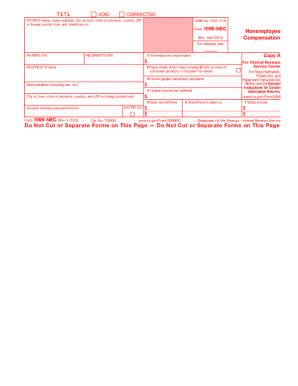

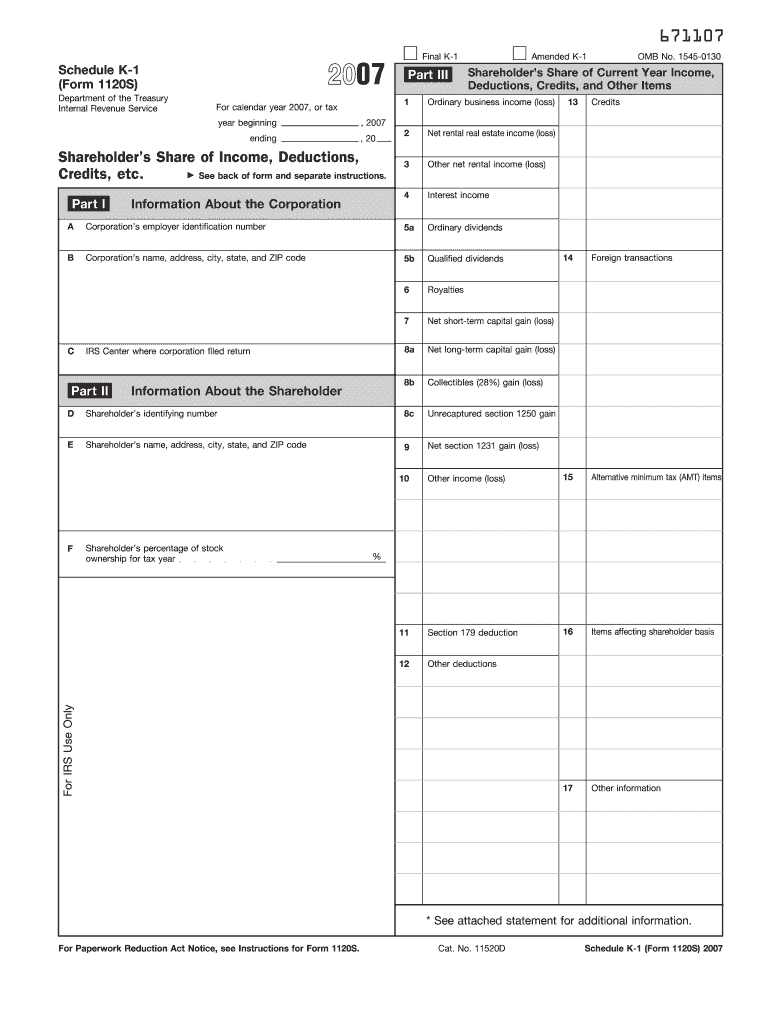

IRS 1120S - Schedule K-1 2007 free printable template

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

About IRS 1120S - Schedule K-1 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S - Schedule K-1

What should I do if I realize I've made a mistake on my submitted 2007 form 1120s k1?

If you discover an error after filing your 2007 form 1120s k1, you should file an amended return using Form 1120-S. Ensure to explain the changes clearly and submit it as soon as possible to avoid penalties. Retain copies of your amended return for your records.

How can I check the status of my 2007 form 1120s k1 filing?

To verify the status of your 2007 form 1120s k1, you can use the IRS online tool or contact the IRS directly. Keep your EIN and other relevant information handy to help expedite the process. Quick verification will assist in addressing any potential rejection issues.

What should I do if my e-filed 2007 form 1120s k1 is rejected?

If your e-filed 2007 form 1120s k1 is rejected, carefully review the rejection notice for error codes. Common reasons include mismatches in information provided. Correct the identified issues and resubmit your form promptly. It's crucial for timely compliance and to avoid issues with your submission.

What is the recommended method for keeping records of my filed 2007 form 1120s k1?

It is advisable to maintain records of your 2007 form 1120s k1 for at least three years after filing. This may include copies of your returns, any supporting documents, and correspondence with the IRS. Such records are essential in case of audits or inquiries.

Can a nonresident file a 2007 form 1120s k1 for U.S. income?

Yes, a nonresident can file a 2007 form 1120s k1 for U.S. income. However, they should be aware of specific requirements and potential limitations regarding U.S. tax obligations. Consulting a tax professional experienced in U.S. tax law for nonresidents can be beneficial.

See what our users say