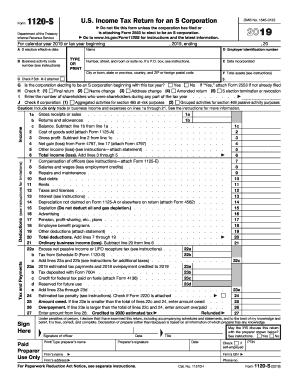

IRS 1120S 2009 free printable template

Instructions and Help about IRS 1120S

How to edit IRS 1120S

How to fill out IRS 1120S

About IRS 1120S 2009 previous version

What is IRS 1120S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

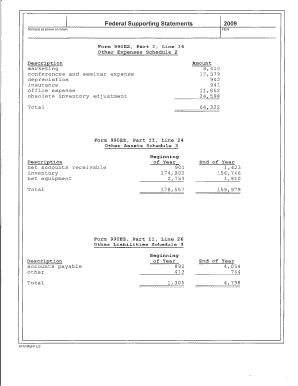

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

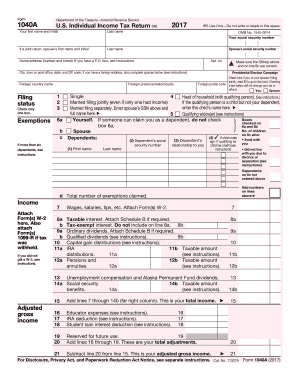

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120S

How can I get [SKS]?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the [SKS] in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit [SKS] in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your [SKS], which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I sign the [SKS] electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your [SKS] in seconds.

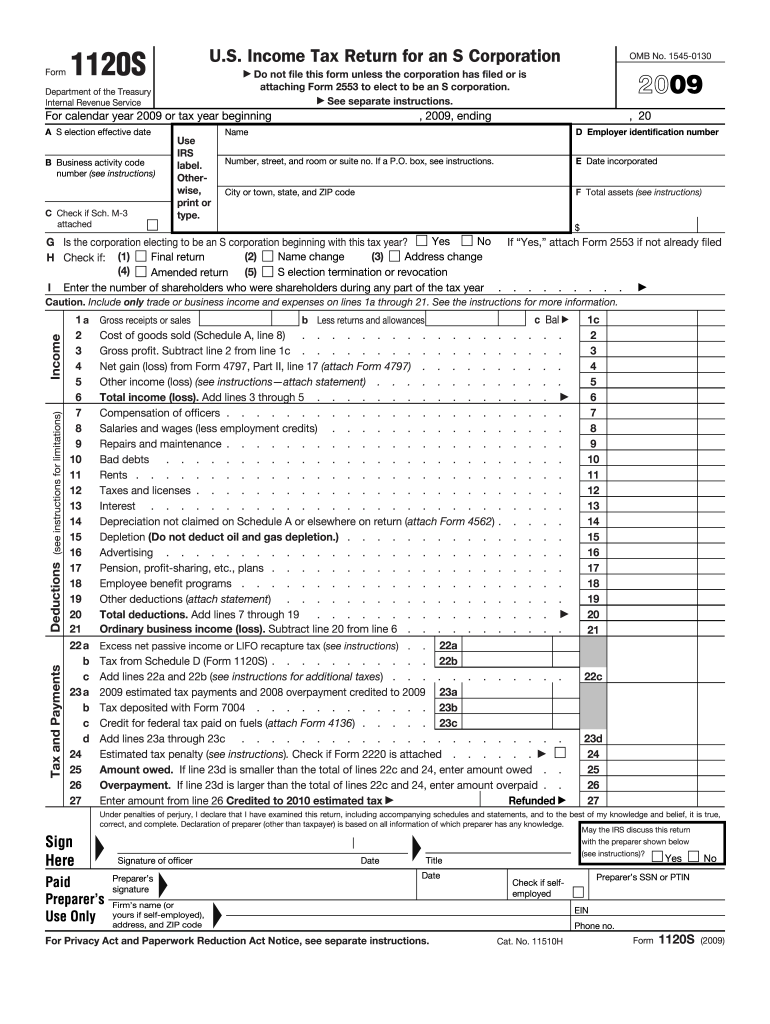

What is IRS 1120S?

IRS 1120S is the tax form used by S corporations to report income, deductions, and credits to the Internal Revenue Service.

Who is required to file IRS 1120S?

S corporations, which are corporations that elect to be taxed under Subchapter S of the Internal Revenue Code, are required to file IRS 1120S.

How to fill out IRS 1120S?

To fill out IRS 1120S, you need to provide details regarding the corporation's income, deductions, and any relevant tax credits, following the specific instructions provided by the IRS.

What is the purpose of IRS 1120S?

The purpose of IRS 1120S is to report the financial activity of an S corporation and to calculate the tax liability of the corporation's shareholders.

What information must be reported on IRS 1120S?

Information that must be reported on IRS 1120S includes the corporation's income, expenses, deductions, credits, and information about the shareholders.

See what our users say