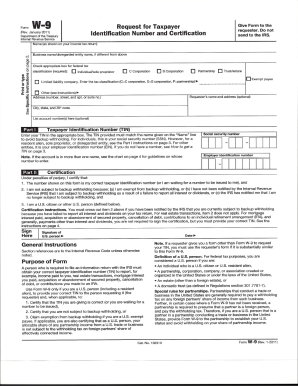

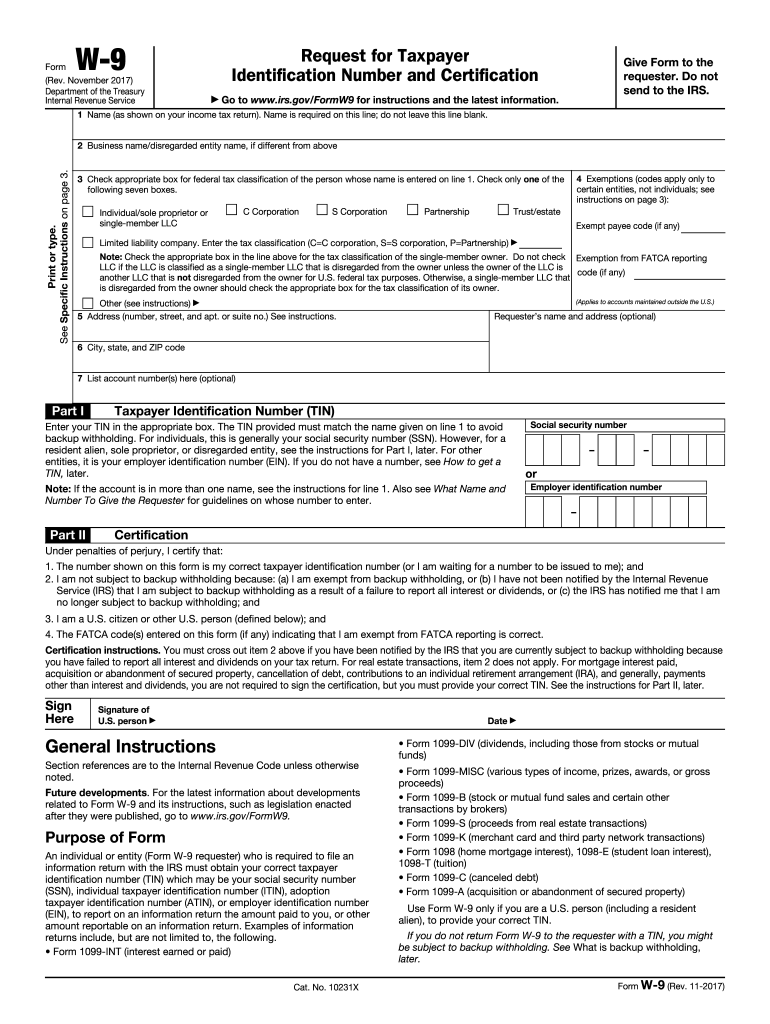

IRS W-9 2017 free printable template

Instructions and Help about IRS W-9

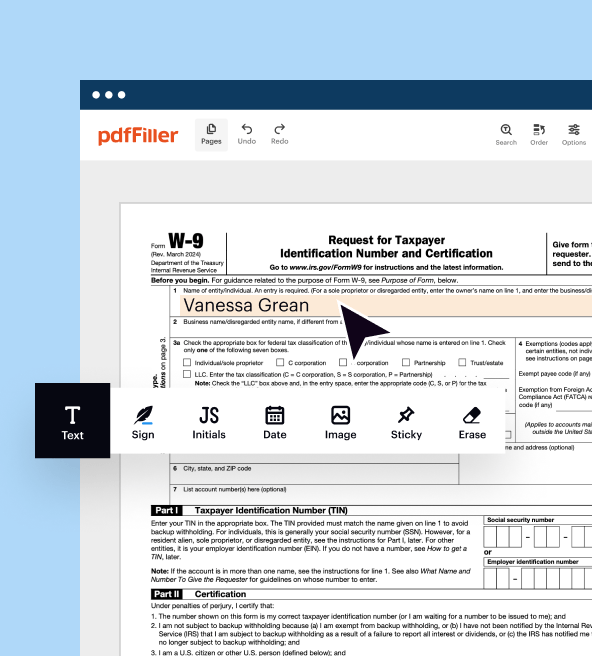

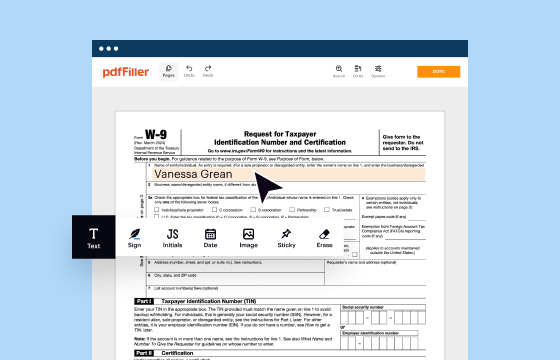

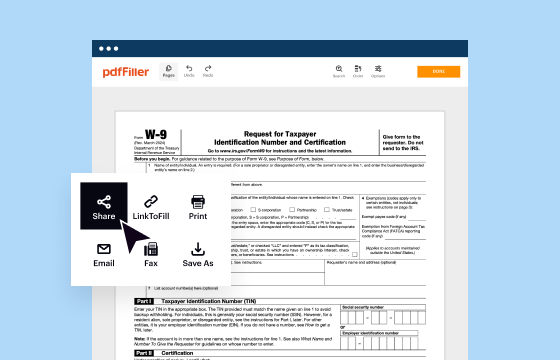

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2017 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

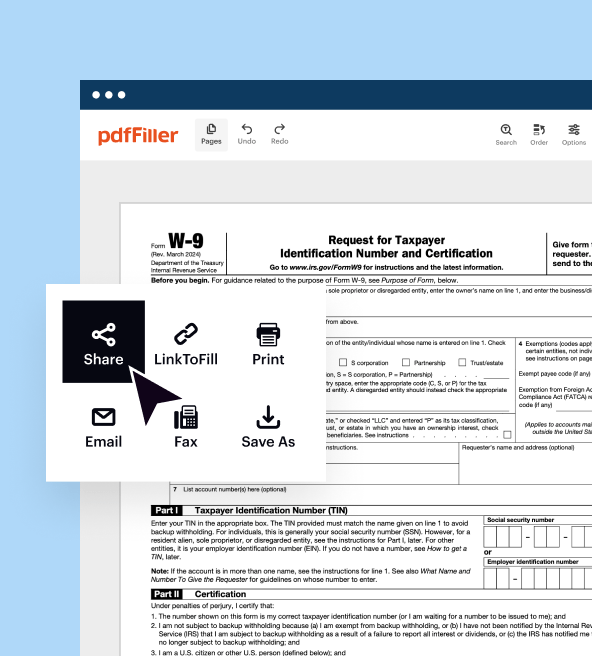

Where do I send the form?

FAQ about IRS W-9

What should I do if I realize I've made an error on my submitted IRS W-9?

If you discover a mistake on your IRS W-9 after submission, the first step is to submit a corrected form. You can do this by filling out a new IRS W-9 and marking it as a correction. Keep a copy of both the original and corrected form for your records to ensure proper documentation.

How can I verify if my IRS W-9 has been received and processed?

To verify the receipt and processing of your IRS W-9, you should follow up directly with the requester of the form, such as your employer or financial institution. They can confirm if they have successfully received and processed the form on their end.

How long should I retain copies of my IRS W-9 for record-keeping?

It is advisable to retain copies of your IRS W-9 for a minimum of four years. This period aligns with the IRS statute of limitations for auditing purposes, ensuring you have the necessary documentation in case of any inquiries or audits.

What should I do if my IRS W-9 submission gets rejected?

In the event that your IRS W-9 submission is rejected, carefully review the feedback or error message provided to identify the reason for rejection. Once you understand the issue, correct it and re-submit the form as necessary. Keeping a close eye on any communications from the requester will also aid in resolving the matter quickly.

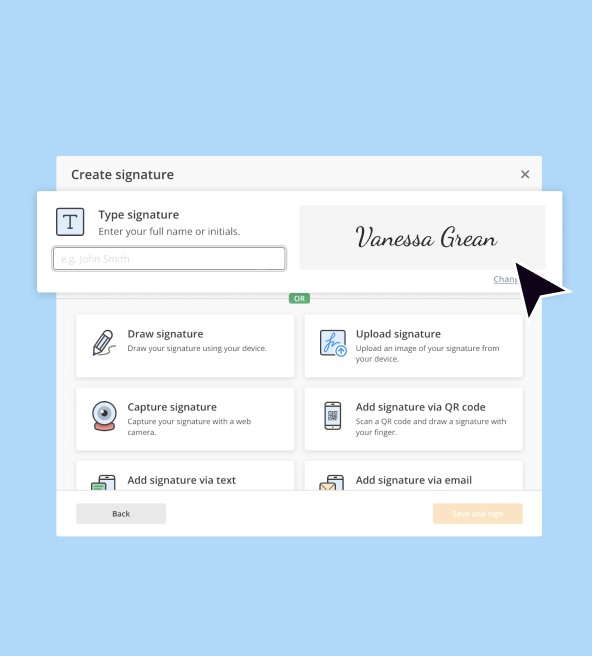

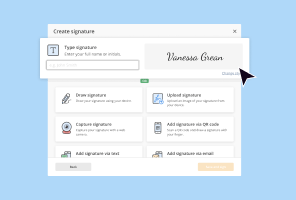

Can I use an e-signature for my IRS W-9, and what are the guidelines?

Yes, you can use an e-signature for your IRS W-9, provided that the e-signature meets the IRS's criteria for authenticity and consent. Ensure that you understand the specific e-signature requirements and maintain security measures to protect your personal data when using electronic forms.

See what our users say