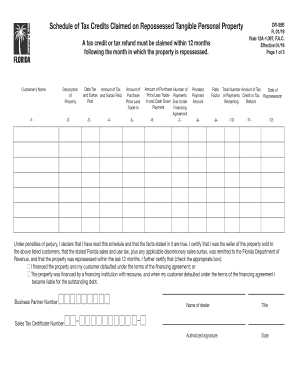

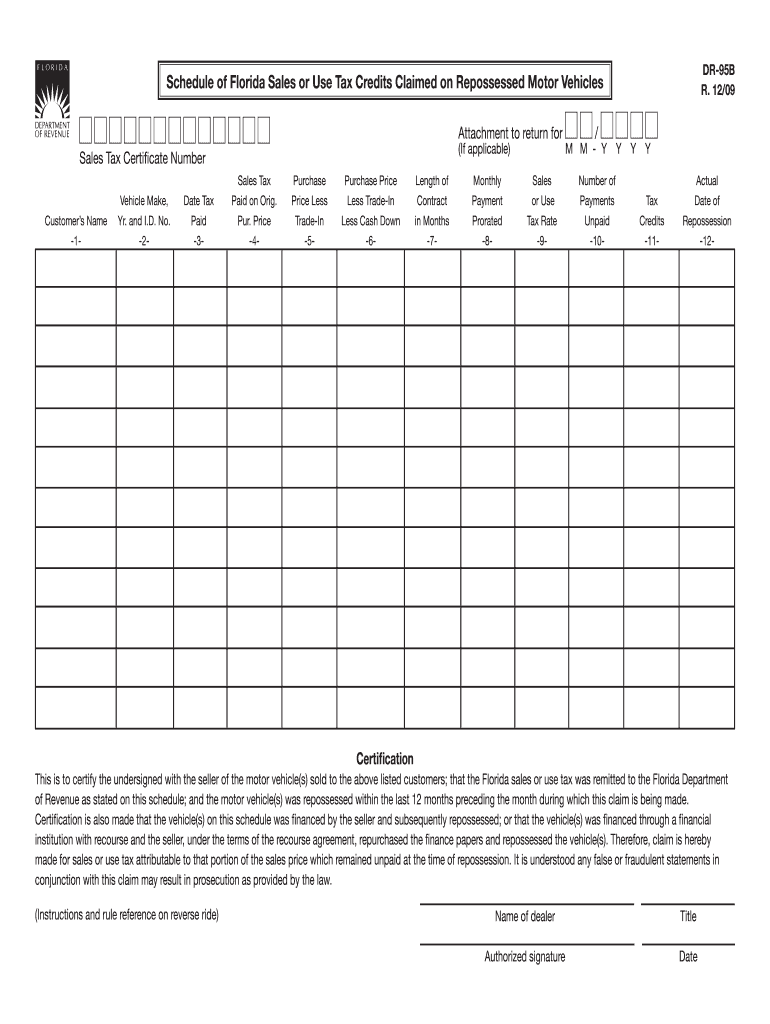

FL DoR DR-95B 2009 free printable template

Show details

DR-95B R. 12/09 Schedule of Florida Sales or Use Tax Credits Claimed on Repossessed Motor Vehicles Attachment to return for If applicable Sales Tax Certificate Number Customer s Name -1- Vehicle Make Yr. Rule Reference Rule 12A-1. 012 2 a Florida Administrative Code states A dealer who has paid sales tax in full on the selling price of tangible personal property sold under a retain title conditional sale or similar contract may upon on a subsequent return or obtain a refund of that portion of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL DoR DR-95B

Edit your FL DoR DR-95B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL DoR DR-95B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing FL DoR DR-95B online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL DoR DR-95B. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-95B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL DoR DR-95B

How to fill out FL DoR DR-95B

01

Download the FL DoR DR-95B form from the Florida Department of Revenue website.

02

Fill out the top section with your name, address, and contact information.

03

Enter your social security number or EIN in the appropriate field.

04

Provide detailed information regarding the tax year in question.

05

Complete the sections related to your income, expenses, and any deductions.

06

Review all information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form either online or by mailing it to the specified address.

Who needs FL DoR DR-95B?

01

Individuals or businesses that have overpaid taxes in Florida and are seeking a refund.

02

Taxpayers who need to report adjustments to their tax situation after the end of a tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is the first report of injury for workers comp in Florida?

DWC1 First Report of Injury (FROI). As soon as you have been notified of a work-related injury, please fill out this form and submit it to EMPLOYERS. This form must be completed within 10 days from notice of a work-related injury. Fatalities must be reported within 24 hours.

What is the 13 week wage statement in Florida?

If the injured employee worked during “substantially the whole of 13 calendar weeks” immediately preceding the accident, the employee's average weekly wage is one-thirteenth of the total amount of wages earned during the 13 calendar weeks.

What does wage statement mean?

What Is Form W-2: Wage and Tax Statement? Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

How is workmans comp calculated in Florida?

Workers' Compensation ing to Florida law (440.12 (2), Florida Statutes), the maximum weekly compensation rate for work-related injuries and illnesses shall be equal to 100 percent of the Statewide average weekly wage, rounded to the nearest dollar.

What are the wage replacement benefits in Florida?

Wage replacement. If you're completely unable to work, workers' compensation will pay you 66.67 percent of your AWW. If you're under a doctor's work restrictions that your employer cannot accommodate, workers' compensation pays you 64 percent of your average weekly wage. These benefits are paid on a bi-weekly basis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL DoR DR-95B in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your FL DoR DR-95B and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I sign the FL DoR DR-95B electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your FL DoR DR-95B in minutes.

How do I complete FL DoR DR-95B on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your FL DoR DR-95B by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is FL DoR DR-95B?

FL DoR DR-95B is a Florida Department of Revenue form used to report information related to the distribution of tangible personal property.

Who is required to file FL DoR DR-95B?

Businesses that engage in the distribution of tangible personal property in Florida are required to file FL DoR DR-95B.

How to fill out FL DoR DR-95B?

To fill out FL DoR DR-95B, provide business information, report the types and quantities of tangible personal property, and include any necessary supporting documentation as instructed on the form.

What is the purpose of FL DoR DR-95B?

The purpose of FL DoR DR-95B is to ensure proper reporting and accountability of tangible personal property transactions for tax purposes.

What information must be reported on FL DoR DR-95B?

The information that must be reported includes the name and address of the business, details of the tangible personal property distributed, quantities, dates of distribution, and signature of the preparer.

Fill out your FL DoR DR-95B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL DoR DR-95b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.