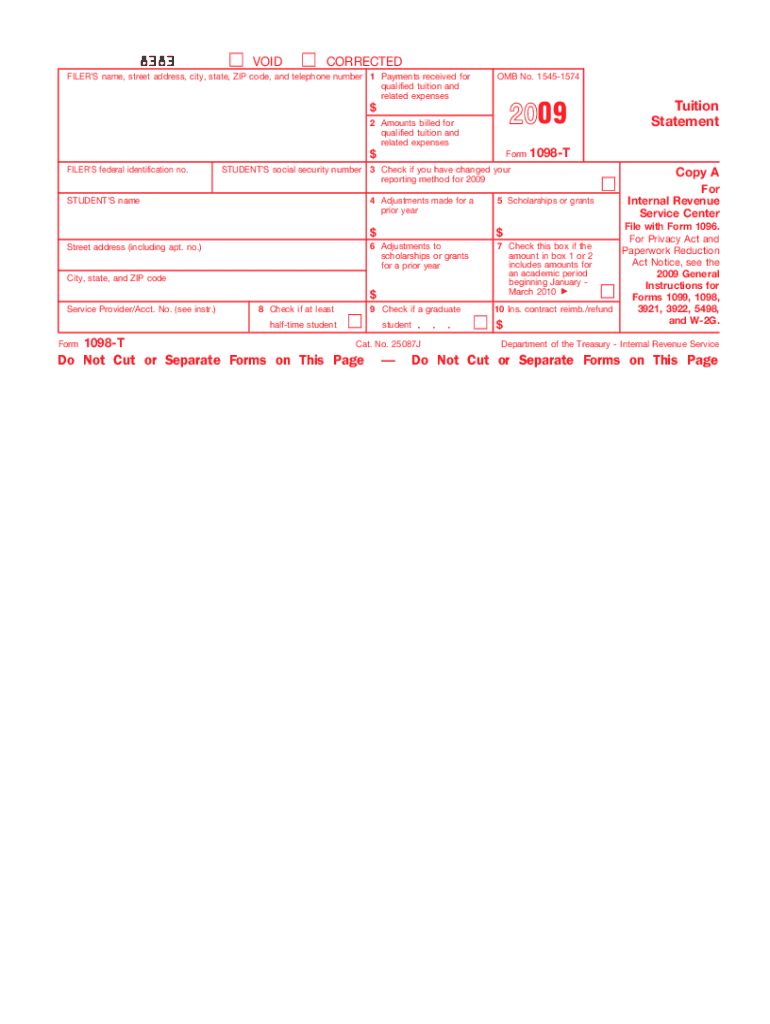

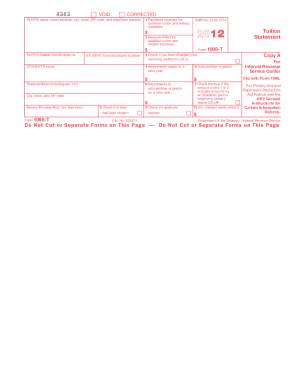

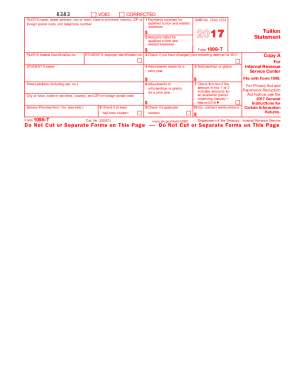

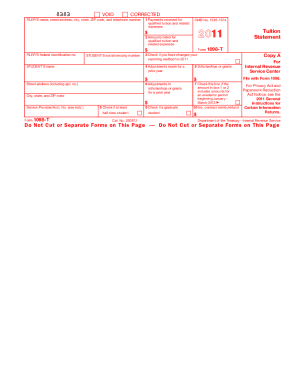

About IRS 1098-T 2009 previous version

What is IRS 1098-T?

IRS 1098-T is an information return used by eligible educational institutions to report payments received for qualified tuition and related expenses. This form is also utilized to document scholarships and grants awarded to students. The data on the 1098-T is critical for both students and the IRS to verify eligibility for education-related tax credits.

What is the purpose of this form?

The purpose of IRS 1098-T is to provide students and the IRS with information regarding payments made for qualified tuition and related expenses. The form helps students calculate their eligibility for education tax credits, such as the American Opportunity Credit or the Lifetime Learning Credit. Additionally, educational institutions use this form to ensure compliance with federal tax reporting requirements.

Who needs the form?

IRS 1098-T must be issued by eligible educational institutions to any student who has made payments for qualified tuition and related expenses during the tax year. Additionally, students who received scholarships or grants need to receive the form, which includes information pertinent to their tax obligations. Parents or guardians claiming a student as a dependent may also benefit from this information when filing their own taxes.

When am I exempt from filling out this form?

Some individuals may be exempt from filing IRS 1098-T if their educational institution did not receive payments for qualified tuition for the tax year. Institutions may also be exempt if the student is enrolled in courses that provide no credit, such as non-degree programs. Additionally, certain international students may not require a 1098-T based on their residency status.

Components of the form

The IRS 1098-T consists of multiple boxes that report different types of information. Box 1 reports payments received for qualified tuition and related expenses. Box 2, which was temporarily removed, used to reflect amounts billed for those expenses. Box 5 details scholarships and grants that were awarded to students, which may reduce their eligibility for tax credits.

What payments and purchases are reported?

IRS 1098-T reports qualified tuition and related expenses paid during the tax year. These typically include tuition fees, enrollment fees, and certain course-related expenses, such as textbooks and supplies. It is essential to note that not all costs qualify; for instance, personal expenses and transportation costs are not reportable on the 1098-T.

How many copies of the form should I complete?

Generally, you do not need to complete multiple copies of IRS 1098-T if you are the recipient. The educational institution will prepare the appropriate copies and send them out to the relevant parties, including the student and the IRS. Always ensure to retain a copy for your records when you receive it.

What are the penalties for not issuing the form?

Failing to issue IRS 1098-T can result in penalties for the educational institution. These penalties can range from $50 for each form not filed correctly to more significant amounts for intentional disregard of filing requirements. It is crucial for institutions to comply to avoid financial repercussions.

What information do you need when you file the form?

When filing IRS 1098-T, you need various pieces of information, including your TIN, the amount of tuition paid, scholarships and grants received, and academic institution's information. Ensuring accurate reporting of these elements helps facilitate processing and prevents errors in tax return submissions.

Is the form accompanied by other forms?

IRS 1098-T may not necessarily be accompanied by other forms, but students should be aware that if they are claiming education tax credits, they might need to complete Form 8863 to calculate and substantiate those credits. Proper documentation is crucial for ensuring compliance with IRS regulations.

Where do I send the form?

You do not send IRS 1098-T directly to the IRS; instead, you retain it for your records when filing your tax returns. Educational institutions must send their copies to the IRS by the designated deadline. Students should consult IRS guidelines to ensure they understand how to use the information for their tax filings.