Get the free pdf it 140 2017 - state wv

Get, Create, Make and Sign pdf it 140 2017

How to edit pdf it 140 2017 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdf it 140 2017

How to fill out PDF form IT-140 2017?

Who needs PDF form IT-140 2017?

Instructions and Help about pdf it 140 2017

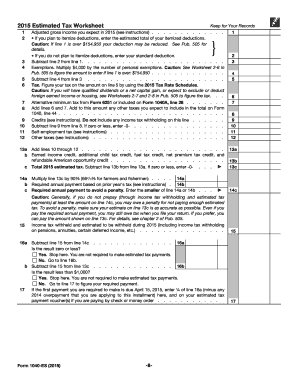

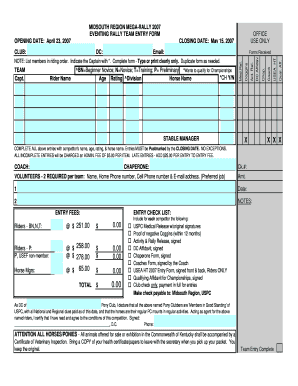

Law.com legal forms guide form I t140 NRS special non-resident income tax return West Virginia income tax form I t140 NRS is only to be completed by residents of Kentucky Virginia Maryland Pennsylvania and Ohio who had West Virginia income tax withheld from their wages by employers this document is completed to claim credit on these taxes paid the document can be found on the website of the government of West Virginia step 1 on the forms first line give your last name and social security number step 2 on the second line give your first name and middle initial step 3 on the third line give your street address step 4 on the fourth line give your city state and zip code check the box where indicated if filing an amended return step 5 on lines one through five indicated with a check mark which of the five states listed above is your state of residence residents of Virginia and Pennsylvania must also enter the number of dates they were in West Virginia step 6 enter your total West Virginia income online one of the next section step 7 to complete line to you must first skip to the second page to complete form 140w documenting your taxes withheld in box a give the name of the employer the name of the employee in bucks be and the tax withheld in box see total the tax withheld in column C and transfer this to line two on the first page step 8 if filing an amended return complete line three otherwise leave this blank step 9 if you wish to contribute to the state's children's trust fund enter the amount on line four steps 10 subtract the sum of lines three and four from line two and to the refund due on line five if you wish to receive a direct deposit give your routing and account number to watch more videos please make sure to visit laws calm

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit pdf it 140 2017 online?

Can I create an electronic signature for signing my pdf it 140 2017 in Gmail?

How do I fill out the pdf it 140 2017 form on my smartphone?

What is pdf it 140?

Who is required to file pdf it 140?

How to fill out pdf it 140?

What is the purpose of pdf it 140?

What information must be reported on pdf it 140?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.