Get the free 1993 Form 8843. Statement for Exempt Individuals and Individuals with a Medical Cond...

Show details

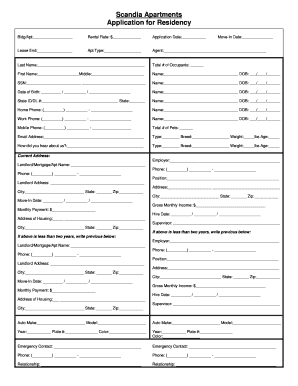

Form 8843 Statement for Exempt Individuals and Individuals With a Medical Condition (Under Section 7701(b) of the Internal Revenue Code) beginning For the year January 1--December 31, 1993, or other

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1993 form 8843 statement

Edit your 1993 form 8843 statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1993 form 8843 statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1993 form 8843 statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1993 form 8843 statement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1993 form 8843 statement

01

To fill out the 1993 Form 8843 statement, you should start by obtaining the form itself. It can be downloaded from the Internal Revenue Service (IRS) website or obtained from a local IRS office.

02

Once you have the form, carefully read the instructions provided. The instructions will guide you through the process of filling out the form correctly and provide valuable information regarding who needs to file this form.

03

Begin by entering your personal information in the top section of the form, including your full name, US taxpayer identification number (if applicable), current address, and country of residence.

04

The next part of the form requires you to provide information about your visa status and the purpose of your stay in the United States. You will need to indicate your visa type, dates of entry and exit, and the educational institution you attended (if applicable).

05

If you have a US social security number or individual taxpayer identification number, enter it in the designated section. If you do not have one, leave it blank.

06

Next, you will need to sign and date the form. If you have a US tax return filing requirement, you may need to attach the completed Form 8843 to your tax return.

Who needs the 1993 Form 8843 statement?

01

Nonresident aliens living in the United States who are engaged in certain academic activities or have other non-immigrant status may need to file Form 8843. This includes students, scholars, teachers, exchange visitors, trainees, or cultural ambassadors.

02

Additionally, individuals who are in the US on an F, J, M, or Q visa may be required to file this form. It is important to consult the IRS guidelines and your designated school official for further clarification on whether you need to file Form 8843.

03

Even if you had no income or only had income exempt from taxation, you may still be required to file the Form 8843 to satisfy your substantial presence test, maintain a valid immigration status, or claim certain tax treaty benefits.

Note: The eligibility and filing requirements for Form 8843 can vary based on individual circumstances and immigration status. It is advisable to consult the IRS or a tax professional for personalized guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 8843 statement for?

Form 8843 is used by certain individuals to claim the Closer Connection Exception Statement for Aliens. It is primarily used by nonresident aliens who wish to establish that they have a closer connection to a foreign country than to the United States in order to avoid being classified as U.S. residents for tax purposes.

Who is required to file form 8843 statement for?

Nonresident aliens who are present in the United States for any part of the calendar year and wish to claim the Closer Connection Exception must file form 8843. This includes international students, scholars, and certain professional athletes and entertainers.

How to fill out form 8843 statement for?

Form 8843 requires individuals to provide their personal information, details about their stay in the U.S., and information about their ties to a foreign country. It must be completed accurately and signed before submitting it.

What is the purpose of form 8843 statement for?

The purpose of form 8843 is to establish that an individual has a closer connection to a foreign country than to the United States, which allows them to claim the Closer Connection Exception and avoid being classified as U.S. residents for tax purposes.

What information must be reported on form 8843 statement for?

Form 8843 requires individuals to report their personal information such as name, address, and taxpayer identification number. They must also provide details about their stay in the U.S., including the purpose of their visit and the number of days spent in the country.

How can I get 1993 form 8843 statement?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 1993 form 8843 statement in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete 1993 form 8843 statement online?

pdfFiller has made filling out and eSigning 1993 form 8843 statement easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in 1993 form 8843 statement without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your 1993 form 8843 statement, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Fill out your 1993 form 8843 statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1993 Form 8843 Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.