Who needs the S-3 form?

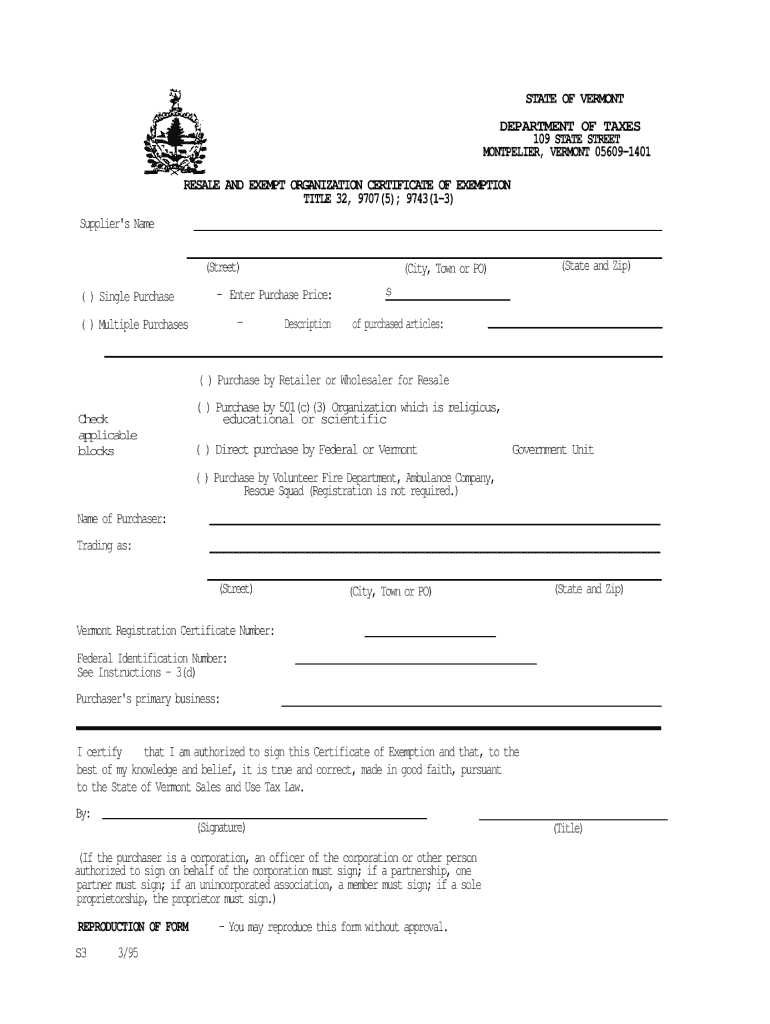

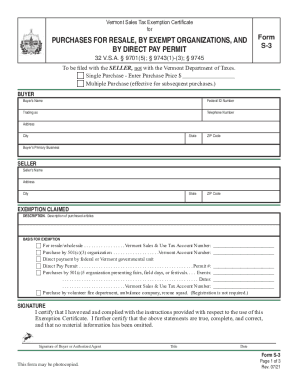

This Sales Tax Exemption Certificate is used by resale and exempt organizations in Vermont. Among these organizations are religious, educational, and scientific organizations as well as Federal or state governmental units, volunteer fire departments, ambulance companies or rescue squads. This form is completed by the purchaser to claim exemption from sales tax on specific purchases.

What is the purpose of the S-3 form?

This certificate is used to exempt the purchaser from payment of the Vermont Sales and Use Tax. It is submitted to the seller who is responsible for tax relief.

What other documents must accompany the S-3 form?

The purchaser has to provide a sales slip or invoice together with this certificate. These supporting documents must contain the name and address of the purchaser.

When is the S-3 form due?

The S-3 form is submitted to the buyer before or at the time of the purchase. The seller should keep the certificate for three years from the date of purchase to provide an explanation of why the sales tax wasn’t exempted.

What information should be provided in the S-3 form?

The Sales Tax Exemption Certificate has four sections for completion:

- Information about the buyer (name, Federal ID number, address, primary business)

- Information about the seller (name, address)

- Information about the claimed exemption (description of purchased articles, basis of exemption - check the appropriate box)

- Certification section (purchaser’s signature and date)

Where do I send the form after its completion?

The completed form is submitted to the seller. The purchaser may keep one copy for his personal records as well.