Get the free ncui 685 form

Show details

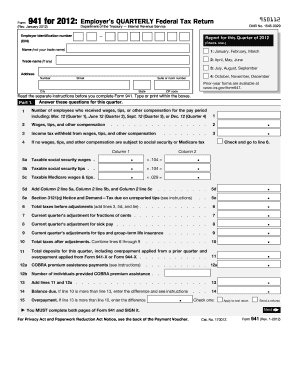

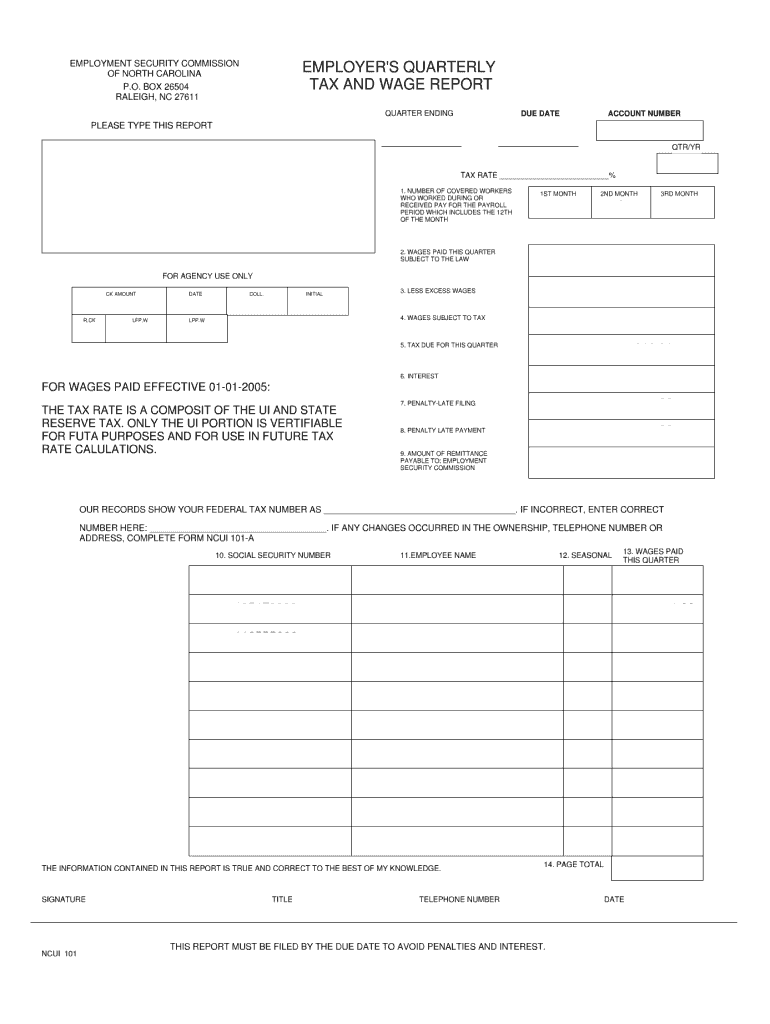

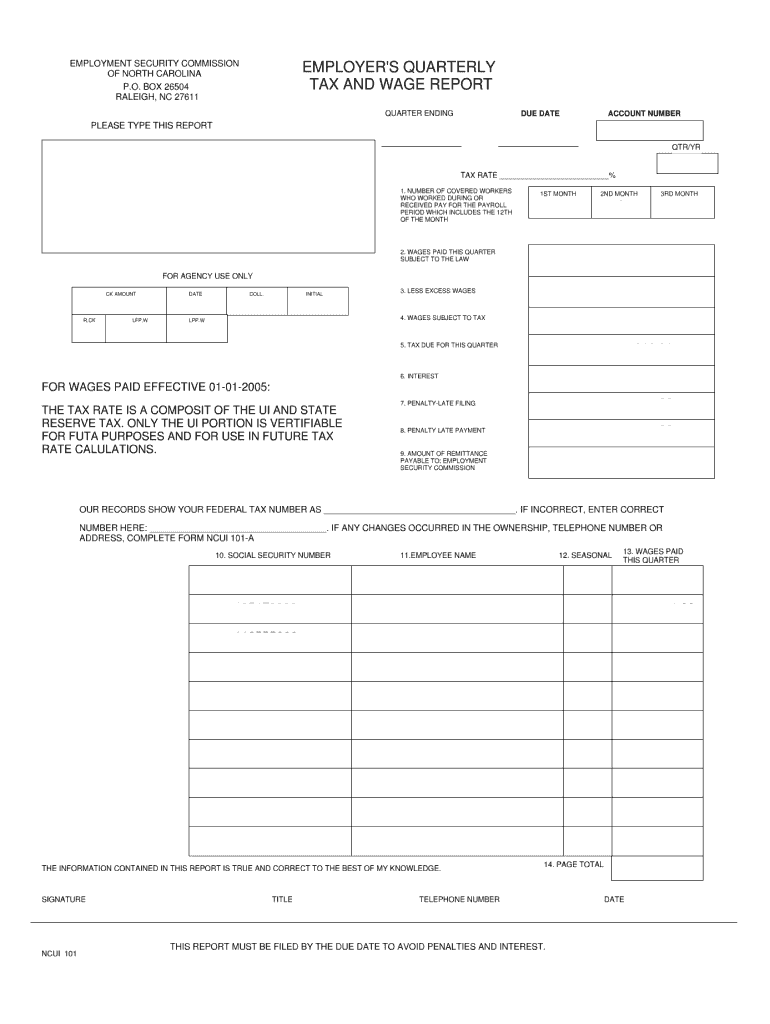

EMPLOYMENT SECURITY COMMISSION OF NORTH CAROLINA P.O. BOX 26504 RALEIGH, NC 27611 PLEASE TYPE THIS REPORT EMPLOYER'S QUARTERLY TAX AND WAGE REPORT QUARTER ENDING DUE DATE ACCOUNT NUMBER 9/30/2010

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample quarterly wage and tax report form

Edit your quarterly wage report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ncui 685 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quarterly unemployment report online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employee wage report form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ncui 101 form

How to fill out NC quarterly tax and:

01

Gather all necessary documents and information such as your tax identification number, income records, and expense receipts.

02

Determine your filing status and gather any applicable forms. NC quarterly tax forms may include the NC-40, NC-3, or NC-5.

03

Calculate your total income for the quarter, including any wages, self-employment income, rental income, or other sources.

04

Deduct any allowable expenses or deductions from your total income to determine your net income.

05

Calculate your NC estimated tax liability using the appropriate tax rates and brackets.

06

Fill out the necessary forms with your personal information and enter your income, deductions, and estimated tax liability.

07

Double-check all the information entered on the forms for accuracy and completeness.

08

Sign and date the forms, and include any required payment if applicable. Payments can be made electronically or by check.

Who needs NC quarterly tax and:

01

Individuals who have self-employment income or income from other sources that are not subject to withholding tax.

02

Business owners who operate as sole proprietors, partnerships, or certain types of corporations.

03

Individuals who are required to make quarterly estimated tax payments based on their expected annual tax liability. This includes people with significant investment income or those who have had underpayment penalties in the past.

It is important to consult with a tax professional or refer to the North Carolina Department of Revenue website for specific instructions and guidance on filling out the NC quarterly tax forms.

Fill

quarterly wage report form

: Try Risk Free

People Also Ask about ncui 101 form 2025

What is North Carolina State Reserve tax?

North Carolina's base tax rate for 2023 will remain 1.9%. The state calculates unemployment tax rates by subtracting an employer's reserve ratio percentage from the base tax rate. Unemployment tax rates are set by state law and range from 0.06% to 5.76%, with new employers having a 1% rate.

What is form Ncui 685?

Instructions for Completing the Adjustment to Employer's Quarterly Tax and Wage Report. (Form NCUI 685)

What is form Ncui 604?

NCUI 604 - Employer Status Report. Page 1. THIS REPORT IS REQUIRED OF EVERY EMPLOYING UNIT AND WILL BE USED TO DETERMINE LIABILITY UNDER THE NORTH CAROLINA EMPLOYMENT SECURITY LAW, GENERAL STATUTE 96 AND DIVISION REGULATIONS. NCUI 604 (Rev 01/2012)

What is the tax form for NC unemployment?

The Division of Employment Security (DES) prepares an IRS Form 1099-G for each person who received unemployment benefits. The form reports the total amount in unemployment benefits a person received in the previous calendar year, plus any state or federal taxes that were withheld.

What wages are subject to N.C. unemployment tax?

Who is liable for Unemployment Tax? A general business employer with gross payroll of at least $1,500 in any calendar quarter or with at least one worker in 20 different weeks during a calendar year.

What is a Ncui 685 form?

Instructions for Completing the Adjustment to Employer's Quarterly Tax and Wage Report. (Form NCUI 685)

What is the penalty for filing NC franchise tax late?

A penalty for failure to timely file a return (5% of the net tax due per month, maximum 25%) will be assessed for failure to file a withholding return by the due date of the return. In addition, criminal penalties are provided for willful failure to comply with the withholding statutes.

What is the tax form for N.C. unemployment?

The Division of Employment Security (DES) prepares an IRS Form 1099-G for each person who received unemployment benefits. The form reports the total amount in unemployment benefits a person received in the previous calendar year, plus any state or federal taxes that were withheld.

What is the penalty for failure to file NCDOR?

Penalties. A taxpayer will be assessed a penalty of $50 per day, up to a maximum of $1,000, for failure to file the informational return by the date the return is due.

What is the penalty for filing Ncui 101 late?

The maximum late filing penalty is 25% (. 25).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employers quarterly tax and wage report in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your ncui 101 form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit employers quarterly tax and wage report form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit quarterly state unemployment or payroll tax report.

How do I fill out nc state income tax on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form ncui 101. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is sample quarterly wage and?

Sample quarterly wage refers to a report that includes the wages paid to employees during a specific quarter by a business or organization.

Who is required to file sample quarterly wage and?

Employers that pay wages to employees are required to file sample quarterly wage reports, including both private sector and public sector employers.

How to fill out sample quarterly wage and?

To fill out a sample quarterly wage, employers need to gather the total wages paid to employees for the quarter, employee details, and follow the specific format and guidelines provided by the relevant authorities.

What is the purpose of sample quarterly wage and?

The purpose of the sample quarterly wage is to provide accurate information for tax reporting, ensuring compliance with payroll taxes, and for statistical purposes related to employment and wage trends.

What information must be reported on sample quarterly wage and?

The information that must be reported typically includes employee names, Social Security numbers, total wages paid for the quarter, and any taxes withheld.

Fill out your ncui 685 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer's Quarterly Tax And Wage Report is not the form you're looking for?Search for another form here.

Keywords relevant to state unemployment quarterly reports

Related to does nc tax social security

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.