Get the free understanding your paycheck 1131l1 form - staff fcps

Show details

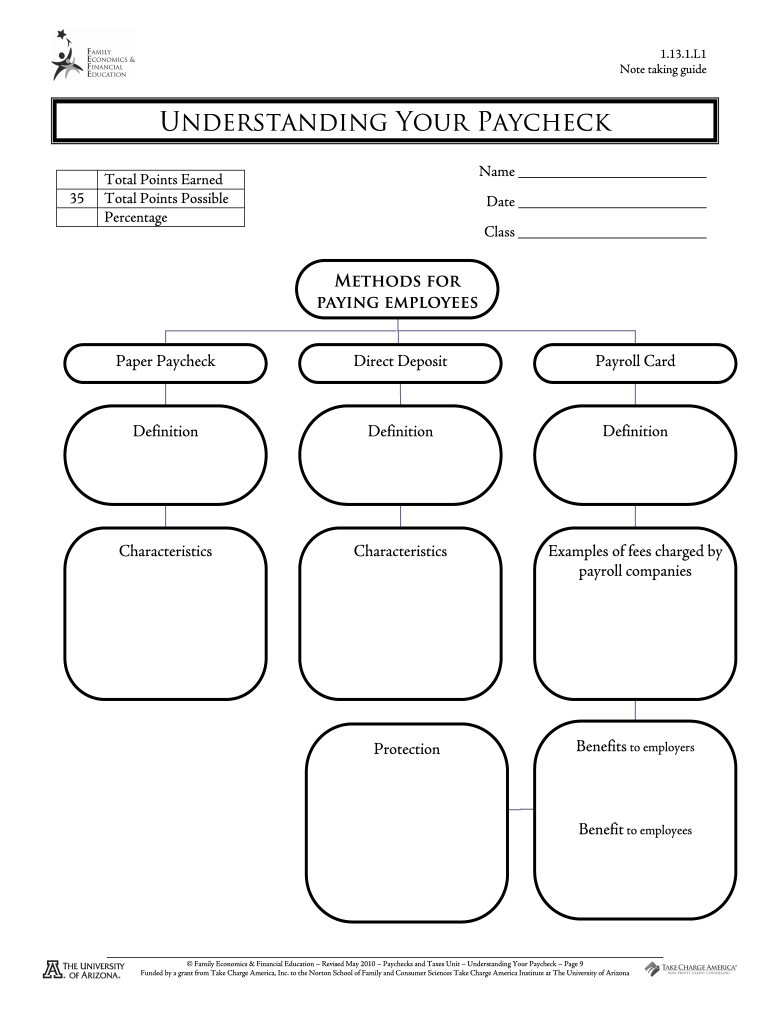

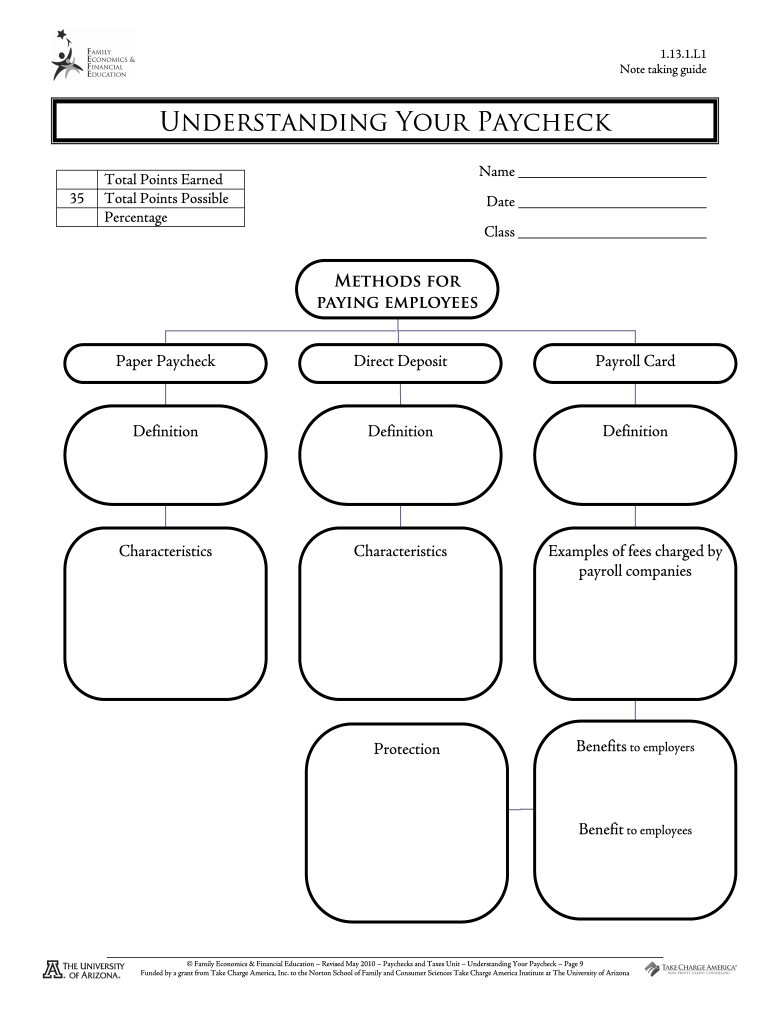

1. 13. 1. L1 Note taking guide Understanding Your Paycheck Name Total Points Earned Total Points Possible Percentage Class Methods for paying employees Paper Paycheck Direct Deposit Payroll Card Definition Characteristics Examples of fees charged by payroll companies Protection Benefits to employers Family Economics Financial Education Revised May 2010 Paychecks and Taxes Unit Understanding Your Paycheck Page 9 Funded by a grant from Take Cha...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding your paycheck 1131l1

Edit your understanding your paycheck 1131l1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your paycheck 1131l1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding your paycheck 1131l1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit understanding your paycheck 1131l1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding your paycheck 1131l1

How to fill out understanding your paycheck 1131l1:

01

Start by obtaining your paycheck: Make sure you receive your paycheck from your employer, either in physical or digital form.

02

Review the pay period: Determine the specific dates covered by the paycheck. This information is usually indicated on the paycheck itself.

03

Identify your gross pay: Look for the gross pay amount on your paycheck. This is the total amount of money you earned before any deductions.

04

Check for deductions: Examine the paycheck for any deductions such as taxes, insurance, retirement contributions, or other withholdings. These deductions reduce your net pay.

05

Calculate your net pay: Subtract the total deductions from your gross pay to determine your net pay. This is the amount you will actually receive in your bank account.

06

Understand the deductions: If there are deductions that you don't understand, refer to your company's payroll department or consult with a human resources representative for clarification.

07

Analyze additional information: Some paychecks may provide additional information such as year-to-date earnings, vacation or sick leave balances, or other relevant data. Take note of this information if applicable.

Who needs understanding your paycheck 1131l1?

01

Employees: Anyone who receives a paycheck can benefit from understanding how to fill out and interpret their paycheck. It helps in understanding the different components and deductions that impact their net pay.

02

New hires: Individuals starting a new job may need assistance in comprehending the various components of their paycheck, especially if it differs from their previous employment.

03

Individuals with complex pay structures: Some individuals, such as those with multiple sources of income or freelance workers, may have a more intricate paycheck that requires a deeper understanding of the calculations and deductions involved.

04

Those seeking financial literacy: Understanding your paycheck is an essential aspect of financial literacy. It helps individuals manage their finances effectively, budget their income, and plan for future financial goals.

Fill

form

: Try Risk Free

People Also Ask about

How do I read my federal pay stub?

Basic Information. SSN. Your Pay Consists Of. Your current pay period and year-to-date totals for your gross pay, Tax Information. Your current federal and state marital status, exemptions, and. Earnings. Displays the type of pay (regular, leave, etc.), Deductions. FERS/CSRS Retirement. Benefits Paid by Govt. Leave.

How much federal tax should be taken out of my paycheck?

Withhold half of the total 15.3% from the employee's paycheck (7.65% = 6.2% for Social Security plus 1.45% for Medicare). The other half of FICA taxes is owed by you, the employer. For a hypothetical employee, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

How does 401K show up on paystub?

Common pay stub deduction codes include the self-explanatory 401K for retirement savings contributions and 401K ER, which refers to an employer's contribution if the employee receives a company match. However, this is by no means an exhaustive list.

Is 401K automatically deducted from paycheck?

Automatic enrollment allows an employer to automatically deduct elective deferrals from an employee's wages unless the employee makes an election not to contribute or to contribute a different amount. Any plan that allows elective salary deferrals (such as a 401(k) or SIMPLE IRA plan) can have this feature.

How do you read a paycheck?

How to read a pay stub Employee name and address. The full name and address of the person receiving payment. Company name and address. The employer's name and address. Identifying information. Pay type. Pay date. Pay period. Hours worked. Pay rate.

How does 401k appear on paycheck?

Many employers include a similar listing for contributions to retirement savings plans and health plans. You'll generally see these fields marked as the acronym “YTD” (year-to-date) on your pay stubs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit understanding your paycheck 1131l1 in Chrome?

understanding your paycheck 1131l1 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out understanding your paycheck 1131l1 using my mobile device?

Use the pdfFiller mobile app to fill out and sign understanding your paycheck 1131l1 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit understanding your paycheck 1131l1 on an Android device?

You can make any changes to PDF files, like understanding your paycheck 1131l1, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is understanding your paycheck 1131l1?

Understanding your paycheck 1131l1 is a form used to report income, deductions, and taxes withheld by an employer.

Who is required to file understanding your paycheck 1131l1?

Employees who receive a paycheck from an employer are required to file understanding your paycheck 1131l1.

How to fill out understanding your paycheck 1131l1?

Understanding your paycheck 1131l1 can be filled out by entering the relevant information from your paystub, such as gross income, deductions, and taxes withheld.

What is the purpose of understanding your paycheck 1131l1?

The purpose of understanding your paycheck 1131l1 is to provide transparency on how your income is calculated and how taxes are deducted.

What information must be reported on understanding your paycheck 1131l1?

Information such as gross income, deductions for benefits or taxes, and the amount of taxes withheld must be reported on understanding your paycheck 1131l1.

Fill out your understanding your paycheck 1131l1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Your Paycheck 1131L1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.