Get the free blank loan application

Show details

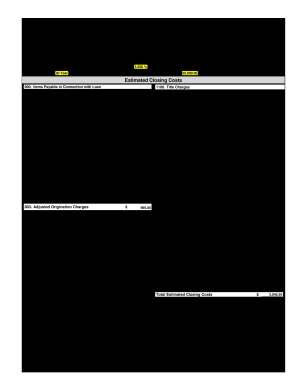

This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as Borrower” or “Co-Borrower,” as applicable. Co-Borrower

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign blank loan application

Edit your blank loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your blank loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit blank loan application online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit blank loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out blank loan application

How to fill out what is a uniform:

01

Start by providing a clear definition of what a uniform is, including its purpose and characteristics.

02

Describe the different types of uniforms that exist in various settings, such as school uniforms, military uniforms, and work uniforms.

03

Discuss the importance of uniforms in promoting unity, professionalism, and safety.

04

Explain the process of selecting a uniform, including considerations such as functionality, comfort, and adherence to any specific regulations or guidelines.

05

Provide examples of how uniforms are typically worn or accessorized, depending on the context and purpose.

06

Conclude by emphasizing the significance of understanding and adhering to uniform policies, as they contribute to a collective identity and overall organizational goals.

Who needs what is a uniform:

01

Students: Uniforms are commonly required in educational institutions, such as schools, to promote equality, discipline, and a sense of belonging among students.

02

Employees: Many companies and organizations enforce a uniform policy to maintain a professional image, improve customer service, and enhance security.

03

Military and law enforcement personnel: Uniforms are an integral part of military and law enforcement operations, serving to distinguish and identify personnel, as well as instill a sense of order and authority.

04

Sports teams: Athletes often wear uniforms to foster team spirit, streamline identification during competitions, and adhere to regulatory guidelines of their respective sports.

05

Hospitality and service industries: Uniforms are frequently utilized in hotels, restaurants, and other service-oriented establishments, enabling staff members to project a unified image and make them easily identifiable to customers.

In summary, understanding how to fill out what is a uniform involves providing a thorough explanation of its definition, purpose, and various types. Additionally, different individuals and organizations require uniforms to promote unity, professionalism, safety, and adherence to specific regulations or guidelines.

Fill

form

: Try Risk Free

People Also Ask about

Who fills out the uniform residential loan application?

Borrowers can either fill the 1003 form in person or mortgage lenders help them fill it out after all the details must have been sent by the borrowers. The 1003 loan application form is also called a Fannie Mae Form 1003, it was developed by the Federal National Mortgage Association, or Fannie Mae.

Why is uniform loan application important?

The application is designed to help lenders establish all the information needed to accurately determine a borrower's risk level by examining the type and terms of the loan, property information, borrower income and expenses, and more.

What is the purpose of the 1003 loan application?

Lenders use the Uniform Residential Loan Application or Form 1003 to evaluate and determine your creditworthiness when applying for a home loan. This form is designed to help lenders make more informed decisions when extending mortgages to borrowers.

What is the difference between ULAD and iLAD?

The iLAD is a “superset” of loan application data based on MISMO v3. 4 that includes all the data in the ULAD Mapping Document and the GSE AUS Specifications. iLAD also includes additional origination data points requested by the industry that may be needed for exchange of loan information.

What is the purpose of the Urla?

The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories.

What is another name for the uniform residential loan application?

Fannie Mae and Freddie Mac (the GSEs) redesigned the Uniform Residential Loan Application (URLA) (Fannie Mae Form 1003) and created new automated underwriting system (AUS) specifications (Fannie Mae Desktop Underwriter® [DU®] Spec) to help lenders better capture relevant loan application information and support the

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the blank loan application in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your blank loan application and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out blank loan application on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your blank loan application by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out blank loan application on an Android device?

Use the pdfFiller Android app to finish your blank loan application and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is blank loan application?

A blank loan application is a standardized form that individuals or businesses fill out to apply for a loan, which typically includes personal, financial, and employment details but initially contains no information.

Who is required to file blank loan application?

Anyone who seeks to borrow money through a formal lending institution, such as banks or credit unions, is required to file a blank loan application.

How to fill out blank loan application?

To fill out a blank loan application, one must provide accurate personal details, financial information, employment history, and specify the loan amount requested, and then review it for completeness and accuracy before submission.

What is the purpose of blank loan application?

The purpose of a blank loan application is to gather necessary information from the borrower to assess creditworthiness and determine eligibility for the loan being requested.

What information must be reported on blank loan application?

The information that must be reported on a blank loan application typically includes personal identification information, employment details, income sources, debts, assets, and the intended purpose of the loan.

Fill out your blank loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.