Get the free 2555 ez 2010 form

Show details

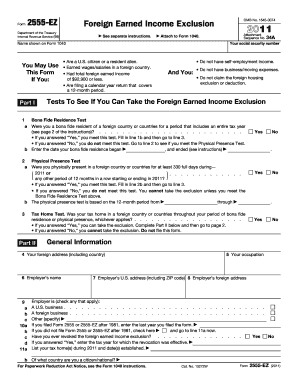

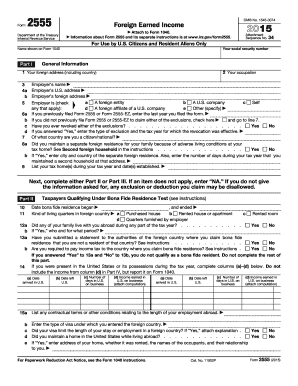

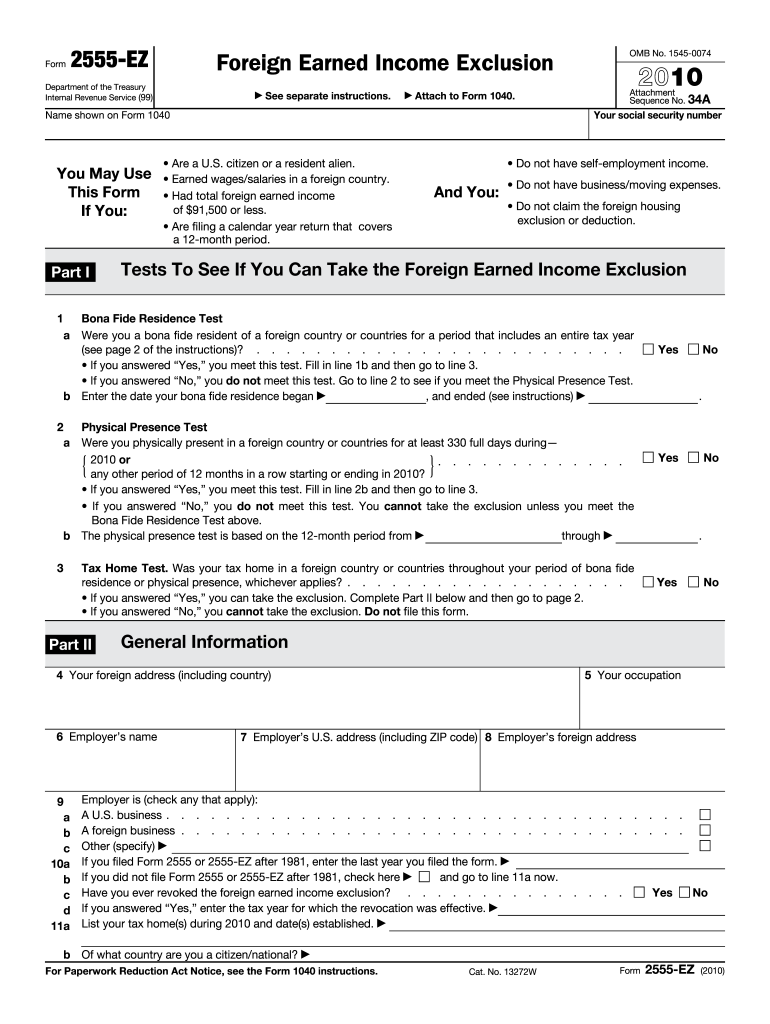

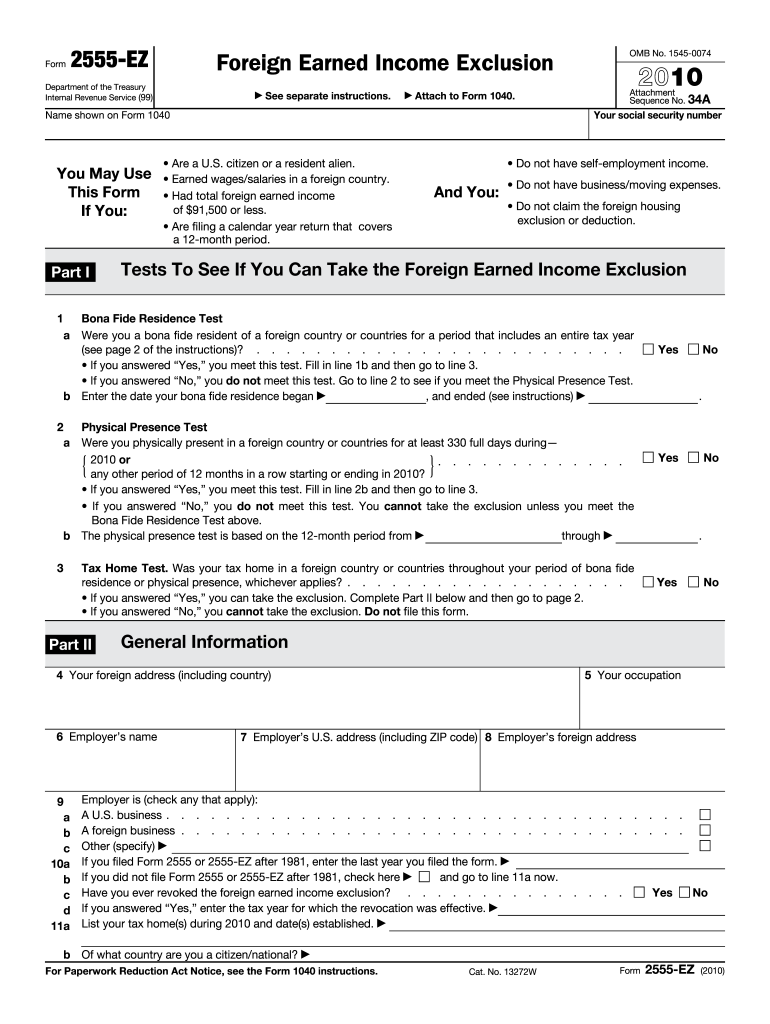

Cat. No. 13272W Form 2555-EZ 2010 Page Days Present in the United States Complete this part if you were in the United States or its possessions during 2010. 91 500 00 x days Multiply line 13 by line 15 Enter in U.S. dollars the total foreign earned income you earned and received in 2010 see instructions. Be sure to include this amount on Form 1040 line 7. on Form 1040 line 21. Next to the amount enter 2555-EZ. A foreign business. Other specify If...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2555 ez 2010 form

Edit your 2555 ez 2010 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2555 ez 2010 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2555 ez 2010 form online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2555 ez 2010 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2555 ez 2010 form

How to fill out 2555 ez 2010 form:

01

Gather all necessary documents such as your passport, visa, and any supporting documents related to your foreign income.

02

Start by providing your personal information such as your name, address, and social security number in the appropriate sections of the form.

03

Fill out Part I of the form where you will indicate your eligibility for the foreign earned income exclusion and your tax home status.

04

Proceed to Part II where you will calculate the amount of your foreign earned income exclusion.

05

Fill out Part III if you qualify for the foreign housing exclusion or deduction.

06

In Part IV, report any foreign housing cost amounts that were not provided by your employer.

07

Complete Part V to calculate the total foreign earned income exclusion, foreign housing exclusion, and/or foreign housing deduction.

08

If you have any foreign business interests or investments, complete Part VI accordingly.

09

Sign and date the form in the designated areas.

10

Attach any supporting documents required by the form, such as Form 2555-T or Form 1116, if applicable.

11

Keep a copy of the completed form for your records.

Who needs 2555 ez 2010 form:

01

US citizens or resident aliens who have qualified foreign earned income and wish to claim the foreign earned income exclusion on their tax return.

02

Individuals who meet the IRS's requirements for tax home status and a bona fide residence or physical presence in a foreign country or countries.

03

Taxpayers who meet the eligibility criteria for the foreign housing exclusion or deduction and need to report their foreign housing costs.

Please note that this information is specific to the 2555 ez 2010 form and may not apply to other forms or tax years. It is always recommended to consult with a tax professional or the IRS directly for personalized guidance.

Fill

form

: Try Risk Free

People Also Ask about

What is the foreign earned income exclusion for 2010?

However, you may qualify to exclude from income up to an amount of your foreign earnings that is now adjusted for inflation ($91,400 for 2009, $91,500 for 2010, $92,900 for 2011, $95,100 for 2012).

What are forms 2555 and 2555-EZ used for?

If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. You cannot exclude or deduct more than your foreign earned income for the year.

What types of income qualify for the foreign earned income exclusion?

The Foreign Earned Income Exclusion (FEIE) is a US tax benefit that allows you to exclude from taxation a certain amount of foreign-earned income over $100,000. The maximum foreign-earned income exclusion for the 2022 tax year is $112,000.

What is form 2555-EZ vs 2555?

Form 2555-EZ is a simplified version of Form 2555, however, the taxpayer must make sure that all the criteria apply. Firstly, the taxpayer must be a US Citizen or resident alien. Secondly the Taxpayer must have earned foreign wages of $100,800 or less.

How do I know if I qualify for foreign earned income exclusion?

A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

Who can file form 2555-EZ?

You need to file IRS form 2555 if you want to claim the Foreign Earned Income Exclusion. The FEIE is available to expats who either: Work outside the U.S. as employees, whether for a U.S. or non-U.S. employer. Work outside the U.S in a self-employed or partner capacity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 2555 ez 2010 form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 2555 ez 2010 form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out 2555 ez 2010 form using my mobile device?

Use the pdfFiller mobile app to complete and sign 2555 ez 2010 form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit 2555 ez 2010 form on an Android device?

You can make any changes to PDF files, like 2555 ez 2010 form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is 2555 ez form?

The 2555 ez form is a simplified version of Form 2555, which is used to claim the foreign earned income exclusion on your U.S. federal income tax return.

Who is required to file 2555 ez form?

U.S. citizens and resident aliens who have foreign earned income and meet certain eligibility requirements may be required to file Form 2555 ez.

How to fill out 2555 ez form?

To fill out Form 2555 ez, you need to provide information about your foreign earned income, your tax home, and your bona fide residence or physical presence test. The form also requires you to calculate the amount of foreign earned income exclusion you are eligible for.

What is the purpose of 2555 ez form?

The purpose of Form 2555 ez is to allow eligible taxpayers to exclude a certain amount of foreign earned income from their U.S. federal income tax.

What information must be reported on 2555 ez form?

On Form 2555 ez, you must report your foreign earned income, your tax home, and your eligibility for the foreign earned income exclusion based on either the bona fide residence test or the physical presence test.

Fill out your 2555 ez 2010 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2555 Ez 2010 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.