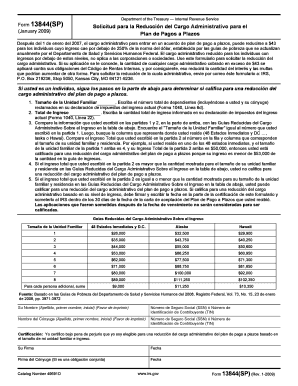

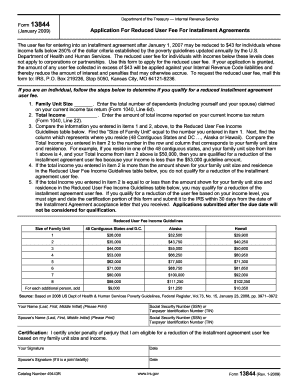

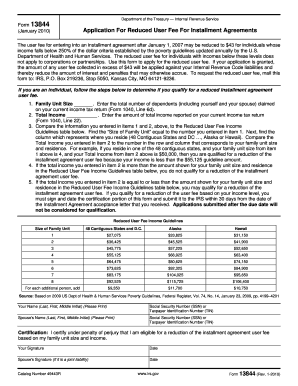

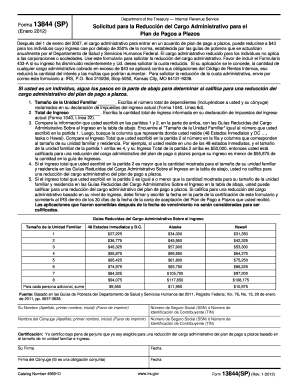

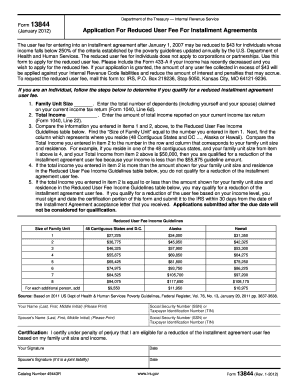

Form 13844

What is form 13844?

Form 13844 is an important document that serves as a Request for Relief/Refund of Overpayment of Taxes. It is used by taxpayers to inform the Internal Revenue Service (IRS) about their overpaid taxes and request a refund or apply the amount to their future tax liabilities. This form provides taxpayers with a simple and convenient way to resolve overpayment issues and ensure their tax matters are handled efficiently.

What are the types of form 13844?

There are a few types of form 13844, depending on the purpose of the request. These include:

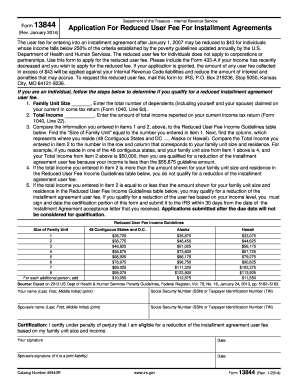

Form 13844 - Application for Refund of Overpayment

Form 13844-B - Business Application for Refund of Overpayment

How to complete form 13844

Completing form 13844 is a straightforward process. Here are the steps you need to follow:

01

Provide your personal information, such as your name, address, and Social Security Number (SSN).

02

Indicate the tax period for which you are requesting relief.

03

Specify the overpayment amount and whether you want a refund or a credit for future tax liabilities.

04

Attach any supporting documents or explanations that may assist the IRS in processing your request.

05

Sign and date the form to certify the accuracy of the information provided.

By following these steps, you can ensure that your form 13844 is completed accurately and efficiently.

Video Tutorial How to Fill Out form 13844

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much does it cost to set up an installment agreement with the IRS?

Fees for IRS installment plans If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465. If not using direct debit, then setting up the plan online will cost $130.

Has my IRS payment plan been approved?

You can also confirm your installment agreement with the IRS by calling them at 1-800-829-1040 Monday - Friday, 7:00 am - 7:00 pm local time once your return has been fully processed (allow 2 weeks for processing).

Can I do a tax repayment plan?

If you can't pay your tax bill in 90 days and want to get on a payment plan, you can apply for an installment agreement. It may take up to 60 days to process your request. Typically, you will have up to 12 months to pay off your balance.

How long can the IRS collect on an installment agreement?

If you enter into an installment agreement with the IRS, the rule remains the same: They have 10 years to collect, and you have no more than 10 years to pay. An IRS installment agreement does not extend the time frame the IRS has to collect.

How long does it take the IRS to approve payment plan?

It can take up to 30 days for the IRS to approve your Payment Plan/Installment Agreement. If you requested a Payment Plan/Installment Agreement when you E-filed your Tax Return and it has not been approved yet, then I recommend that you make a payment by the due date of your return, 4/17/18.

How long does it take for IRS to approve installment agreement?

If you apply for a payment plan (installment agreement), it may take up to 90 days to process your request. Typically, you may have up to 3 to 5 years to pay off your balance.

Related templates