IL RUT-50 Instructions 2010 free printable template

Show details

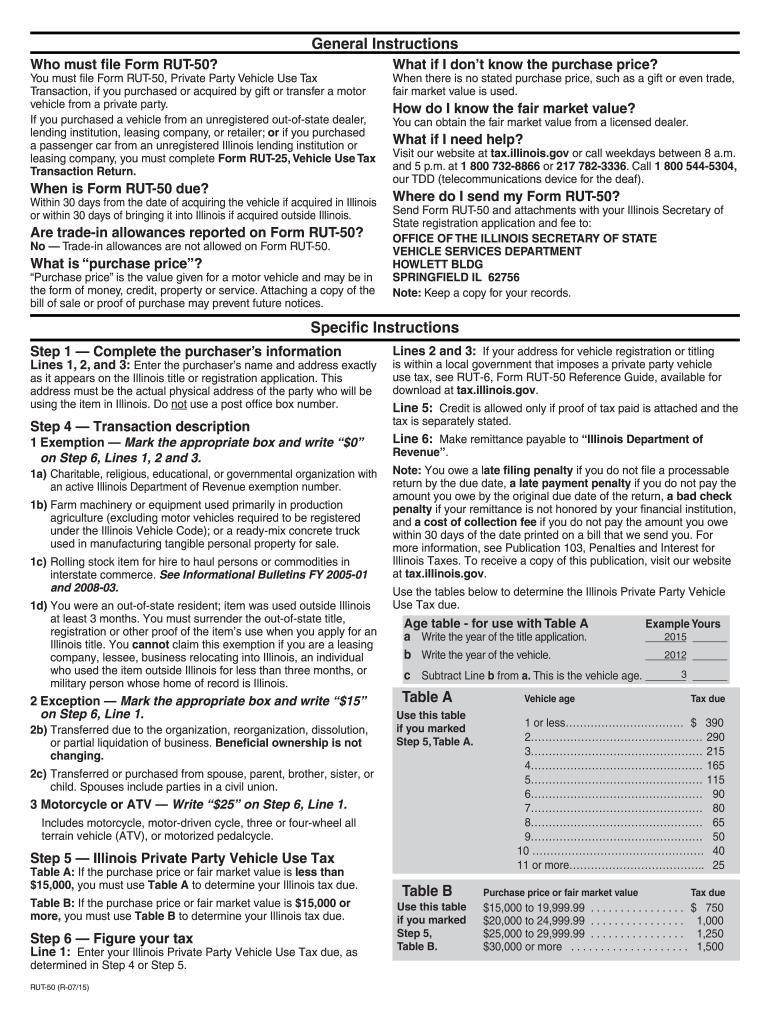

General Instructions

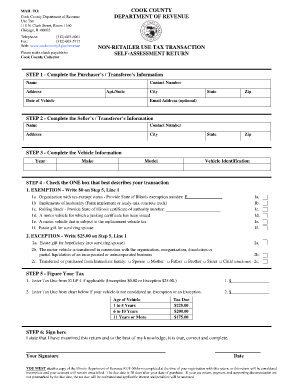

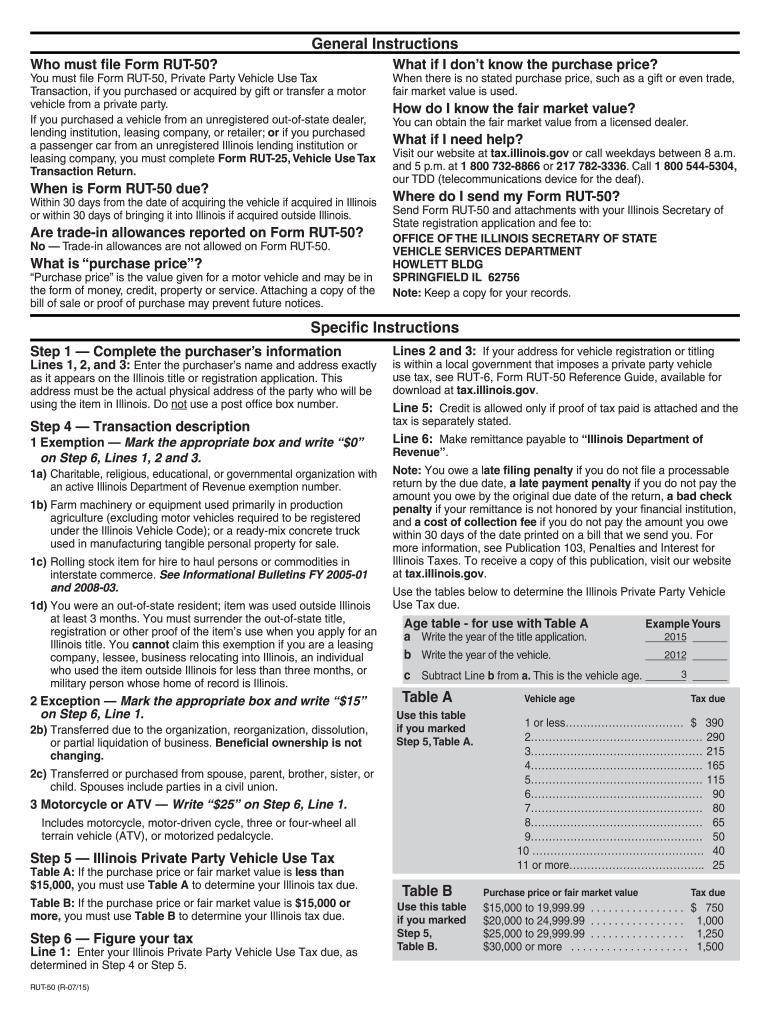

Who must file Form RUT50? You must file Form RUT50, Private Party Vehicle Use Tax

Transaction, if you purchased or acquired by gift or transfer a motor

vehicle from a private

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL RUT-50 Instructions

Edit your IL RUT-50 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL RUT-50 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL RUT-50 Instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL RUT-50 Instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL RUT-50 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL RUT-50 Instructions

How to fill out IL RUT-50 Instructions

01

Obtain the IL RUT-50 form from the appropriate Illinois Department of Revenue website or office.

02

Fill in the tax year at the top of the form.

03

Provide your name and address in the designated fields.

04

Enter your identification number, such as your Social Security number or federal employer identification number.

05

Complete the section regarding your business type and nature of your tax liability.

06

Report your total gross receipts, including any applicable deductions.

07

Calculate the total tax due based on the provided tax rates and any exemptions.

08

Sign and date the form at the bottom to certify the accuracy of the information provided.

09

Submit the completed form by mail or electronically, as instructed.

Who needs IL RUT-50 Instructions?

01

Individuals and businesses in Illinois who are required to report and pay taxes related to their business activities or sales.

02

Tax preparers assisting clients with sales and related tax obligations in the state.

03

Any entity that engages in taxable transactions and needs to comply with the Illinois Department of Revenue regulations.

Fill

form

: Try Risk Free

What is rut 50 form?

Form RUT-50 must be filed by a person or business titling a motor vehicle in Illinois when the person or business: ... moved into Illinois with a motor vehicle he or she owns that was originally purchased or acquired by gift or transfer from a private party.

People Also Ask about

Where can I get a rut 50 in Illinois?

These forms are available at the offices of the Illinois Secretary of State, the Illinois Department of Transportation, or the Illinois Department of Natural Resources. If you need to obtain the forms prior to registering the vehicle, send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302.

What is Rut 50 tax Illinois?

You must file Form RUT-50, Private Party Vehicle Use Tax. Transaction, if you purchased or acquired by gift or transfer a motor. vehicle from a private party. If you purchased a vehicle from an unregistered out-of-state dealer, lending institution, leasing company, or retailer; or if you purchased.

What is a rut 25 form?

You must complete Form RUT-25, Vehicle Use Tax Transaction Return, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you purchased from an unregistered out-of-state dealer or retailer.

What is a rut-50 in Illinois?

Form RUT-50 must be filed by a person or business titling a motor vehicle in Illinois when the person or business: purchased or acquired a motor vehicle by gift or transfer from a private party either within or outside Illinois; or.

What is a rut-25 LSE form?

Forms RUT-25, RUT-25-LSE, and RUT-50 are generally obtained when you license and title your vehicle at the applicable state facility or at a currency exchange. Do not make copies of the forms prior to completing. These forms have unique transaction numbers that should not be duplicated. Doing so could delay processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IL RUT-50 Instructions directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IL RUT-50 Instructions and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit IL RUT-50 Instructions from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IL RUT-50 Instructions into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in IL RUT-50 Instructions?

The editing procedure is simple with pdfFiller. Open your IL RUT-50 Instructions in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

What is IL RUT-50 Instructions?

IL RUT-50 Instructions are guidelines provided by the Illinois Department of Revenue for taxpayers to report their use tax on purchases made from out-of-state sellers.

Who is required to file IL RUT-50 Instructions?

Any individual or business in Illinois that has made purchases from out-of-state sellers and did not pay sales tax at the time of purchase must file IL RUT-50 Instructions.

How to fill out IL RUT-50 Instructions?

To fill out IL RUT-50 Instructions, gather all necessary documentation of purchases, complete the form with accurate details of transactions, including the total amount of purchases and any applicable use tax, and submit it to the Illinois Department of Revenue.

What is the purpose of IL RUT-50 Instructions?

The purpose of IL RUT-50 Instructions is to help taxpayers accurately report and pay use tax on items purchased from out-of-state sellers to ensure compliance with Illinois tax laws.

What information must be reported on IL RUT-50 Instructions?

IL RUT-50 Instructions require reporting information such as the purchaser's name and address, the seller's name and address, the dates of purchase, the description of the items purchased, and the total use tax owed.

Fill out your IL RUT-50 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL RUT-50 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.