Get the free Form 8894 (September 2005 ) - irs

Show details

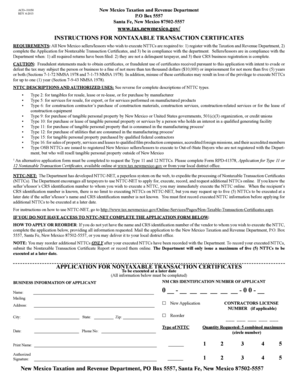

Form 8894 (September 2005) Department of the Treasury Internal Revenue Service Request to Revoke Partnership Level Tax Treatment Election For tax year beginning, 20 and ending, 20 OMB No. 1545-1955

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8894 september 2005

Edit your form 8894 september 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8894 september 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 8894 september 2005 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 8894 september 2005. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8894 september 2005

How to fill out form 8894 September 2005?

01

Start by carefully reading the instructions provided with the form. Familiarize yourself with all the requirements and guidelines before filling it out.

02

Gather all the necessary information and documentation needed to complete the form accurately. This may include personal details, financial information, and any other supporting documents that may be required.

03

Fill in the form by providing the requested information in the appropriate fields. Make sure to double-check the accuracy of the data to avoid any errors or discrepancies.

04

Pay attention to any specific instructions or additional forms that may need to be attached to Form 8894. Ensure that all required attachments are included before submitting the form.

05

Review the completed form to ensure all sections are filled out correctly, all necessary information is provided, and all required signatures are obtained.

Who needs form 8894 September 2005?

01

Form 8894 September 2005 is typically required by individuals or businesses who have engaged in a like-kind exchange of property under Section 1031 of the Internal Revenue Code.

02

It is necessary for taxpayers who want to defer recognizing gains or losses on the exchange of like-kind property to report their transactions and claim the appropriate tax benefits.

03

Additionally, taxpayers who are part of a multiple-party exchange or who use an intermediary to facilitate the exchange may be required to file Form 8894 to comply with the IRS regulations.

Note: It is always recommended to consult with a tax professional or refer to the IRS instructions for Form 8894 September 2005 to ensure compliance with the specific requirements and regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 8894?

Form 8894, request to revoke partnership level tax treatment election.

What is the statement for exempt individuals and individuals with a Medical Condition?

Form 8843 - Statement for Exempt Individuals and Individuals with a Medical Condition. Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition, is used to exclude days of presence in the U.S. for certain individuals.

What is IRS Form 8893 for?

It's for specialized treatment at audit and at trial for small partnerships. Read the election statement on the form, which states, in part: "This election will subject the partnership to the unified audit and litigation procedures of sections 6221 through 6234."

What are the tax benefits of a partnership?

Tax Benefits of a Partnership. A partnership is considered a pass-through tax entity. This means that the partnership does not pay income tax, but instead the profits pass-through the company and to the owners or partners. For tax purposes, a partnership is ultimately viewed as an extension of its owners.

What is the statement for exempt individuals?

IRS Form 8843 Statement for Exempt Individuals and Individuals with a Medical Condition, For use by alien individuals only, is used to exclude days of presence in the U.S. for certain individuals. ing to the instructions for the form, it would either be mailed to the IRS alone or with Form 1040NR or 1040NR-EZ.

Does a partnership have to file a tax return if no income?

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8894 september 2005 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your form 8894 september 2005 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the form 8894 september 2005 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form 8894 september 2005 in minutes.

How do I edit form 8894 september 2005 straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing form 8894 september 2005.

What is form 8894 september?

Form 8894 September is a tax form used by taxpayers to report their Qualified Cyclically Employee Positions (QCEPs) and to determine the amount of QCEP wages eligible for the tax credit.

Who is required to file form 8894 september?

Taxpayers who have qualified cyclically employee positions and want to claim the QCEP tax credit are required to file form 8894 September.

How to fill out form 8894 september?

To fill out form 8894 September, taxpayers need to provide information about their QCEPs, including the number of positions, wages paid, and other required details. The form must be filled accurately and completely, following the instructions provided by the IRS.

What is the purpose of form 8894 september?

The purpose of form 8894 September is to enable taxpayers to claim the Qualified Cyclically Employee Positions tax credit. This credit is designed to support businesses that hire and retain employees in cyclically sensitive industries.

What information must be reported on form 8894 september?

On form 8894 September, taxpayers must report detailed information about their qualified cyclically employee positions, including the number of positions, wages paid, and other relevant data. They may also need to provide supporting documentation as required by the IRS instructions.

Fill out your form 8894 september 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8894 September 2005 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.