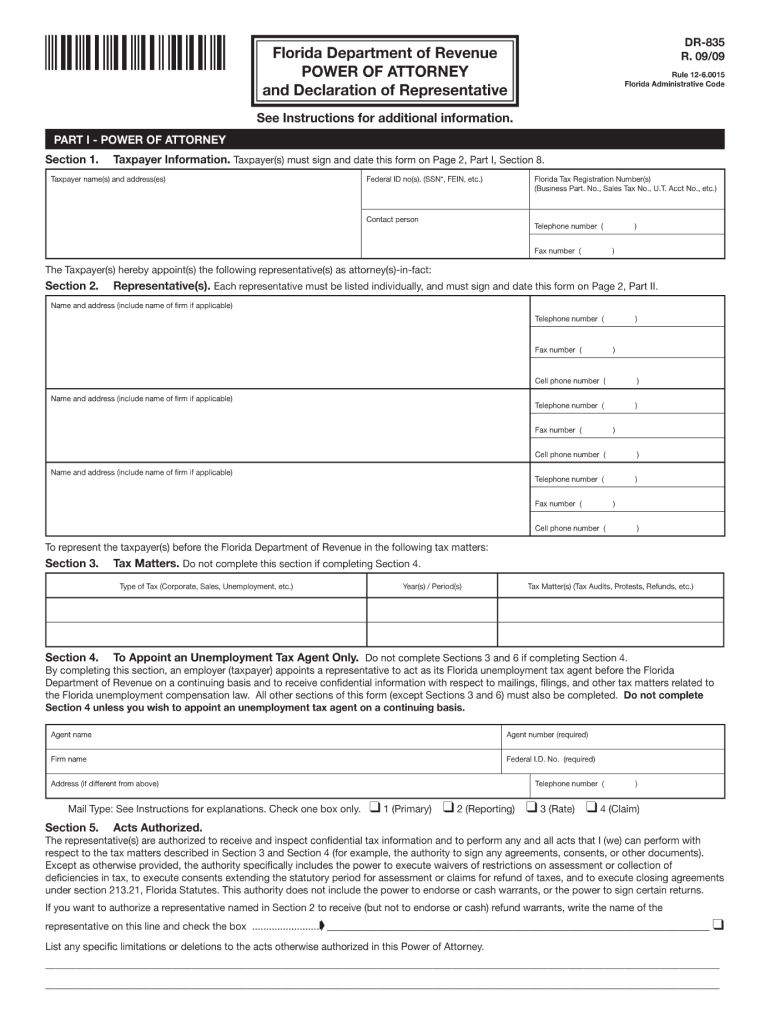

Who needs a DR-835 Florida power of attorney?

A person who wants to grant a right to represent their taxpayer interests to another person should file this Power of Attorney and Declaration of Representative form.

What is Form DR-835 for?

This form is required by Florida Department of Revenue in order for taxpayer’s representative to perform operations on behalf of the taxpayer and have access to confidential tax information. A person may grant their representation to any qualified person who could be for example an attorney, enrolled or unemployment tax agent, or certified public accountant.

This form can be used for any matters dealing with Department of Revenue including the audit and collection processes.

This form is not required if your representative officially works for you (as a corporate officer), and has served as a representative of your company for the tax authorities.

Before filing, check whether your representative is a violator of the law. In this case according to the law, he will not be able to represent your interests.

Is DR-835 fillable form accompanied by other forms?

This form is a separate document requiring no accompany of other forms.

When is the fillable form DR-835 due?

A Power of Attorney will remain in effect until you revoke it.

How do I fill out Form DR-835?

The third and fourth pages of this fillable Florida Department of Revenue form DR 835 contain detailed instructions on how to fill this one out and to what aspects special attention should be paid. Before you start filling out the form, make sure that you are familiar with this instruction.

Where do I send the Florida form DR-835?

If the Florida DR-845 form was filled out for a specific matter, mail to the office of the employee handling this specific matter. If else, mail it to the Florida Department of Revenue: ? P.O. Box 6510, Tallahassee FL 32314-6510.