CA USTLA 5 2002 free printable template

Show details

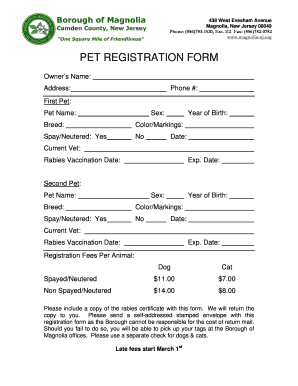

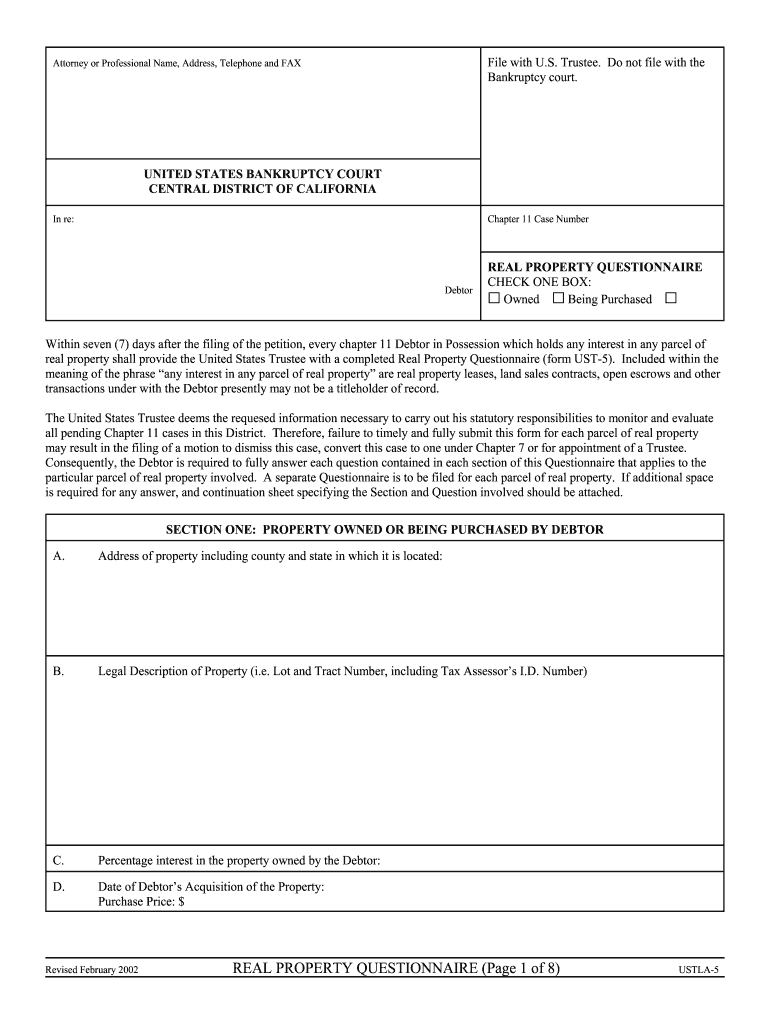

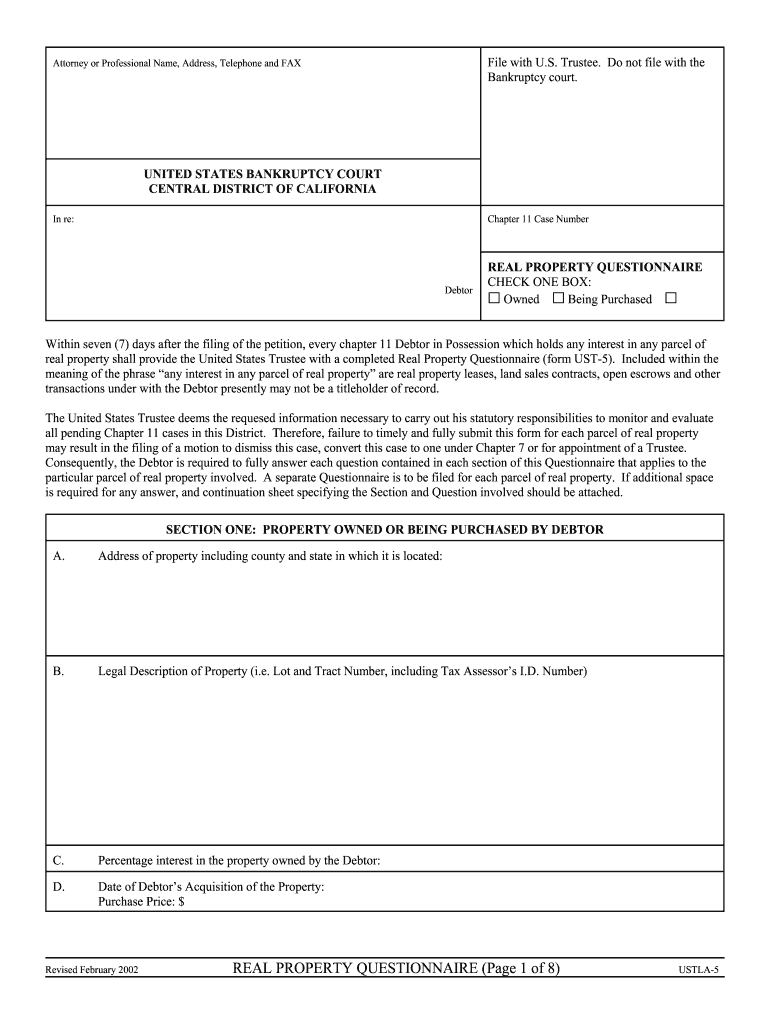

D. Number C. Percentage interest in the property owned by the Debtor D. Date of Debtor s Acquisition of the Property Purchase Price Revised February 2002 USTLA-5 E. Type of real property i.e. single family residence condominium apartment bldg. File with U*S* Trustee. Do not file with the Bankruptcy court. Attorney or Professional Name Address Telephone and FAX UNITED STATES BANKRUPTCY COURT CENTRAL DISTRICT OF CALIFORNIA In re Chapter 11 Case Number Debtor REAL PROPERTY QUESTIONNAIRE CHECK...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign property real questionnaire

Edit your property real questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property real questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property real questionnaire online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit property real questionnaire. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA USTLA 5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out property real questionnaire

How to fill out CA USTLA 5

01

Obtain the CA USTLA 5 form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Read the instructions carefully to understand the requirements.

03

Fill out your business information including name, address, and contact details.

04

Provide your taxpayer identification number (TIN) or Social Security Number (SSN).

05

Specify the type of transaction or services that apply to your business.

06

Enter the applicable sales tax rate for your location.

07

Calculate the total amount of tax due based on your reported transactions.

08

Review the form for any errors or omissions.

09

Sign and date the form where indicated.

10

Submit the completed form as instructed, either electronically or by mail.

Who needs CA USTLA 5?

01

Businesses operating in California that are subject to the use tax.

02

Individuals or entities purchasing tangible personal property for use in California.

03

Taxpayers who have received a notice from the CDTFA regarding use tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is required on a deed in NC?

A North Carolina deed must contain the grantor's name, the grantee's name and address, the preparer's name, and must receive a notary's approval. A deed requires a description of the property or asset. Both parties must sign the deed for it to gain eligibility for legal enforcement.

How do I transfer a real estate deed in NC?

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

How much does it cost to transfer a deed in NC?

When ownership in North Carolina real estate is transferred, an excise tax of $1 per $500 is levied on the value of the property. For example, a $600 transfer tax would be imposed on the sale of a $300,000 home. Transfer taxes in North Carolina are typically paid by the seller.

How do I transfer a property deed in North Carolina?

What Are the Steps to Transfer a Deed Yourself? Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Can Medicaid take a jointly owned home in NY?

Under federal law, the Medicaid program can indeed seek to attach the portion of the home that you retained ownership of after you die. For example, if your son and your daughter were joint tenants, a third of the value of the home would be fair game for the Medicaid recovery unit.

How do I get a copy of my deed in NY?

Call 311 or 212-NEW-YORK (212-639-9675) for assistance. You can request a certified or uncertified copy of property records online or in person. Certified copies cost $4 per page. Uncertified copies printed at a City Register Office cost $1 per page.

What is the joint tenancy right of survivorship in New York State?

If Property is a Joint Tenancy, New York Laws Can Allow Probate Avoidance. When property is owned as a joint tenancy with rights of survivorship, this means that the co-owners are automatically going to inherit the property if any one of the owners passes away. This is what is meant by the right of survivorship.

What happens to a jointly owned property if one owner dies in New York?

Joint tenants – each owner owns an undivided interest in the whole property, but if the interest is sold, the joint tenancy ends and the owners become tenants in common. If one of the joint tenants dies, the deceased person's interest automatically goes to the other joint tenant.

How do I transfer a deed to New York State?

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my property real questionnaire in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your property real questionnaire along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I fill out the property real questionnaire form on my smartphone?

Use the pdfFiller mobile app to fill out and sign property real questionnaire. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit property real questionnaire on an Android device?

With the pdfFiller Android app, you can edit, sign, and share property real questionnaire on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is CA USTLA 5?

CA USTLA 5 is a form used by taxpayers in California to report information related to their use of the state's underground storage tank liability fund.

Who is required to file CA USTLA 5?

Entities that operate or have operated an underground storage tank in California and are seeking to claim benefits from the state's underground storage tank fund are required to file CA USTLA 5.

How to fill out CA USTLA 5?

To fill out CA USTLA 5, taxpayers need to provide specific details regarding the storage tank, such as its location, type, and the nature of the contamination. It is advisable to follow the instructions provided with the form meticulously.

What is the purpose of CA USTLA 5?

The purpose of CA USTLA 5 is to collect data required for assessing claims and eligibility for financial assistance related to the cleanup of leaks from underground storage tanks.

What information must be reported on CA USTLA 5?

The information that must be reported on CA USTLA 5 includes the owner's contact details, tank specifications, contamination details, site information, and any previous assessments or cleanup efforts.

Fill out your property real questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Real Questionnaire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.