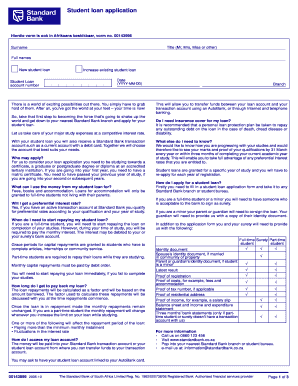

UK HMRC P11D 2011 free printable template

Get, Create, Make and Sign UK HMRC P11D

How to edit UK HMRC P11D online

Uncompromising security for your PDF editing and eSignature needs

UK HMRC P11D Form Versions

How to fill out UK HMRC P11D

How to fill out UK HMRC P11D

Who needs UK HMRC P11D?

Instructions and Help about UK HMRC P11D

Hi and welcome to this short video we're on the remove you through the general tips and fundamental facts that you'll need to know and submitting ap11 t return so let's jump right into it what is a P 11 d return a p xi d return is an end of your submission that an employer will have to make to HMRC at the end of a given tax year so who needs to complete a p Legend submission ultimately is down to the employer to make the submissions on behalf of the individuals however as some guidance any company director an employee earning a rate of 8500 pounds or more need to make a submission in ap11 d providing they are receiving any expense payment or benefits in kind throughout the year so what is an expense payment and a benefit in kind an expense payment is a cost that employee or director will incur whilst performing their work duties that will be reimbursed to them by the company throughout the year some common examples of this will be travel costs subsistence and any entertainment expenses as well and a benefit in kind will be a monetary or non-monetary reward that is given to the director or employee on top of their basic salary the value of which these benefits are calculated can differ however the most common examples that you will find will be company cars loans made out to employees of Directors or any private healthcare costs that are covered by the company, so now we know what RP seventy is and some contents within it when is the submission actually in just a p xi t return will need to be far to HMRC by the 6th of July following the end of the tax year so for example if the tax year is 2014-15 which ends on the 5th of April 2015 then the P 11 D for that year will need to be submitted by the six of July 2015 so once the P 11 d return has actually been submitted what does that also mean do we have to pay any income tax or national insurance well benefits in kind are taxable so depending on your level of income there may be income tax due on these however only certain benefits in kind are liable for class one a national insurance contributions this will be due for payment by the 19th of July following the submission also in addition to this the director or employees will have to pay income tax on these benefits they received now this will be done either via the payroll, and they receive each month all through a self-assessment submission so finally what happens if we miss the filing deadline well it shouldn't be too much of a surprise that HMRC will look to send out fines and penalties if you have missed the submission deadline this amount will be one hundred pounds for every month or even part of the month when the submission is late in addition if you are required to pay class 1a National Insurance Contributions then if you are late painless amount that HMRC will look to accrue interest on this amount as well so submitting the P 11 t return is one of many tasks you have to undertake when being a director of your own limited company and running...

People Also Ask about

How do I submit an amended P11D?

What happens if I incorrectly submit P11D?

Can I submit a paper for P11D?

What form is a P11D?

Where do I post my P11D?

What is a P11D filing?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UK HMRC P11D in Gmail?

Can I create an electronic signature for signing my UK HMRC P11D in Gmail?

How do I fill out the UK HMRC P11D form on my smartphone?

What is UK HMRC P11D?

Who is required to file UK HMRC P11D?

How to fill out UK HMRC P11D?

What is the purpose of UK HMRC P11D?

What information must be reported on UK HMRC P11D?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.