NC DoR E-500 2010 free printable template

Show details

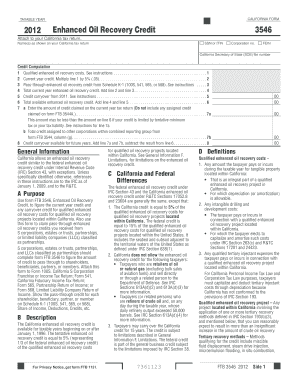

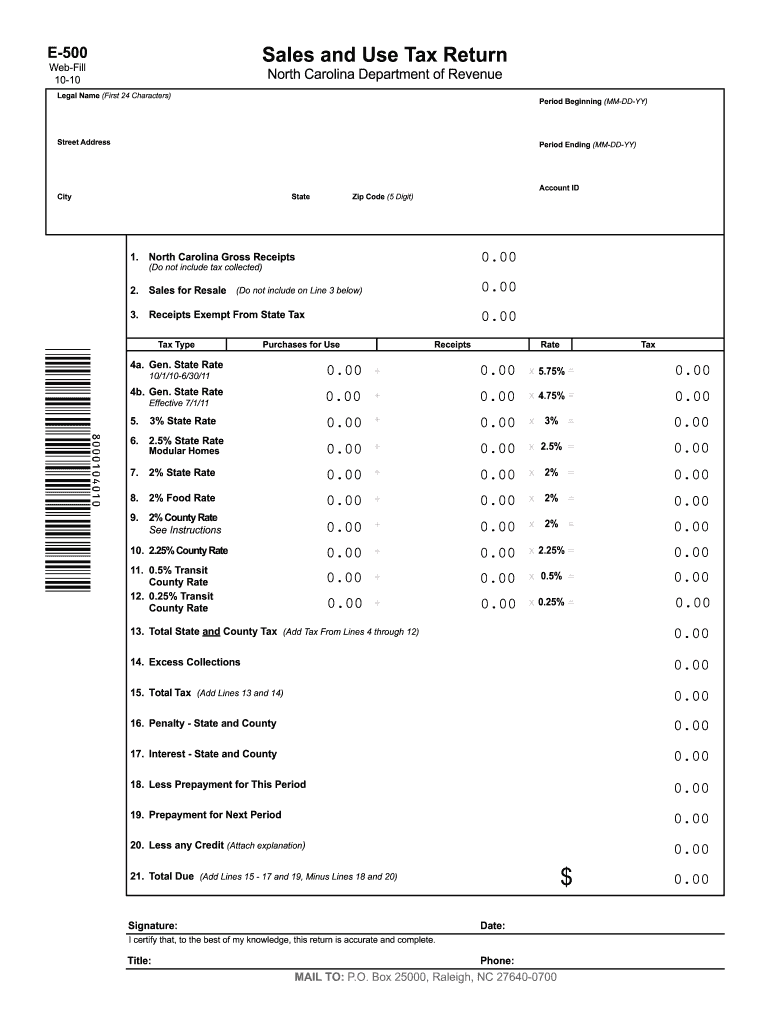

Sales and Use Tax Return E-500 Web-Fill 10-10 North Carolina Department of Revenue Legal Name First 24 Characters PRINT CLEAR Period Beginning MM-DD-YY Street Address Period Ending MM-DD-YY City State Account ID Zip Code 5 Digit 2. Sales for Resale Do not include on Line 3 below Do not include tax collected Receipts Exempt From State Tax Tax Type Purchases for Use Receipts Rate Tax 4a* Gen* State Rate x 5. 75 x 4. 75 x 10/1/10-6/30/11 Effective 7/1/11 3 State Rate Modular Homes x 2. 5 2 Food...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR E-500

Edit your NC DoR E-500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR E-500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR E-500 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NC DoR E-500. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR E-500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR E-500

How to fill out NC DoR E-500

01

Obtain the NC DoR E-500 form from the North Carolina Department of Revenue website or your local tax office.

02

Fill in your business information, including the name, address, and federal employer identification number (EIN).

03

Enter the reporting period for which you are filing the form.

04

Calculate the total sales for the period, including taxable and non-taxable sales.

05

Report any adjustments or exemptions that apply to your business.

06

Compute the total tax due based on the applicable rates.

07

If applicable, include any payments made and subtract them from the total tax due.

08

Sign and date the form, certifying that the information is accurate to the best of your knowledge.

09

Submit the completed form to the NC Department of Revenue by the deadline.

Who needs NC DoR E-500?

01

Businesses and organizations operating in North Carolina that are required to report sales tax collected during a specified period.

02

Retailers, wholesalers, and service providers that make taxable sales in the state.

03

Any entity that has registered for a sales tax permit with the North Carolina Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is NC E-500 form?

Use Form E-500 to file and report your North Carolina State, local and transit sales and use taxes. Taxpayers who.

How do I amend my sales tax return in NC?

You can use a copy of your original return or one of the additional report forms provided in the back of your tax payment forms booklet to make the corrections to the applicable period. The report form should be marked "AMENDED" and forwarded to the Department with any additional tax, penalty and interest due.

How do I pay sales tax in NC?

How to File and Pay Sales Tax in North Carolina File online – File online at the North Carolina Department of Revenue. File by mail – You can use form E-500 and file and pay through the mail, but North Carolina encourages all sellers to pay online. AutoFile – Let TaxJar file your sales tax for you.

How do I pay sales tax in North Carolina?

How to File and Pay Sales Tax in North Carolina File online – File online at the North Carolina Department of Revenue. File by mail – You can use form E-500 and file and pay through the mail, but North Carolina encourages all sellers to pay online. AutoFile – Let TaxJar file your sales tax for you.

Do I have to pay sales tax in NC?

Every person engaged in business in North Carolina is required to collect and pay sales or use tax on retail sales or leases of tangible personal property and certain digital property not specifically exempt by law.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NC DoR E-500?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NC DoR E-500 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit NC DoR E-500 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NC DoR E-500, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out the NC DoR E-500 form on my smartphone?

Use the pdfFiller mobile app to complete and sign NC DoR E-500 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NC DoR E-500?

NC DoR E-500 is a form used by taxpayers in North Carolina to report and remit their sales and use tax.

Who is required to file NC DoR E-500?

Any business or individual in North Carolina who collects sales and use tax from customers is required to file NC DoR E-500.

How to fill out NC DoR E-500?

To fill out NC DoR E-500, provide your business information, total sales, taxable sales, amount of tax collected, and any deductions. Ensure all calculations are accurate before submitting.

What is the purpose of NC DoR E-500?

The purpose of NC DoR E-500 is to facilitate the reporting and payment of the sales and use tax collected by businesses in North Carolina.

What information must be reported on NC DoR E-500?

The information that must be reported on NC DoR E-500 includes the taxpayer's name, address, the total amount of sales, taxable sales amount, tax collected, and any deductions for exempt sales.

Fill out your NC DoR E-500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR E-500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.