IRS 5471 2012 free printable template

Show details

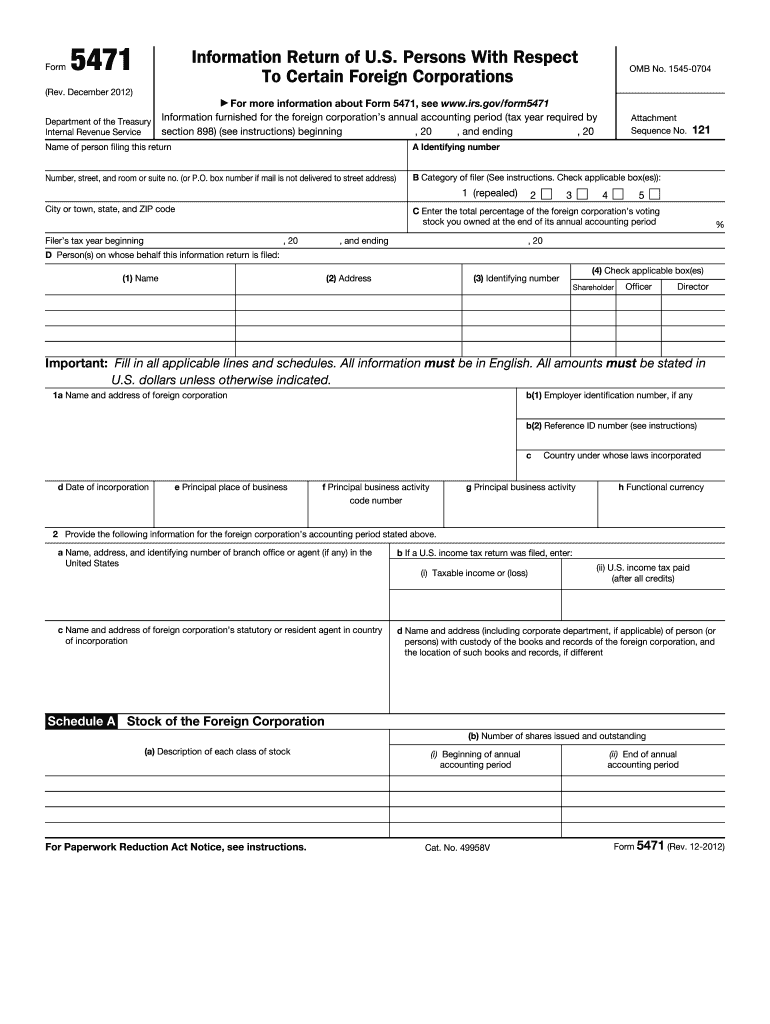

I Beginning of annual accounting period Cat. No. 49958V ii End of annual Form 5471 Rev. 12-2012 Page 2 Schedule B U.S. Shareholders of Foreign Corporation see instructions number of shareholder shareholder. Form Information Return of U.S. Persons With Respect To Certain Foreign Corporations Rev. December 2012 Department of the Treasury Internal Revenue Service OMB No. 1545-0704 For more information about Form 5471 see www.irs.gov/form5471 Information furnished for the foreign corporation s...annual accounting period tax year required by section 898 see instructions beginning and ending Attachment Sequence No. Name of person filing this return Number street and room or suite no. or P. O. box number if mail is not delivered to street address A Identifying number B Category of filer See instructions. Check applicable box es 1 repealed City or town state and ZIP code Filer s tax year beginning C Enter the total percentage of the foreign corporation s voting stock you owned at the end of...its annual accounting period D Person s on whose behalf this information return is filed 1 Name 2 Address 4 Check applicable box es Shareholder Officer Director Important Fill in all applicable lines and schedules. All information must be in English. All amounts must be stated in U*S* dollars unless otherwise indicated* 1a Name and address of foreign corporation b 1 Employer identification number if any b 2 Reference ID number see instructions c d Date of incorporation e Principal place of...business f Principal business activity code number Country under whose laws incorporated h Functional currency 2 Provide the following information for the foreign corporation s accounting period stated above. a Name address and identifying number of branch office or agent if any in the United States b If a U*S* income tax return was filed enter of incorporation persons with custody of the books and records of the foreign corporation and the location of such books and records if different i...Taxable income or loss ii U*S* income tax paid after all credits Schedule A Stock of the Foreign Corporation b Number of shares issued and outstanding a Description of each class of stock For Paperwork Reduction Act Notice see instructions. Note This description should match the corresponding description entered in Schedule A column a. c Number of shares held at e Pro rata share of subpart F income enter as a percentage Schedule C Income Statement see instructions Important Report all...information in functional currency in accordance with U*S* GAAP. Also report each amount in U*S* dollars translated from functional currency using GAAP translation rules. However if the functional currency is the U*S* dollar complete only the U*S* Dollars column* See instructions for special rules for DASTM corporations. Net Income Deductions Income 1a b 6a Gross receipts or sales. Returns and allowances. Subtract line 1b from line 1a. Cost of goods sold. Gross profit subtract line 2 from line...1c. Dividends. Interest. Gross rents. Gross royalties and license fees.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 5471

How to edit IRS 5471

How to fill out IRS 5471

Instructions and Help about IRS 5471

How to edit IRS 5471

Edit IRS Form 5471 using tools that allow for modifications in text fields, such as pdfFiller. Access the form through the platform, and utilize editing features to ensure that all necessary fields are filled accurately. Make sure to save all changes before finalizing the document.

How to fill out IRS 5471

Filling out IRS Form 5471 requires precise information about your foreign corporation and your involvement with it. Follow these steps to complete the form:

01

Gather required information about the foreign corporation, including its name, address, and Employer Identification Number (EIN).

02

Complete the specific sections of the form according to your relationship with the foreign corporation, such as ownership and financial data.

03

Review all entered information for accuracy before final submission.

About IRS 5 previous version

What is IRS 5471?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 5 previous version

What is IRS 5471?

IRS Form 5471 is known as the Information Return of U.S. Persons With Respect to Certain Foreign Corporations. It is filed by U.S. citizens and resident aliens who are officers, directors, or shareholders in a foreign corporation. Completing this form is crucial for reporting interests in foreign entities to ensure compliance with U.S. tax regulations.

What is the purpose of this form?

The primary purpose of IRS Form 5471 is to provide the IRS with detailed information about foreign corporations in which U.S. persons have significant ownership or control. This ensures the IRS can monitor U.S. taxation on foreign income and verify compliance with international taxation laws.

Who needs the form?

U.S. persons, including citizens and residents, who are officers, directors, or shareholders in a foreign corporation must file Form 5471 if they meet certain ownership thresholds. This typically involves individuals who own at least 10% of a foreign corporation, either directly or indirectly.

When am I exempt from filling out this form?

You may be exempt from filing IRS Form 5471 if you do not meet specific ownership thresholds. Also, individuals who are only shareholders of a foreign corporation that is not controlled by U.S. persons may not need to file. Always consult the latest IRS guidelines or a tax professional to confirm your exemption status.

Components of the form

IRS Form 5471 includes several components that require detailed information about the foreign corporation, including:

01

General information about the foreign corporation, such as its name, address, and EIN.

02

Details on the U.S. person's ownership percentage and type of shares held.

03

Financial statements and summaries of foreign transaction data.

Each section must be completed accurately to avoid penalties or delays in processing.

What are the penalties for not issuing the form?

Failure to file IRS Form 5471 can result in significant penalties. The IRS may impose a penalty of $10,000 for each form not filed or filed incorrectly. Additionally, continued non-compliance can lead to further penalties and even criminal charges in severe cases. Understanding these penalties highlights the importance of timely and accurate submissions.

What information do you need when you file the form?

When filing IRS Form 5471, you will need various pieces of information, including the foreign corporation's financial statements, transaction details, and your ownership structure. Ensure that you have accurate records of your investments and any transactions conducted with the foreign corporation.

Is the form accompanied by other forms?

IRS Form 5471 often accompanies other tax forms, such as Form 8832, Elections to be Treated as a Corporation, or Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships. Review current IRS requirements to determine if additional forms are necessary based on your specific situation.

Where do I send the form?

IRS Form 5471 must be submitted to the IRS service center where you file your tax return. Ensure that all documents are sent to the proper address according to the most recent IRS instructions. Use certified mail or a trackable shipping method to confirm that your forms have been received.

See what our users say