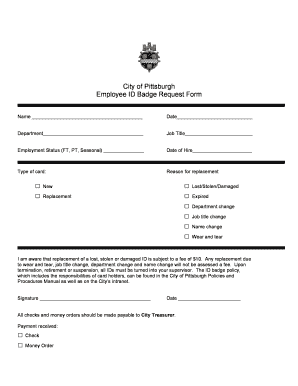

NZ MBIE 6204 T1 (Formerly 3639 T1) 2014 free printable template

Show details

Bond judgement form 1. Fill out this form to lodge your bond. The bond money and this form must be sent to the Ministry of Business, Innovation and Employment within 23 working days of the tenant

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ MBIE 6204 T1 Formerly 3639

Edit your NZ MBIE 6204 T1 Formerly 3639 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ MBIE 6204 T1 Formerly 3639 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NZ MBIE 6204 T1 Formerly 3639 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NZ MBIE 6204 T1 Formerly 3639. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ MBIE 6204 T1 (Formerly 3639 T1) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ MBIE 6204 T1 Formerly 3639

How to fill out NZ MBIE 6204 T1 (Formerly 3639 T1)

01

Obtain the NZ MBIE 6204 T1 form from the official MBIE website or relevant office.

02

Ensure to have all necessary documentation ready, such as identification and proof of residency.

03

Fill out the personal details section, including full name, address, and contact information.

04

Provide details regarding your current qualifications and employment history.

05

Answer any specific questions related to your application category accurately.

06

Review all information filled in the form for any errors or omissions.

07

Submit the form either online or in person as instructed, following any additional guidelines provided.

Who needs NZ MBIE 6204 T1 (Formerly 3639 T1)?

01

Individuals applying for a visa or an immigration status that requires this form.

02

Employers sponsoring foreign workers who need to verify specific details.

03

Those who are seeking to work or live in New Zealand under specified conditions.

Fill

form

: Try Risk Free

People Also Ask about

Is a bond required in Victoria?

If you want to rent privately in Victoria and need assistance with the bond, you may be able to borrow the money for an interest-free bond loan. If you want to rent privately, most residential rental providers will ask you to pay a bond before you move in. A bond is a security deposit in case you damage the property.

How does bond work NZ?

A bond is money that you, the tenant, pay to the landlord as security for any unpaid rent or any damage you cause that has to be fixed when the tenancy ends. In those cases the landlord will be able to take the rent or repair costs out of the bond.

Do I have to charge a bond WA?

In Western Australia, a bond or security deposit is referred to as a 'security bond'. There is no minimum security bond amount, and a landlord in WA may choose not to charge a security bond. The bond is the tenant's money and must be lodged with the Bond Administrator (Consumer Protection) until the end of the tenancy.

How long do you have to lodge a bond in NZ?

At the start of a tenancy They should also complete and sign the bond lodgement form if the landlord is charging a bond. If you're a landlord you must: lodge the bond within 23 working days of receiving it. Not doing this is an unlawful act and you could be required to pay a penalty.

How much is a bond in WA?

In-going costs to rent a property in Western Australia would generally be two weeks rent in advance, a security bond equivalent to four weeks rent and sometimes the option fee.

How do you lodge a bond NZ?

You will need to complete a bond lodgement form and have it signed by everyone who signed the tenancy agreement. The same people who sign the bond lodgement form need to sign the bond refund form when the tenancy ends. If these names and signatures don't match, there will be delays processing the bond.

Do bonds have to be lodged?

At the start of a tenancy If you're a landlord you must: lodge the bond within 23 working days of receiving it. Not doing this is an unlawful act and you could be required to pay a penalty.

Who holds rental bond in WA?

The tenant pays the landlord the Security Bond. The landlord must then lodge the entire amount of the Security Bond with the Bond Administrator along with a 'Lodgement of Security Bond Money' form signed by all the tenants and the landlord. A landlord has 14 days to lodge the Security Bond with the Bond Administrator.

What is the time limit for lodging a bond in Victoria?

The rental provider must lodge the bond with the RTBA within 10 business days of receiving it. The RTBA must give a receipt with the bond ID number to the rental provider and renter within 7 days.

How long does it take to lodge a bond?

Tenants must give bond to landlords before they move in. This must then be lodged with Tenancy Services within 23 working days.

What does lodging your bond online mean?

NSW Fair Trading provides a voluntary online rental bond system that allows tenants and landlords to manage their bonds. Rental Bonds Online allows payment of bonds through bpay and bank transfer. You may lodge a bond with Rental Bonds Online before you have signed the tenancy agreement.

How do I pay my rental bond in Victoria?

The law on paying a bond complete and sign a bond lodgment form. give this to you to sign at the time you pay the bond. give you a copy – you should also ask for a receipt, especially if you pay by cash. lodge the form and your bond money with the Residential Tenancies Bond Authority (RTBA) within 10 business days.

How long does it take to get your bond back in Victoria?

When renters make the claim themselves, bond refunds take between 14 and 20 business days. This allows time for other renters or the rental provider to be notified of the claim and to contest it if they choose.

Does bond have to be lodged?

If you're a self-managing landlord or property agent, you're legally required to offer a tenant the option of lodging their bond directly through Rental Bonds Online (RBO). If the tenant is unable to access the online service, or chooses to use the paper-based method, you'll need to lodge a Rental Bond Lodgement form.

How do I lodge a bond online in Victoria?

Your access level will be listed at the top. Sign in to RTBA Online. Select the 'Lodge a bond' tab. Select 'No' if the loan was not provided by the Homes Victoria, and 'Electronic' for your transaction method, then 'Enter property details'. Fill in the rented property details. Fill in the tenancy and bond details.

How do I lodge a bond in Victoria?

Lodging a bond Once a renter has given their bond money to the rental provider, the rental provider must lodge the bond with the RTBA. Renters will be asked to accept the transaction by email. Once the bond is lodged, the RTBA will send a receipt to the renter with the bond number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NZ MBIE 6204 T1 Formerly 3639 in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your NZ MBIE 6204 T1 Formerly 3639 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get NZ MBIE 6204 T1 Formerly 3639?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific NZ MBIE 6204 T1 Formerly 3639 and other forms. Find the template you need and change it using powerful tools.

How do I edit NZ MBIE 6204 T1 Formerly 3639 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your NZ MBIE 6204 T1 Formerly 3639 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

What is NZ MBIE 6204 T1 (Formerly 3639 T1)?

NZ MBIE 6204 T1 (Formerly 3639 T1) is a form used in New Zealand for reporting specific information related to the business activities and compliance of organizations with regulatory requirements.

Who is required to file NZ MBIE 6204 T1 (Formerly 3639 T1)?

Organizations and businesses operating in New Zealand that meet certain criteria set by the Ministry of Business, Innovation and Employment (MBIE) are required to file NZ MBIE 6204 T1.

How to fill out NZ MBIE 6204 T1 (Formerly 3639 T1)?

To fill out NZ MBIE 6204 T1, follow the instructions provided with the form, ensuring all required fields are completed accurately, including financial data, business activities, and compliance information.

What is the purpose of NZ MBIE 6204 T1 (Formerly 3639 T1)?

The purpose of NZ MBIE 6204 T1 is to collect essential data from businesses for regulatory and statistical purposes, helping the government analyze industry performance and compliance within New Zealand.

What information must be reported on NZ MBIE 6204 T1 (Formerly 3639 T1)?

The information that must be reported on NZ MBIE 6204 T1 includes financial statements, details of business operations, compliance with relevant legislation, and other pertinent business-related information.

Fill out your NZ MBIE 6204 T1 Formerly 3639 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ MBIE 6204 t1 Formerly 3639 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.