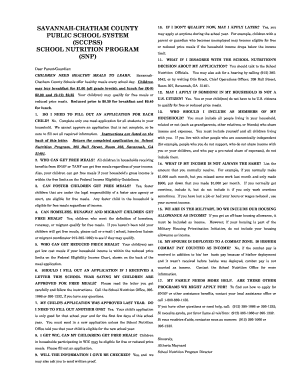

PBGC 500 & 501 2013 free printable template

Get, Create, Make and Sign PBGC 500 501

How to edit PBGC 500 501 online

Uncompromising security for your PDF editing and eSignature needs

PBGC 500 & 501 Form Versions

How to fill out PBGC 500 501

How to fill out PBGC 500 & 501

Who needs PBGC 500 & 501?

Instructions and Help about PBGC 500 501

Hey folks this is Steve with nonprofit ally, and today I'm going to be going over the 501c3 application for nonprofits its form 10:23 that's one zero to three that you'll be filling out and submitting to the IRS I'm going to go over the application that I'm actually submitting to them for Noble pause which is a non-profit that we're starting up here in Alaska, and I'll take you through the different sections of the 501c3 application the form 10:23 and give you an idea of what to expect when you're going to go ahead and fill out this form there's a number of things you have to have in place prior to filling out your form 10:23, and I'll go over what those things are, so you can be prepared when you do fill out this form so if you're ready let's go ahead and get started all right, so this is the IRS 10:23 application it's laid out for you here, and I'm going to just give you a quick overview of this because I'm going to go into a little more detail just following this so the first thing you're going to have is the 10:23 checklist and that is actually included in part of the application and needs to be turned in then there is your 10:23 application which is about 14 pages long after that yet turn in your articles of organization which you should have already filed with your state if you've done any amendments to your articles of organization or your Articles of Incorporation as some people called it if there are any amendments be sure to include those and then of course you have to include your bylaws which should have already been approved at your first nonprofit meeting so all of this should already be completed at this point and then here are all the attachments that go along with your 10:23 application and each attachment is for different sections that throughout the application process that you have to fill in with more details, so those attachments get included and of course you have to pay the IRS for this and currently at the time of this recording its eight hundred and fifty dollars to apply for your 501c3 status, and you do need an EIN number, so it's easy it's free you know it takes five minutes to fill out, and you can do it online just look up EAN and IRS and E I n and Google, and it'll get you to the right page okay so let's head on into the more detailed version of this okay folks were there she is this is your form 10:23 that you can download from the IRS is website it's a PDF file I'm going to flip through this for you, so we're going to just going to remove it here, and we'll kind of just go through it quickly page by page, so you can get an idea of what you're what you're in for here a lot of it has checkboxes that you can fill out on your own as you go through it other with other times you can type in your information right into the lines but what's going to end up happening is you go through if it's going to ask you to attach files and documents to it so that you can explain more in detail some of the questions they're asking...

People Also Ask about

Does PBGC offer lump sum payments?

Can I take all my pension as a lump sum?

Can I take a lump sum from PBGC?

How do I contact PBGC for information on how do you send us your documentation?

Can I cash out my PBGC pension?

What is the maximum guaranteed benefit for 2023 PBGC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my PBGC 500 501 directly from Gmail?

How do I make changes in PBGC 500 501?

How do I edit PBGC 500 501 straight from my smartphone?

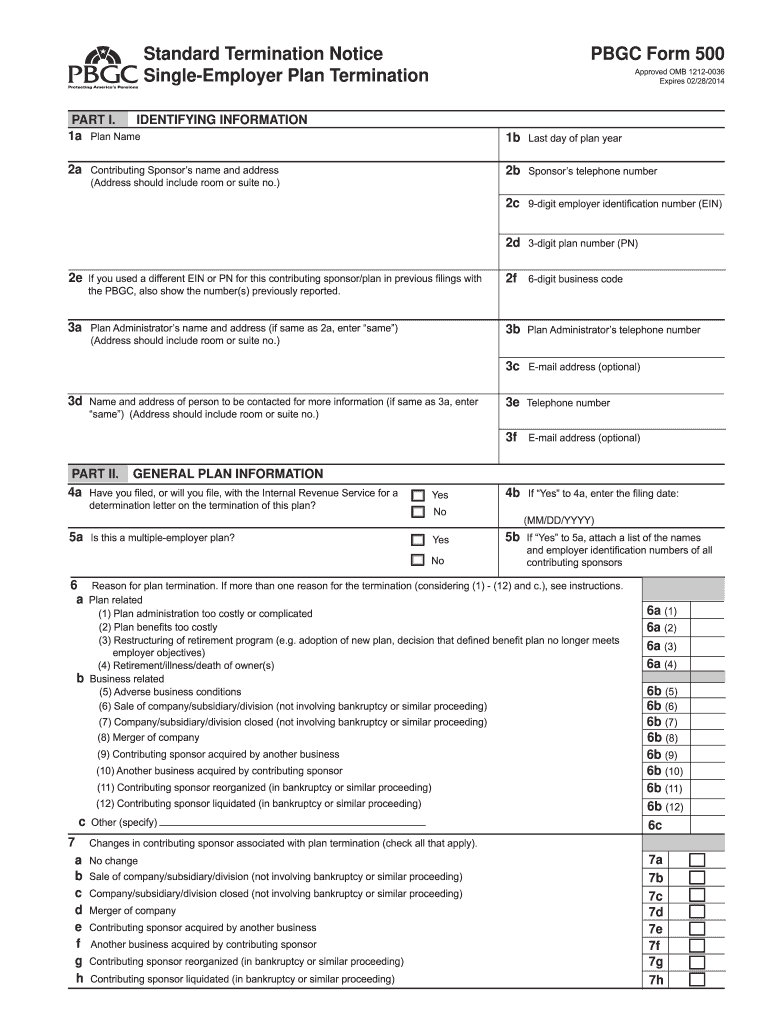

What is PBGC 500 & 501?

Who is required to file PBGC 500 & 501?

How to fill out PBGC 500 & 501?

What is the purpose of PBGC 500 & 501?

What information must be reported on PBGC 500 & 501?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.