Get the free Memorandum: Recognition of Gift Card Sale Proceeds - irs

Show details

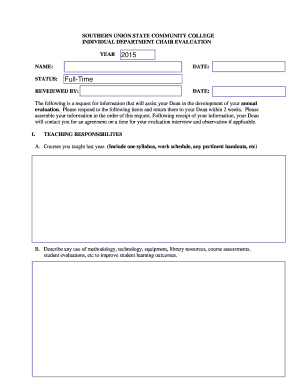

This memorandum from the Office of Chief Counsel of the IRS addresses the tax treatment of gift card sale proceeds, including recognition of income and timing of deductions related to gift cards managed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign memorandum recognition of gift

Edit your memorandum recognition of gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your memorandum recognition of gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit memorandum recognition of gift online

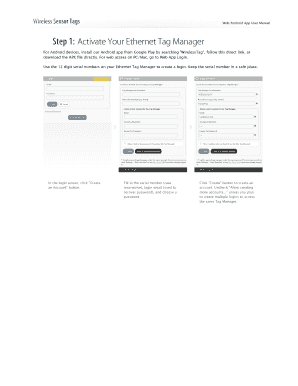

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit memorandum recognition of gift. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out memorandum recognition of gift

How to fill out Memorandum: Recognition of Gift Card Sale Proceeds

01

Begin by entering the date at the top of the memorandum.

02

Clearly state the subject: 'Recognition of Gift Card Sale Proceeds'.

03

Identify the parties involved, including the issuer of the gift cards and the recipient organization.

04

Outline the rationale for recognizing the proceeds from gift card sales.

05

Specify the period during which the gift card sales occurred.

06

Provide the total amount of gift card sale proceeds to be recognized.

07

Include any relevant details, such as terms of usage or expiration dates for the gift cards.

08

Sign the memorandum with the name and position of the individual responsible for issuing it.

09

Distribute copies to all relevant stakeholders for their records.

Who needs Memorandum: Recognition of Gift Card Sale Proceeds?

01

Financial departments of organizations managing gift card programs.

02

Auditors who need to verify the recognition of gift card sale proceeds.

03

Accounting departments for accurate financial reporting.

04

Business owners wanting to keep track of gift card sales.

05

Non-profit organizations recognizing contributions through gift card sales.

Fill

form

: Try Risk Free

People Also Ask about

How do you account for gift card sales?

The sale of a gift certificate should be recorded with a debit to Cash and a credit to a liability account such as Gift Certificates Outstanding. Note that revenue is not recorded at this point.

How are gift card sales recorded in accounting?

Liability Recognition The initial sale of a gift card triggers the recordation of a liability, not a sale. This is a debit to cash and a credit to the gift cards outstanding account.

What is the journal entry for the sale of a gift card?

Gift Cards: IRS categorizes gift cards as “cash” or “cash transaction” (income). Gift card value is reportable regardless of dollar amount. Non-Cash Items: IRS categorizes non-cash items as a taxable benefit (income) regardless of item and/or cost.

How do I record a gift card transaction?

Select Sales receipt. Fill out the sales receipt, then select the payment method and where the gift card amount will be deposited to. Enter a line under PRODUCT/SERVICES and choose the gift certificate you added. Add the gift card amount and the sales tax rate.

How do I account for gift card sales in Quickbooks?

2 Answers 2 When you receive the $50 gift card: credit $50 to an income account, and debit $50 to an asset account (eg ``gift cards''). ie increase the income account by $50, and increase the asset account by $50. When you spend the $50 gift card: debit $50 to your expenses, and credit $50 to the asset account above.

How to recognize gift card revenue?

You Credit (CR) the amount to a liability account for gift cards. For example, the account can be called the Gift Card Liability account, Gift Cards Outstanding account or even Shopify Gift Card account, as long as the account is a current liability account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Memorandum: Recognition of Gift Card Sale Proceeds?

Memorandum: Recognition of Gift Card Sale Proceeds is a document used by businesses to report the income recognized from the sale of gift cards in accordance with accounting principles.

Who is required to file Memorandum: Recognition of Gift Card Sale Proceeds?

Businesses that sell gift cards and need to report the recognition of income from those sales are required to file the Memorandum.

How to fill out Memorandum: Recognition of Gift Card Sale Proceeds?

To fill out the Memorandum, businesses must provide details such as the total gift card sales, the amount of income recognized, and any relevant tax identification information.

What is the purpose of Memorandum: Recognition of Gift Card Sale Proceeds?

The purpose of the Memorandum is to ensure proper reporting of income from gift card sales for taxation and financial reporting purposes.

What information must be reported on Memorandum: Recognition of Gift Card Sale Proceeds?

The Memorandum must include information such as total sales from gift cards, the amount received, the period of recognition, and any necessary business identification details.

Fill out your memorandum recognition of gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Memorandum Recognition Of Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.