Get the free irs form 709 rev july 1999

Show details

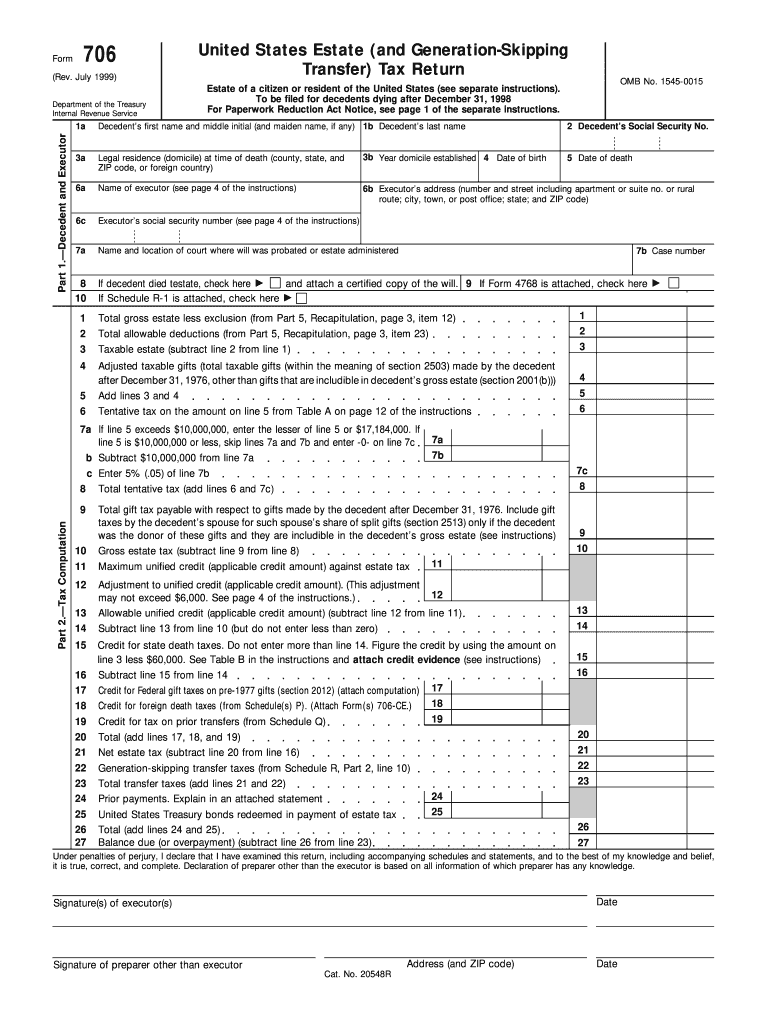

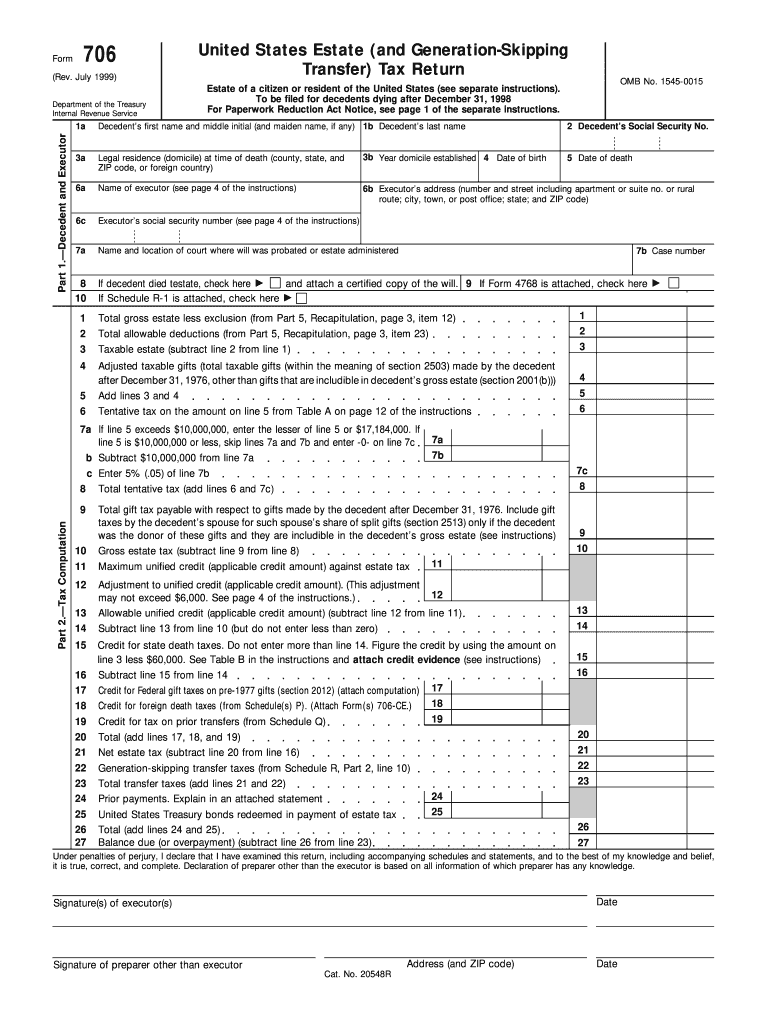

Form706(Rev. July 1999)Part 1. Decedent and ExecutorDepartment of the Treasury

Internal Revenue ServiceUnited States Estate (and Generation Skipping

Transfer) Tax Return1aDecedents first name and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 709 rev

Edit your irs form 709 rev form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 709 rev form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form 709 rev online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 709 rev. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 709 rev

How to fill out IRS Form 709 Rev:

01

Gather all necessary information: Before filling out Form 709 Rev, make sure you have all the required information at hand. This includes personal information for yourself (such as name, address, and social security number) as well as for the donor and recipient of the gifts.

02

Understand what qualifies as a gift: In order to accurately fill out the form, it's important to understand what qualifies as a gift in the eyes of the IRS. Generally, any transfer of property where full consideration is not received in return is considered a gift. This can include cash, assets, or even partial interests in property.

03

Determine the applicable exclusions and deductions: The IRS allows certain exclusions and deductions when reporting gifts on Form 709 Rev. Familiarize yourself with these to ensure you are taking advantage of any potential tax benefits. This can include the annual exclusion, marital deduction, and charitable deduction.

04

Calculate the taxable gifts: The form requires you to calculate the total value of taxable gifts made during the year. This is done by subtracting any applicable exclusions and deductions from the total value of gifts made.

05

Report the gifts made: Once you have calculated the taxable gifts, you will need to report them on the appropriate section of Form 709 Rev. Be sure to accurately list the amount, nature of the gift, and the identities of the donor and recipient.

06

Complete the necessary schedules: Depending on the complexity of the gifts made, you may need to complete additional schedules that accompany Form 709 Rev. These schedules provide more detailed information about specific types of gifts and should be filled out accordingly.

Who needs IRS Form 709 Rev:

01

Individuals who make gifts exceeding the annual exclusion: The IRS requires individuals to file Form 709 Rev if they make gifts to any one person that exceed the annual exclusion amount. The annual exclusion is the maximum amount that can be gifted to an individual within a calendar year without triggering the need to report it.

02

Donors who want to preserve their lifetime gift and estate tax exemptions: Filing Form 709 Rev allows donors to keep track of their lifetime gift tax exemptions. By filing the form, donors can reduce the amount of their available exemption that is used, thus preserving it for potential future use in estate tax planning.

03

Individuals in a gift-splitting situation: Married couples who split gifts with each other can utilize Form 709 Rev to report these split gifts. This allows them to take advantage of both spouses' annual exclusions and lifetime gift tax exemptions.

Remember, it is always recommended to consult with a tax professional or seek guidance from the IRS website to ensure accurate completion of Form 709 Rev and compliance with any current tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

How does the IRS know if you give a gift?

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

What is the IRS rule for gifting money to family members?

The gift tax limit was $16,000 in 2022 and is $17,000 in 2023. The gift tax rates range from 18% to 40%. The gift giver is the one who generally pays the tax, not the receiver.

What is the gift tax exclusion for 1999?

The first $10,000 of gifts of present interests to each donee during the calendar year is subtracted from total gifts in figuring the amount of taxable gifts. For a gift in trust, each beneficiary of the trust is treated as a separate donee for purposes of the annual exclusion.

What is the best way to gift money to family members?

Giving cash is the easiest and most straightforward way to accomplish gifting money to family members. You can write a check, wire money, transfer between bank accounts, or even give actual cash. You know exactly how much you are giving, making it easy to stay under the $17,000 annual gift tax exclusion.

What happens if I don't fill out Form 709?

The IRS finds out if you gave a gift when you file a form 709 as is required if you gift over the annual exclusion. If you fail to file this form, the IRS can find out via an audit.

What is the penalty for 709 gift tax return?

Late filing penalty. A penalty is usually charged if your Form 709 is filed after the due date (including extensions). It is usually 5% of the tax not paid by the original due date for each month or part of a month your return is late. The maximum penalty is 25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irs form 709 rev without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your irs form 709 rev into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete irs form 709 rev online?

Completing and signing irs form 709 rev online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make edits in irs form 709 rev without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your irs form 709 rev, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is irs form 709 rev?

IRS Form 709 is used to report gifts and generation-skipping transfers subject to federal gift and/or generation-skipping transfer tax.

Who is required to file irs form 709 rev?

Individuals who have made gifts in excess of the annual exclusion amount or want to split gifts with their spouse may be required to file IRS Form 709.

How to fill out irs form 709 rev?

IRS Form 709 can be filled out by providing information about the donor, recipient, and details of the gift or generation-skipping transfer. The form also requires information on any previous gifts made by the donor.

What is the purpose of irs form 709 rev?

The purpose of IRS Form 709 is to calculate and report gift and generation-skipping transfer tax liabilities to the Internal Revenue Service.

What information must be reported on irs form 709 rev?

Information such as the donor's and recipient's details, value of the gift or generation-skipping transfer, any gift tax paid, and details of any previous gifts must be reported on IRS Form 709.

Fill out your irs form 709 rev online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 709 Rev is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.