Net Worth Statement Worksheet free printable template

Fill out, sign, and share forms from a single PDF platform

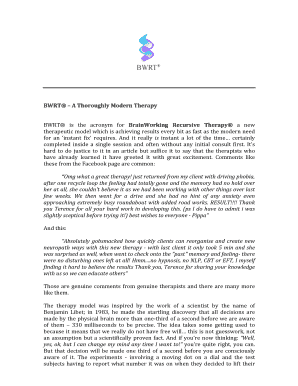

Edit and sign in one place

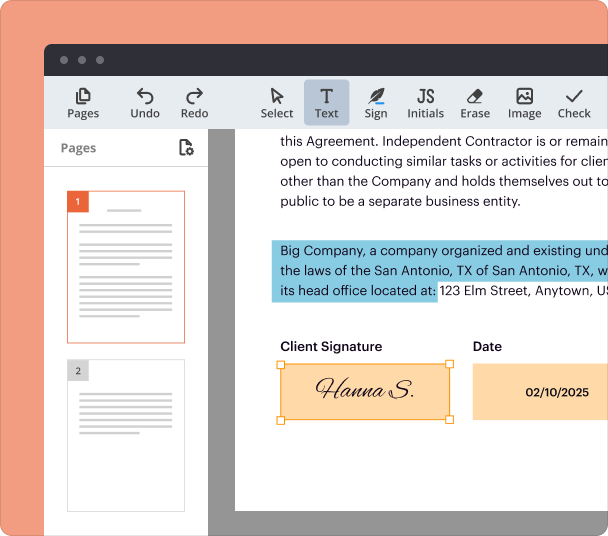

Create professional forms

Simplify data collection

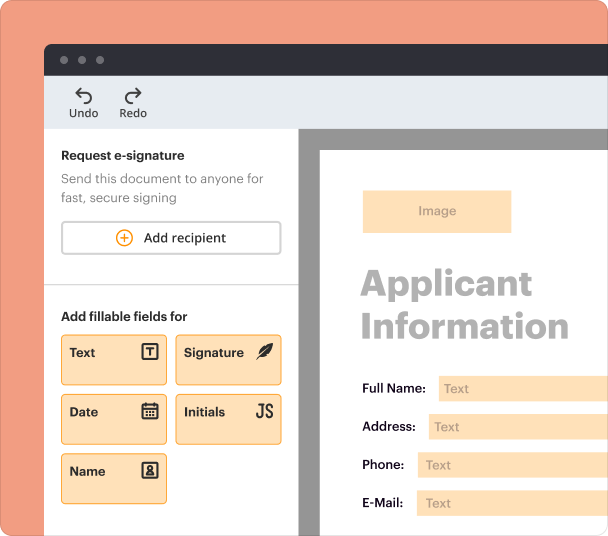

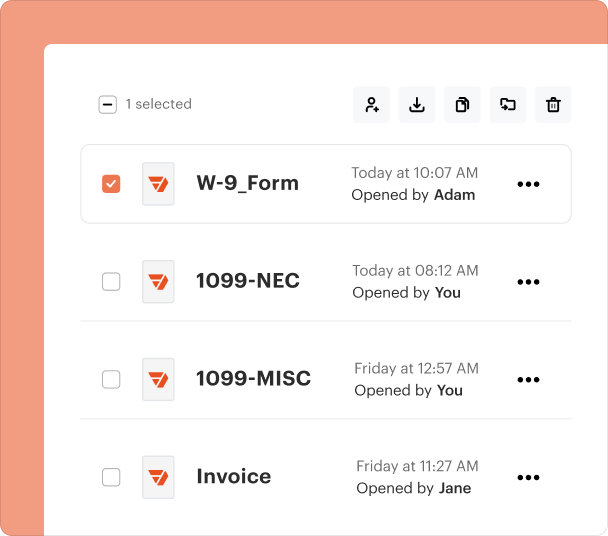

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Net Worth Statement Worksheet Guide

A net worth statement worksheet form is a vital tool for anyone looking to evaluate their financial health. To fill out this form efficiently, list all your assets and liabilities, then calculate the difference to determine your net worth. Regular updates to this document can lead to better financial management and informed decision-making.

What is a net worth statement and why is it important?

A net worth statement is a financial snapshot that summarizes an individual's or entity's assets and liabilities. This document is crucial as it reflects your overall financial health and provides insight into whether you are living within your means. It should be updated annually or whenever significant financial events occur, such as buying a home or incurring new debt.

What components make up your net worth statement?

Understanding the components of your net worth statement, including assets and liabilities, is essential for accurate reporting.

-

Assets can include cash, real estate, and investments, which are crucial elements for calculating your total net worth.

-

Liabilities encompass mortgages, loans, and credit card debts. Knowing these helps you understand your financial obligations.

How to detail your assets?

When detailing your assets, it's important to include all liquid and non-liquid assets. Cash on hand, checking and savings account balances, and market values of real estate must be documented thoroughly to calculate your net worth accurately.

-

Document all cash on hand and account values; these are your most liquid assets.

-

Include the estimated market value of your home along with any additional properties owned.

-

List all investments, including stocks, bonds, and mutual funds, as they contribute significantly to your net worth.

-

Don't forget to include valuable personal items like vehicles and collectibles.

How should you report your liabilities?

Documenting your liabilities is just as crucial as detailing assets. Liabilities are financial obligations that can impact your net worth negatively, so accurate documentation is necessary.

-

Include any outstanding mortgage amounts and home equity loans.

-

Document these loans and any current balances on credit cards.

-

Understanding how these obligations affect your financial health and planning is key in financial management.

How to calculate your net worth?

Calculating your net worth involves subtracting total liabilities from total assets. The resulting figure provides an at-a-glance view of your financial standing.

-

Net worth = Total Assets - Total Liabilities

-

A positive net worth indicates you own more than you owe, while negative net worth may require financial adjustments.

How can pdfFiller assist you with your net worth statement?

pdfFiller offers tools to simplify the process of completing and managing your net worth statement. With an easy-to-use editing interface, you can seamlessly fill out your net worth statement and collaborate with financial advisors using the platform.

-

Easily edit your net worth statement using pdfFiller’s intuitive interface.

-

Quickly eSign documents directly within pdfFiller to enhance security and speed.

-

Work closely with financial professionals using pdfFiller’s collaboration tools.

What are some pro tips for accurate reporting?

For the most accurate net worth statement, rely on reputable sources for valuing assets and track financial changes regularly. Protect the confidentiality of your personal information, especially when sharing documents online.

-

Ensure that asset valuations are based on current market data to maintain accuracy.

-

Monitor your net worth statement annually or after significant financial transactions.

-

Choose a secure platform, like pdfFiller, for managing your sensitive financial documents.

Frequently Asked Questions about net worth statement download form

How often should I update my net worth statement?

You should update your net worth statement at least annually or whenever significant financial changes occur, like acquiring property or changing investment assets.

What happens if I don't keep my net worth statement current?

Failing to keep it updated can lead to a distorted view of your financial health, making it difficult to make informed financial decisions.

Can a net worth statement improve my financial situation?

Yes, maintaining an updated net worth statement allows you to identify areas for improvement, track progress, and set financial goals more effectively.

Is it necessary to report all assets?

While you may not have to report every item, including all significant assets ensures that your net worth statement is comprehensive and accurate.

What tools can help me manage my net worth statement?

Tools like pdfFiller offer cloud-based options for managing, editing, and securely signing your net worth statement, making document management efficient.

pdfFiller scores top ratings on review platforms