Get the free IRS Urges Preparers to Renew PTINs for 2012

Show details

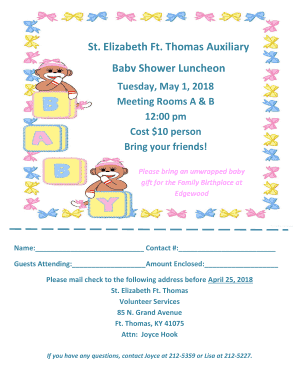

This document serves as a reminder for tax return preparers to renew their PTINs before they expire at the end of the year, providing instructions for online and paper renewal processes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs urges preparers to

Edit your irs urges preparers to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs urges preparers to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs urges preparers to online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs urges preparers to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs urges preparers to

How to fill out IRS Urges Preparers to Renew PTINs for 2012

01

Visit the IRS website.

02

Navigate to the PTIN Renewal section.

03

Log in to your PTIN account or create a new one if you do not have an account.

04

Fill out the renewal application with your personal and professional information.

05

Review your information to ensure accuracy.

06

Submit your application along with the required fee.

07

Keep a copy of your confirmation for your records.

Who needs IRS Urges Preparers to Renew PTINs for 2012?

01

Tax preparers who previously received a PTIN and need to renew it for the 2012 tax year.

02

Individuals preparing tax returns for compensation.

03

Professionals who provide tax services to clients.

Fill

form

: Try Risk Free

People Also Ask about

Can I renew my PTIN now for 2025?

WASHINGTON — The Internal Revenue Service today announced that preparer tax identification number (PTIN) renewals for 2025 are now being processed. The nation's more than 810,000 tax return preparers must renew their PTIN for the coming year. All current PTINs will expire on Dec. 31, 2024.

How much does it cost to renew your PTIN?

Pay the fee – Pay the $19.75 renewal fee via credit/debit/ATM card or eCheck. Upon completion of the application and payment, applicants will receive confirmation that a PTIN has been renewed.

Can I renew my PTIN now for 2025?

WASHINGTON — The Internal Revenue Service today announced that preparer tax identification number (PTIN) renewals for 2025 are now being processed. The nation's more than 810,000 tax return preparers must renew their PTIN for the coming year. All current PTINs will expire on Dec. 31, 2024.

What is the penalty for expired PTIN?

ing to the IRS, the penalty for returns filed in 2024 without a valid PTIN is $60 for each failure, and the maximum penalty is $30,000.

Can you renew PTIN after December 31?

The deadline to apply for or renew a PTIN is usually December 31st of each year, so make sure to complete your renewal by this date to avoid any interruptions in your ability to prepare taxes for clients.

What happens if you forget to renew your PTIN?

What happens if you forget to renew your PTIN? Forgetting to renew your PTIN could result in the imposition of IRS Code Section 6695 penalties, injunctions, and/or disciplinary action by the IRS Office of Professional Responsibility.

Can you renew an expired PTIN?

If your PTIN has been expired for more than a full calendar year, you must renew for each previously expired year during which you prepared returns or were an enrolled agent. If your PTIN has been inactive or expired for more than three consecutive years, you must submit a new registration application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Urges Preparers to Renew PTINs for 2012?

The IRS urges tax preparers to renew their Preparer Tax Identification Numbers (PTINs) for the 2012 tax year to ensure compliance with tax regulations and maintain their ability to prepare tax returns.

Who is required to file IRS Urges Preparers to Renew PTINs for 2012?

Anyone who prepares or assists in preparing U.S. federal tax returns for compensation is required to have a valid PTIN and must renew it annually.

How to fill out IRS Urges Preparers to Renew PTINs for 2012?

Tax preparers can fill out the PTIN renewal application online through the IRS website or by submitting a paper application, providing necessary personal information and payment of the renewal fee.

What is the purpose of IRS Urges Preparers to Renew PTINs for 2012?

The purpose is to maintain updated records of tax preparers who are authorized to file tax returns, ensuring that they meet educational and ethical standards.

What information must be reported on IRS Urges Preparers to Renew PTINs for 2012?

Preparers must report their personal identifying information, including name, address, Social Security number, and details regarding any previous PTINs they have held.

Fill out your irs urges preparers to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Urges Preparers To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.