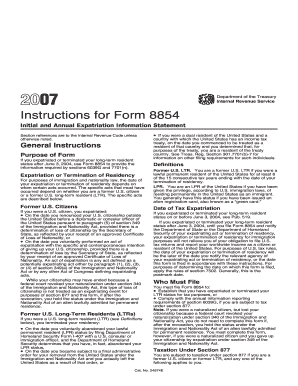

Form 9465 Instructions 2016

What is form 9465 instructions 2016?

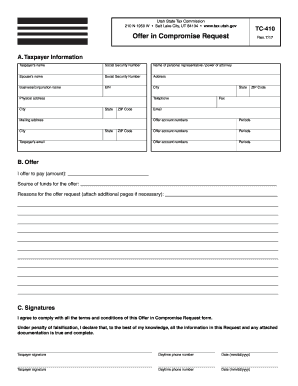

Form 9465 instructions 2016 is a set of guidelines provided by the IRS to help taxpayers understand how to complete and file Form 9465, which is used to request a monthly installment plan for paying taxes owed. These instructions provide step-by-step guidance on who is eligible to use the form, how to fill it out correctly, and what supporting documents may be required.

What are the types of form 9465 instructions 2016?

There are two main types of form 9465 instructions 2016: individual instructions and business instructions. Individual instructions are specifically designed for taxpayers who are filing as individuals or joint filers. Business instructions, on the other hand, are intended for taxpayers who are filing as a business entity, such as a sole proprietorship, partnership, or corporation. Each set of instructions provides detailed information on how to complete the form based on the taxpayer's filing status and financial situation.

How to complete form 9465 instructions 2016

Completing form 9465 requires accuracy and attention to detail. Here are the key steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.