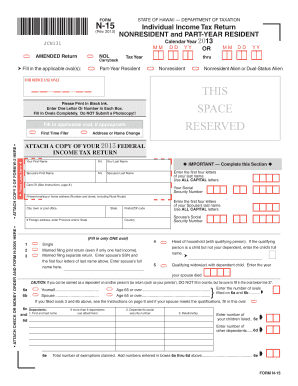

HI N-15 2011 free printable template

Get, Create, Make and Sign HI N-15

Editing HI N-15 online

Uncompromising security for your PDF editing and eSignature needs

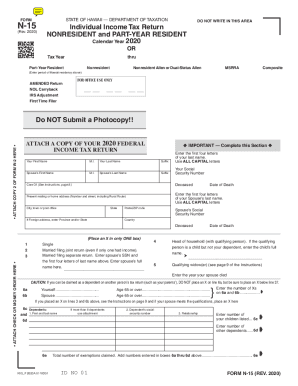

HI N-15 Form Versions

How to fill out HI N-15

How to fill out Hawaii N-15 2011:

Who needs Hawaii N-15 2011?

Video instructions and help with filling out and completing n 15

Instructions and Help about HI N-15

Welcome back to our third video on the Hawaii income tax preparation in this video let's talk about differences between itemized deductions on the Fed return versus our Hawaii return here this form and 11 so if you are claiming itemized deductions on the Hawaii return they are reported here at the bottom of page two in these different categories again these are itemized deduction categories, or we can claim the standard deduction these amounts are based upon the taxpayers filing status if it's larger we either want to deduct the larger of itemized or the standard deduction to save more money the issue though compared with the federal is that the federal standard deduction amounts are larger compared to Hawaii so let's take a look at a comparison here, so these are federal standard deductions Hawaii standard deductions for different filing statuses and as you can see for each filing status the federal is much larger than the Hawaii now if you're claiming itemized deductions on your federal that pretty much means your itemized deductions are going to be larger than the federal and the Hawaii standard deduction now if your itemized deductions fall within these ranges here you want to claim the federal standard deduction but on the Hawaii return you want to itemize claim itemized deductions which is perfectly okay, although now you got to do maybe a little more calculations on the Hawaii return since there's nothing to calculate for itemized on the federal now if you do prepare claim itemized deductions on the federal that means you're going to fill out a form or really a Schedule A and you can see the different categories here, and you're going to see the same category names but just inserting the totals here on the eleven form now these totals are referring you back to a worksheet that's in the instructions to this form and 11 and that's where the main difference is show up between the federal and Hawaii so let's take a look at that worksheet again here in the instructions to form an 11 so the first category of itemized deductions is medical and dental related, and basically we would claim the gross amount that's already reported on your schedule a line one here, but we know we can't deduct the whole thing we have to reduce it by either 10 percent or there's some exception for seven and a half percent of the taxpayers are just the gross income so only the excess gets deductible but this line 2 is the federal adjusted gross income so on Hawaii what we have to do is insert the Hawaii adjusted gross income and as we learned in the previous video there are differences between federal and Hawaii AGI now we apply that 10 or the 7 a half percent reduction to get the amount that's deductible on the Hawaii return on the form and 11 the next category of deductions is taxes and the main difference I guess between Hawaii and federal is that there's a big limitation for Hawaii in terms of deducting state or local income taxes if the taxpayers not Hawaii but...

People Also Ask about

What is Hawaii tax form n15?

How do I get my Hawaii state tax form?

Who is required to file a Hawaii tax return?

What is n-15 tax form?

What is the tax form for non resident Hawaii?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit HI N-15 from Google Drive?

Where do I find HI N-15?

Can I edit HI N-15 on an iOS device?

What is HI N-15?

Who is required to file HI N-15?

How to fill out HI N-15?

What is the purpose of HI N-15?

What information must be reported on HI N-15?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.