India ITD Form No. 49AA 2011 free printable template

Show details

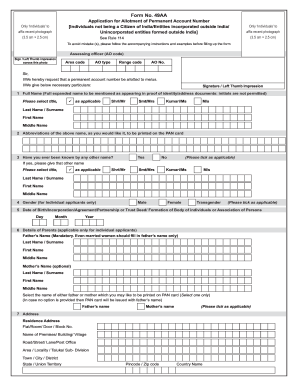

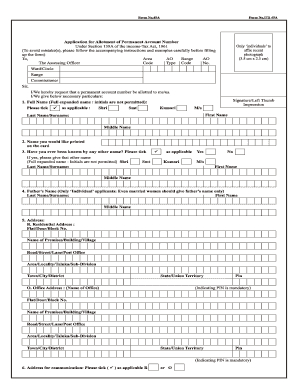

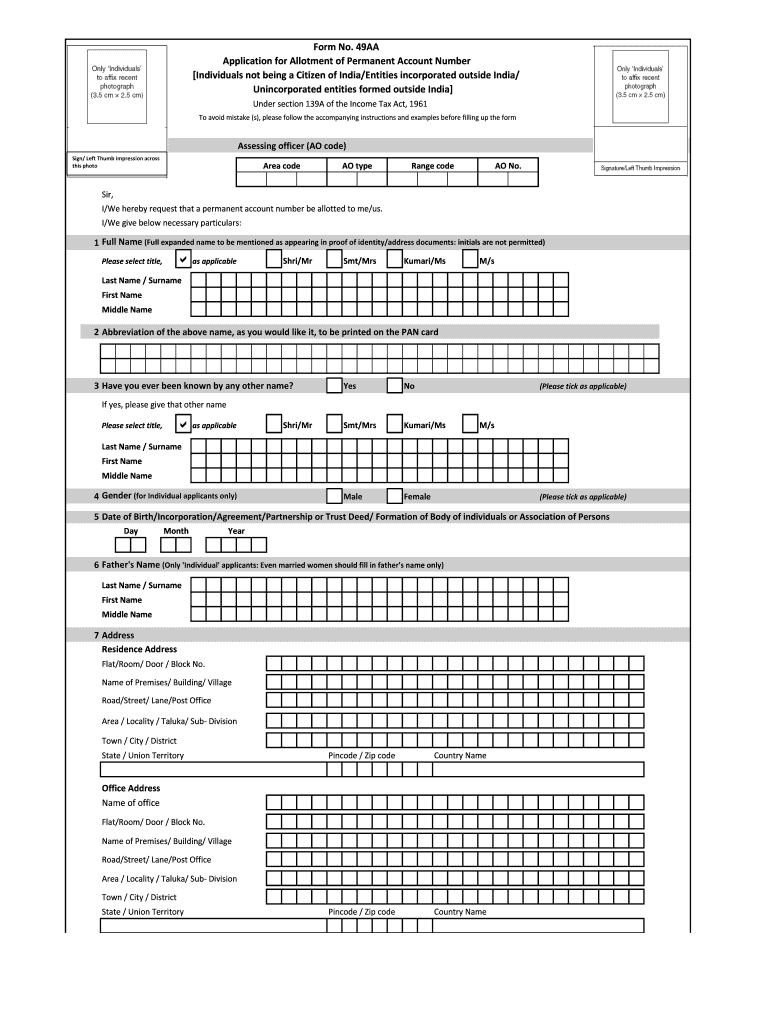

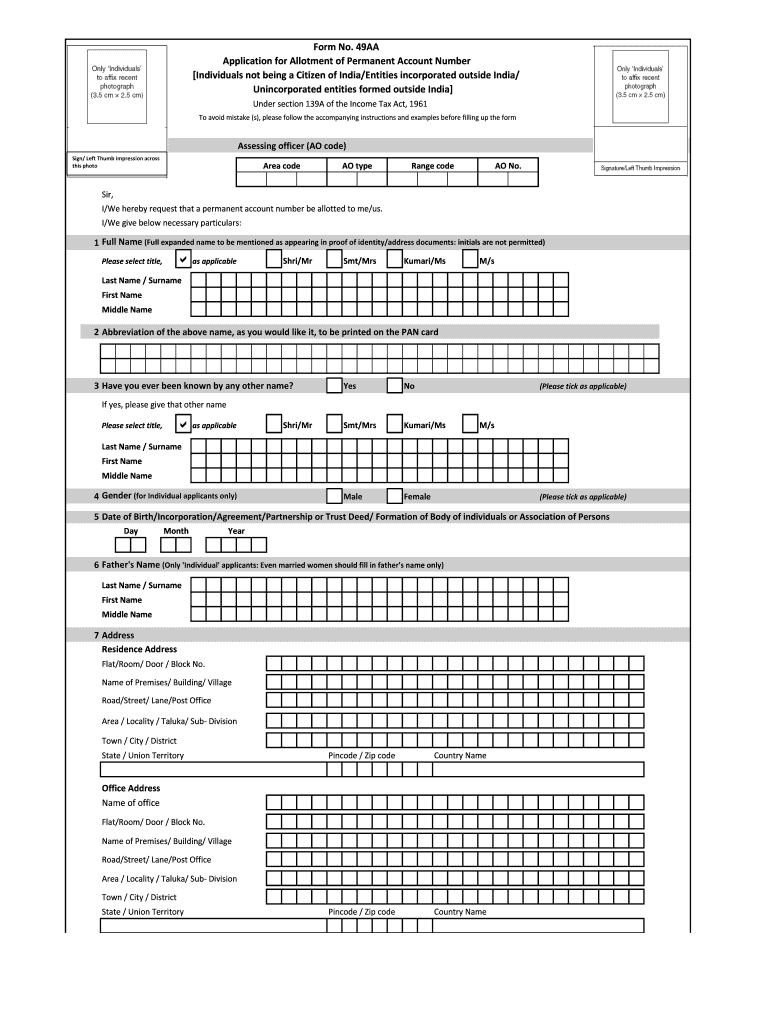

Form No. 49AA Application for Allotment of Permanent Account Number Individuals not being a Citizen of India/Entities incorporated outside India/ Unincorporated entities formed outside India Under section 139A of the Income Tax Act 1961 To avoid mistake s please follow the accompanying instructions and examples before filling up the form Assessing officer AO code Sign/ Left Thumb impression across this photo Area code AO type Range code AO No. Sir I/We hereby request that a permanent account...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign India ITD Form No 49AA

Edit your India ITD Form No 49AA form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India ITD Form No 49AA form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit India ITD Form No 49AA online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit India ITD Form No 49AA. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India ITD Form No. 49AA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India ITD Form No 49AA

How to fill out India ITD Form No. 49AA

01

Start by downloading India ITD Form No. 49AA from the official income tax website or obtain a physical copy from the local tax office.

02

Fill in your legal name as per your official documents in the designated name field.

03

Fill in your address, ensuring that it is correct and current.

04

Provide your date of birth in the specified format, along with any alternate identification details, if applicable.

05

Enter your contact details, including your email address and phone number.

06

Specify the nature of your application; select the relevant option provided in the form.

07

Review the form for accuracy and completeness before submission.

08

Submit the completed form to the relevant tax authority either online or in-person as required.

Who needs India ITD Form No. 49AA?

01

Individuals and entities applying for a Tax Deduction and Collection Account Number (TAN) in India.

02

Non-resident Indians (NRIs) who require a Permanent Account Number (PAN) for tax purposes.

03

Businesses requiring taxation credentials to engage in financial activities in India.

Fill

form

: Try Risk Free

People Also Ask about

Is form 49AA to be filled by foreign citizens?

Non-citizens of India should only use this form (i.e. Form 49AA) for submitting application for allotment of PAN. However, a Qualified Foreign Investor (QFI) has to apply for PAN in Form 49AA through a Depository Participant only.

Can foreigners apply for PAN card in India?

A non-resident Indian ('NRI') can apply for PAN by submitting the Form No. 49A along with the requisite documents and prescribed fees at the PAN application center of UTIITSL or Protean (formerly NSDL eGov).

How can I download PAN card 49A form?

Pan Card Form 49A can be availed from any IT PAN Service Centre (managed by UTIITSL), TIN-Facilitation Centre (TIN-FCs)/ PAN Centre (managed by NSDL e-Gov), any other stationery vendor offering such forms or may be downloaded from the UTIITSL/NSDL/ Income Tax Department website.

Can a US citizen get a PAN card?

PAN can be obtained by Indian Nationals, Foreign Nationals, Indian Entities and Foreign Entities.

How to fill PAN card form online for NRI?

One can apply for PAN by submitting the prescribed PAN application to the authorized PAN agency of the district or through online submission to NSDL along with 2 face-photos, ID proof, address proof and fee. In case of Re-print (re-issue), a photocopy of the old PAN is also required.

How to fill form 49A for PAN card online?

Steps for filing PAN application in Form 49A – 15 digit unique acknowledgment number. Category of the applicant. Permanent Account Number. Name of the applicant. Father's name (only in case of an individual). Date of birth / incorporation / agreement / partnership etc. Address for communication. Payment details.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit India ITD Form No 49AA on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign India ITD Form No 49AA on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit India ITD Form No 49AA on an Android device?

You can make any changes to PDF files, like India ITD Form No 49AA, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I complete India ITD Form No 49AA on an Android device?

Use the pdfFiller mobile app and complete your India ITD Form No 49AA and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is India ITD Form No. 49AA?

India ITD Form No. 49AA is a form used for applying for a Tax Deduction and Collection Account Number (TAN) in India, specifically for foreign entities and individuals who are required to deduct tax at source.

Who is required to file India ITD Form No. 49AA?

Foreign entities and non-resident individuals who are required to deduct tax at source on income earned in India must file ITD Form No. 49AA.

How to fill out India ITD Form No. 49AA?

To fill out ITD Form No. 49AA, applicants need to provide personal and business information including their name, address, country of residence, details of taxes to be deducted, and any other relevant identification details as specified in the form.

What is the purpose of India ITD Form No. 49AA?

The purpose of India ITD Form No. 49AA is to facilitate the application for obtaining a TAN for foreign entities and individuals, enabling them to comply with tax deduction requirements in India.

What information must be reported on India ITD Form No. 49AA?

The information reported on ITD Form No. 49AA includes the applicant's name, address, country of residence, tax-related information, and details about the nature of income from which tax will be deducted.

Fill out your India ITD Form No 49AA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India ITD Form No 49aa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.