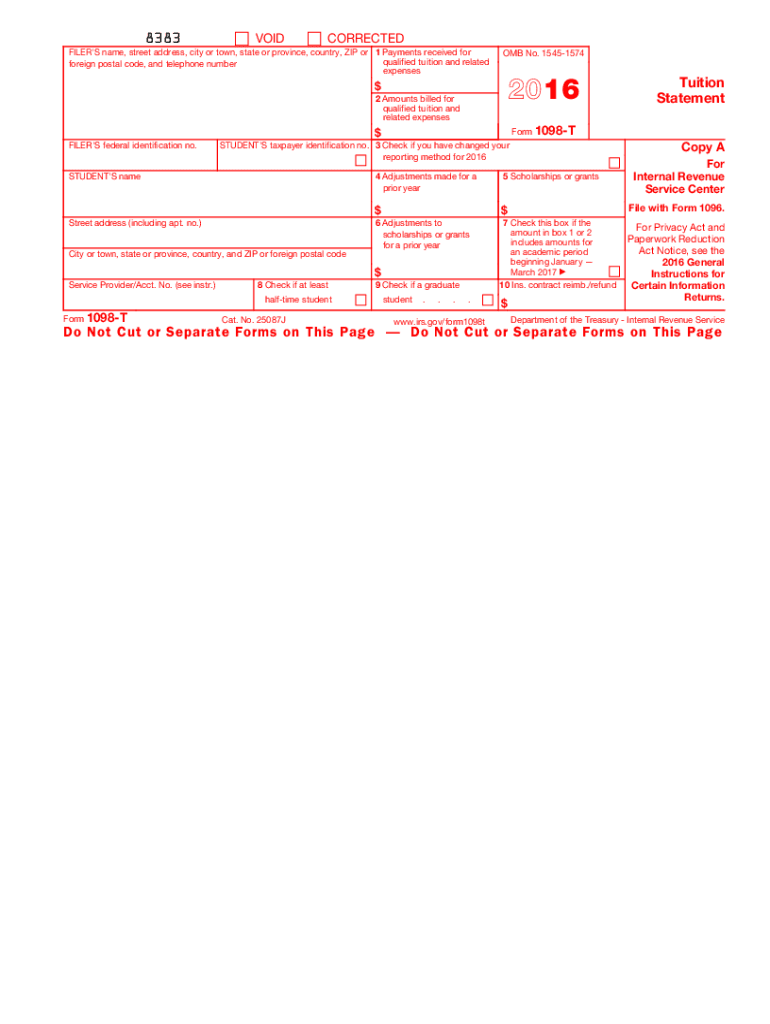

IRS 1098-T 2016 free printable template

Instructions and Help about IRS 1098-T

How to edit IRS 1098-T

How to fill out IRS 1098-T

About IRS 1098-T previous version

What is IRS 1098-T?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1098-T

What should I do if I find a mistake on my IRS 1098-T after filing?

If you discover an error on your IRS 1098-T after submission, it is crucial to file a corrected form. You can submit the amended 1098-T to the IRS, ensuring that you indicate it as a correction. Always retain copies of both the original and amended forms for your records.

How can I verify if my IRS 1098-T has been processed?

To verify the status of your e-filed IRS 1098-T, you can use the IRS e-File status tool, which allows you to check if your submission has been received and processed. Be aware of common rejection codes that may indicate issues with your filing.

Are there any special considerations for filing IRS 1098-T for nonresident aliens?

When filing IRS 1098-T for nonresident aliens, it is essential to address the withholding tax obligations that may apply. Additionally, ensure that the correct tax identification numbers are used and that recipients are properly informed about their tax responsibilities.

What should I do if my IRS 1098-T submission is rejected?

If your IRS 1098-T is rejected, review the rejection notice for specific error codes and reasons. You should correct the mistake and resubmit the form promptly. Note that some e-filing services may offer refunds for submission fees in the event of a rejection.

How long should I retain copies of my IRS 1098-T?

It is recommended to retain copies of your IRS 1098-T for at least three years from the date of filing. This retention period helps ensure you have the necessary documentation on hand in case of an audit or inquiry related to your tax filings.

See what our users say