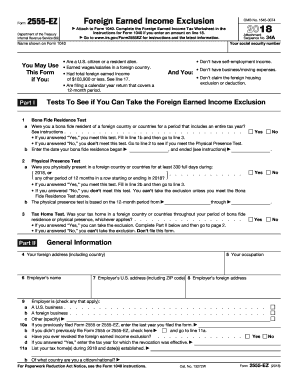

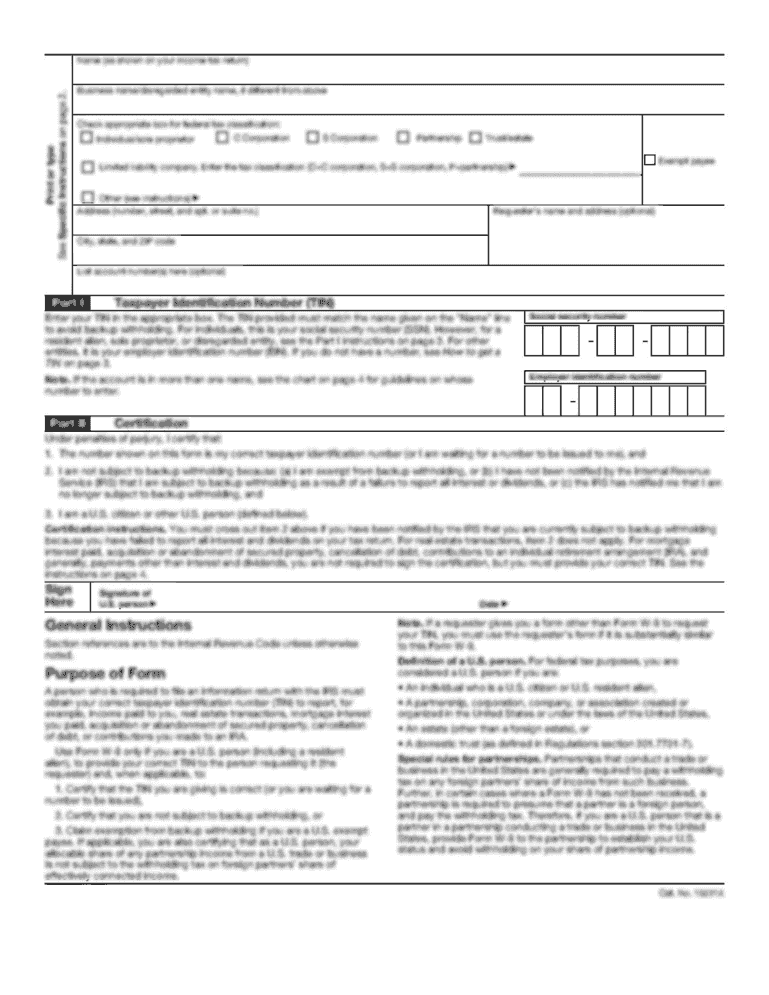

IRS 2555-EZ 2002 free printable template

Instructions and Help about IRS 2555-EZ

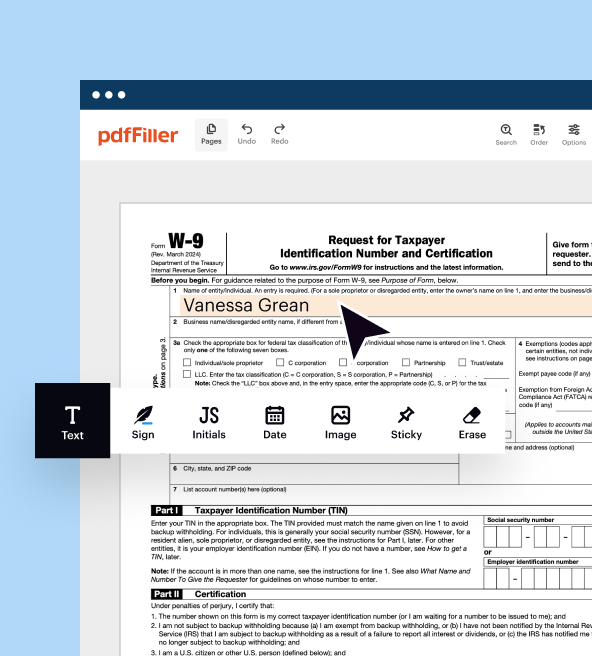

How to edit IRS 2555-EZ

How to fill out IRS 2555-EZ

About IRS 2555-EZ 2002 previous version

What is IRS 2555-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

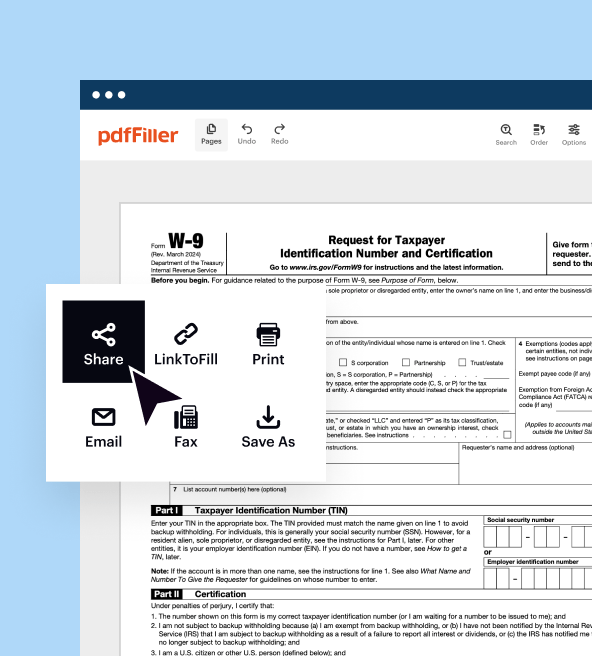

Where do I send the form?

FAQ about IRS 2555-EZ

What should I do if I make a mistake after submitting the f2555ez 2002 form?

If you've submitted the f2555ez 2002 form and realize there's an error, you can file an amended return. This process typically involves completing the required sections on the new form and indicating the changes made. Keep in mind that you may need to provide an explanation for the amendments and retain documentation that supports these corrections.

How can I verify if my f2555ez 2002 form was received or is being processed?

To check the status of your f2555ez 2002 form, you can use the IRS online tracking tools or contact the IRS directly. They can provide information on whether your form has been received and its current processing status, helping assure you that everything is in order.

What are common errors that may occur with the f2555ez 2002 form, and how can I avoid them?

Common errors when filing the f2555ez 2002 form include incorrect personal information, math mistakes, and missing signatures. You can avoid these by double-checking your entries for accuracy, using tax software that offers validation checks, and ensuring all required areas are completed before submission.

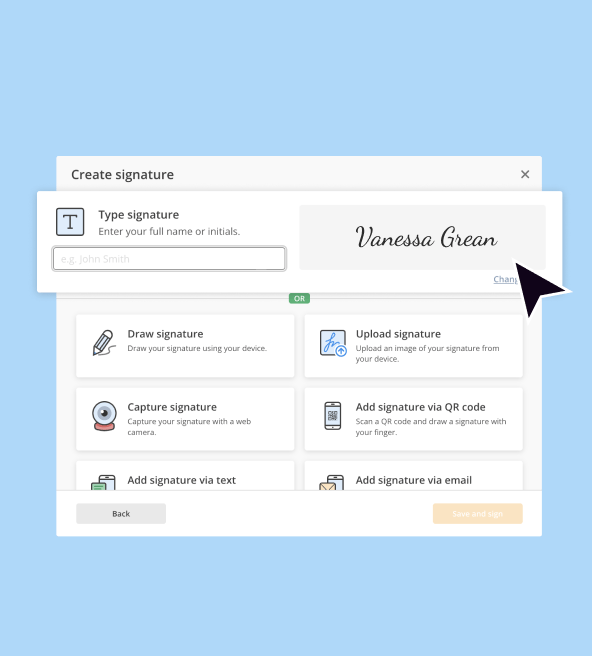

Are there specific requirements for e-signatures when filing the f2555ez 2002 form?

Yes, when submitting the f2555ez 2002 form electronically, you'll need to comply with the IRS's e-signature requirements. This typically includes utilizing a secure method that verifies your identity. Ensure that your e-filing service supports electronic signature options appropriate for tax filings.

What should I do if I receive a notice or audit related to my f2555ez 2002 form submission?

If you receive a notice or are audited regarding your f2555ez 2002 form, respond promptly by reviewing the details in the communication. Gather any required documentation and consider seeking help from a tax professional to ensure you address the issues correctly and timely.