Get the free where to mail form 56

Get, Create, Make and Sign where to send irs form 56

How to edit form 56 mailing address online

Uncompromising security for your PDF editing and eSignature needs

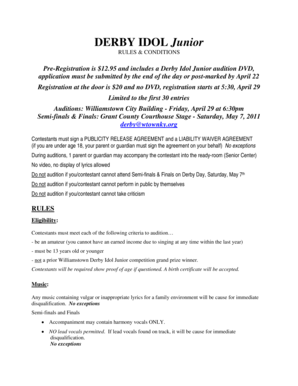

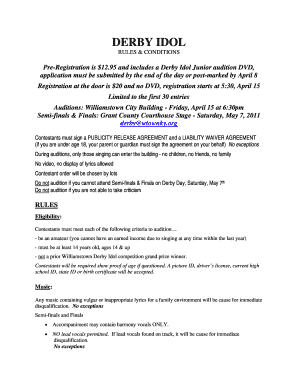

How to fill out form 56 f

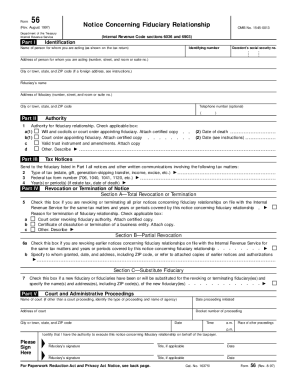

How to fill out Form 56 instructions:

Who needs form 56 instructions:

Video instructions and help with filling out and completing where to mail form 56

Instructions and Help about form 56 pdf

456 why is it so important to fill out this form 56 okay so when these deputy knights crown Templar agents come against the people the errors especially if your Moors even if you're not know this that there are nine times out of ten probably European colonists without a foreign registration statement act without an anti-bribery statement act without a number without paying the taxes for said claim that they've created on the instrument a lot of times people are in the so-called Court venues and the question begs where is the injured party trans versus Pauli arrow go and research that when I've done a video about that earlier the United States military corporation which is registered in District of Columbia are usually the private party and interest the question is in every courtroom you have to ask these pretender imposter judges and prosecutors where is the injured party, and you'd like to speak to them please, so you can settle the matter set it off instantly now prior to going into their venue you need to send off this notice concerning fiduciary relationship because they've claimed to be fiduciary trustees over one's estate, and they're also claiming to be beneficiaries, so they're collecting on the estate while you're standing there in that court venue being auctioned off without your knowledge or consent or authorization and at the same time they're collecting they want you to pay whether it's in your physical being or ever ends what have you Federal Reserve notes now for every venue or claim that they create you need to go and send this document off to the Internal Revenue Service and here's what they are supposed to be paying the taxes on those issues that they create call claims now until you send that form over to and I like the one-one-one-one Constitution Avenue which is Internal Revenue Service I think headquarters William attention Office of William J Wilkins Washington DC in parentheses 2 0 2 2 4 which is a zip code non-domestic without the United States you guys know that already from our other post office videos now when you're sitting in this forum I don't really fill this form out what I tend to do send an ass and even with the form and I had filled it up in the past and I put the judges prosecutors and the police officers or the clerk's name on this document but if you've got a whole host of them you might just want to do an affidavit with a list clerk bailiff sheriff judge prosecuting any of the attorneys police officers they go on this particular form and in the affidavit you know you just write, and you're not much to bring any liability issues upon this court however my life has been placed in jeopardy I am we're being targeted, and we require an advocate and the other line is you do not wish to be a party I always write I do not wish to be a party to any tax fraud so and if you're aware that they need to pay the taxes, and you don't say anything you become culpable to that fraud, so you need to state that in Iran for...

People Also Ask about where do i send form 56

How do I submit form 56 to the IRS?

What is form 56 requirement?

Does form 56 get filed with a tax return?

What do I do with form 56?

Can I file form 56 electronically?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute where do i mail form 56 online?

How do I make changes in form 56?

Can I create an eSignature for the irs form 56 where to mail in Gmail?

What is where to mail form?

Who is required to file where to mail form?

How to fill out where to mail form?

What is the purpose of where to mail form?

What information must be reported on where to mail form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.