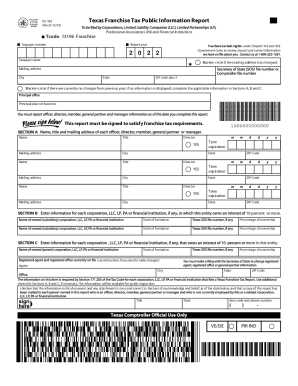

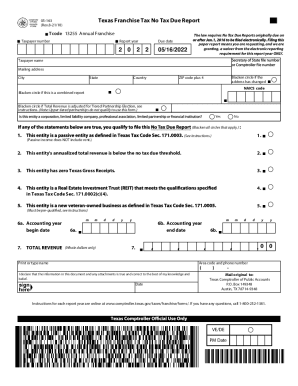

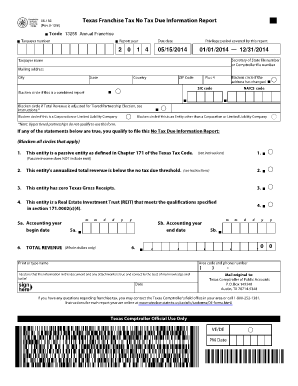

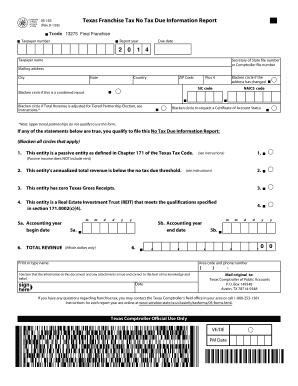

Get the free texas form 05 141 - window state tx

Get, Create, Make and Sign texas form 05 141

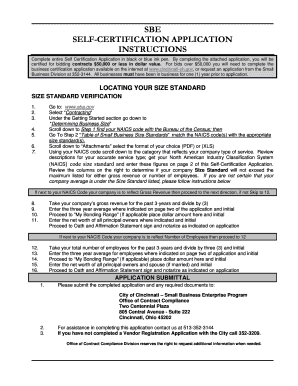

Editing texas form 05 141 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out texas form 05 141

Point by Point instructions on how to fill out Texas Form 05 141:

Who needs Texas Form 05 141?

Instructions and Help about texas form 05 141

Ten statewide constitutional amendments are on the ballot tomorrow we're breaking down a few of them for you starting with proposition 4 it's a hot topic a state income tax as you know Texas does not have a state income tax if passed prop 4 would make it tougher for future lawmakers to enact one the wording is a little confusing, but the bottom line is if you vote YES for prop 4 it means you are against a state income tax another amendment proposition 8 seeks to shore up financing for flood prevention projects in Texas it would set aside some eight hundred million dollars from the state's rainy day fund to pay for flood control and drainage projects and there's a bond proposal for cancer research on the ballot it's called proposition six it would allow the legislature to increase by three billion dollars the maximum amount of bonds it can issue on behalf of the cancer prevention and Research Institute of Texas

People Also Ask about

What is Texas Form 05 164?

Who must file a Texas franchise tax report?

Who needs to file franchise tax in Texas?

What is the no tax due threshold for Texas franchise tax?

What is the income threshold for Texas franchise tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit texas form 05 141 from Google Drive?

How can I get texas form 05 141?

How do I edit texas form 05 141 on an Android device?

What is texas form 05 141?

Who is required to file texas form 05 141?

How to fill out texas form 05 141?

What is the purpose of texas form 05 141?

What information must be reported on texas form 05 141?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.