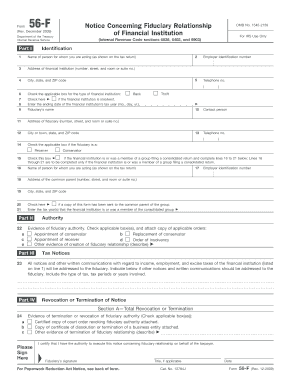

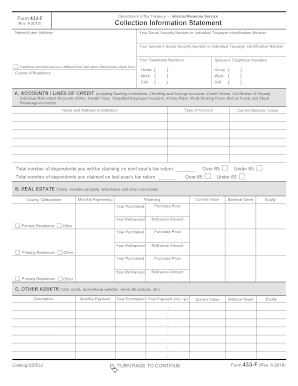

Form 433-f

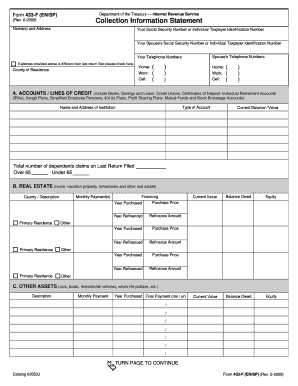

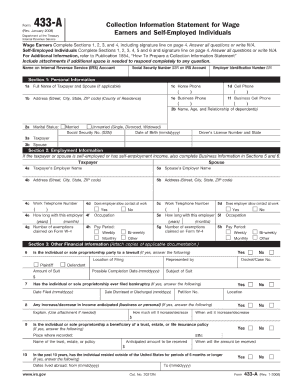

What is form 433-f?

Form 433-F, also known as the Collection Information Statement, is a document used by the Internal Revenue Service (IRS) to collect financial information from individuals and businesses. This form helps the IRS determine your ability to pay your tax debt. It includes detailed questions about your income, expenses, assets, and liabilities.

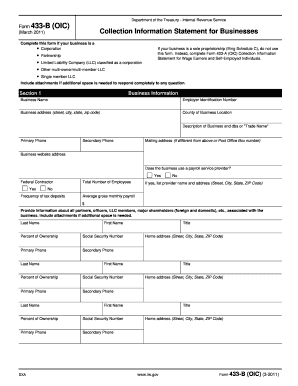

What are the types of form 433-f?

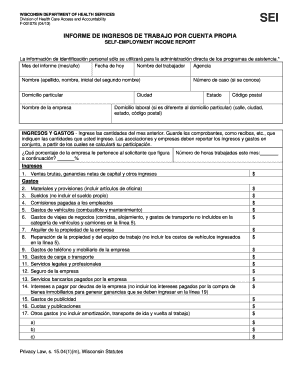

There are two types of Form 433-F: individual and business. The individual form is used by individuals who have a personal tax debt, while the business form is used by businesses that owe taxes. Both forms require similar information, but the business form includes additional sections for reporting business-related income and expenses.

How to complete form 433-f

Completing Form 433-F may seem daunting, but with the right guidance, it can be done efficiently. Here are the steps to complete the form:

With the help of pdfFiller, completing Form 433-F becomes easier. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.