NY TC 343 EC 2012-2025 free printable template

Show details

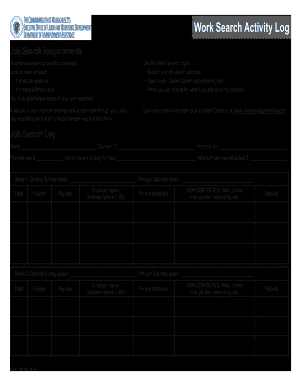

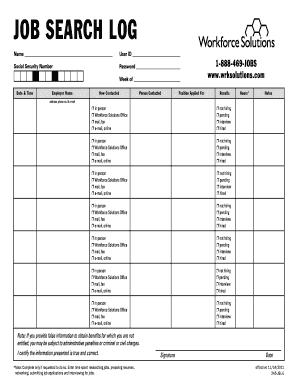

This document is used to record the employers and labor unions contacted during job search activities while claiming unemployment insurance benefits.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ny form work search record

Edit your new york state department of labor form ws5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your get ws5 form get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit get ws5 form edit online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit work search record form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out work search record example form

How to fill out NY TC 343 EC

01

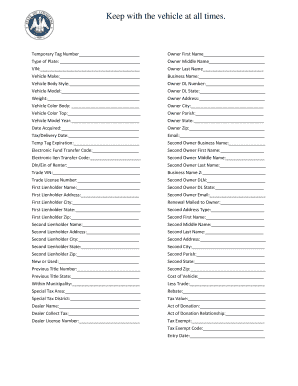

Start by obtaining the NY TC 343 EC form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing the form.

04

Follow the instructions provided for each section of the form, making sure to enter all required information accurately.

05

If applicable, calculate any adjustments or deductions as prompted within the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form according to the guidelines provided, either electronically or via mail.

Who needs NY TC 343 EC?

01

Individuals who are claiming certain credits or exemptions related to the New York State personal income tax.

02

Taxpayers seeking to report specific types of income or deductions as required by New York State tax law.

Fill

form

: Try Risk Free

People Also Ask about

What are the rules for unemployment in Illinois?

Who Qualifies for Unemployment Insurance? 1. To qualify, you must have earned at least $1,600 during a recent 12-month period (known as the base period) and you must have earned at least $440 outside of the base period quarter in which your earnings were the highest.

Who is exempt from work search in NY?

You may be exempt if you are: Temporarily laid off or seasonally employed and have a definite return-to-work date of four weeks or less. A union member who must obtain work through the union hiring hall. You must comply with your union's membership and work search requirements.

What disqualifies you from unemployment in Illinois?

There are several ways you can be disqualified from receiving unemployment benefits in Illinois: You quit your job without good cause. You were fired due to misconduct connected to your work. You did not have a good reason to apply for Illinois unemployment or did not accept a suitable job offered to you.

What reasons can you be denied unemployment in Illinois?

For What Reasons Can You Be Denied Unemployment? Failing to Meet the Earnings Requirements. Quitting Your Last Job. Getting Fired for Misconduct.

What is a work search activity for PA unemployment?

The following qualify as work search activities: Attending a job fair. Searching open positions on PA CareerLink® or job posting boards. Creating and uploading a resume to PA CareerLink® or job posting boards.

What are the work search requirements for unemployment in Illinois?

The work search must include: a list of employers contacted with the names of the persons contacted and their phone numbers or addresses; the dates of your contacts; your methods of contact; the kind of work you applied for; and the results of your contacts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY TC 343 EC for eSignature?

Once you are ready to share your NY TC 343 EC, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the NY TC 343 EC in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NY TC 343 EC and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete NY TC 343 EC on an Android device?

Use the pdfFiller app for Android to finish your NY TC 343 EC. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is NY TC 343 EC?

NY TC 343 EC is a form used in New York State for tax credits related to the Employee Development Program. It is part of the state's efforts to provide tax relief to eligible businesses.

Who is required to file NY TC 343 EC?

Entities that qualify for the Employee Development Program tax credits and wish to claim these credits on their state tax returns are required to file NY TC 343 EC.

How to fill out NY TC 343 EC?

To fill out NY TC 343 EC, applicants must provide accurate information on their business, details regarding the employee development activities, any eligible expenses incurred, and the total credit being claimed.

What is the purpose of NY TC 343 EC?

The purpose of NY TC 343 EC is to enable businesses to claim tax credits for expenses related to employee training and development, thereby promoting workforce improvement and economic growth in New York State.

What information must be reported on NY TC 343 EC?

Required information includes the business's name and identification number, details of the training programs, expenses incurred for those programs, and the total amount of credit being claimed.

Fill out your NY TC 343 EC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY TC 343 EC is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.