OH IT 1040 2009 free printable template

Show details

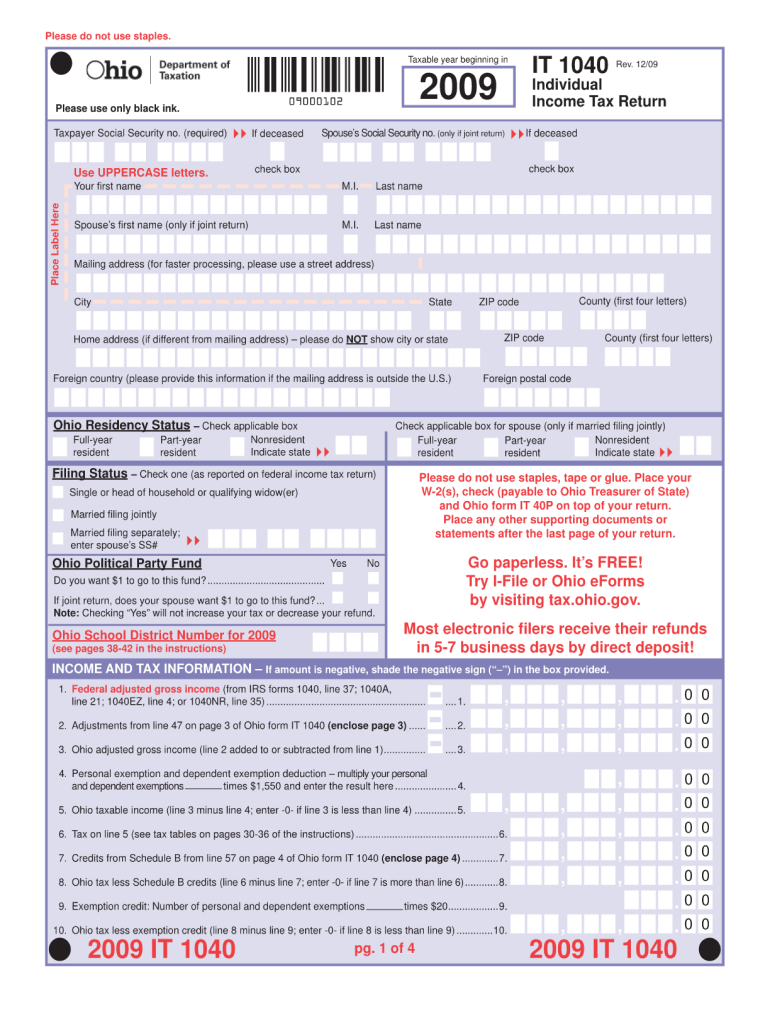

Please do not use staples. Taxable year beginning in Please use only black ink. 09000102 2009 Last name IT 1040 Rev. 12/09 Individual Income Tax Return Taxpayer Social Security no. (required) If deceased

pdfFiller is not affiliated with any government organization

Instructions and Help about OH IT 1040

How to edit OH IT 1040

How to fill out OH IT 1040

Instructions and Help about OH IT 1040

How to edit OH IT 1040

To edit the OH IT 1040 tax form, you can utilize tools that allow for PDF editing. With pdfFiller, users can upload the existing form, make adjustments as necessary, and save the updated document. This can facilitate accurate reporting and compliance with tax laws.

How to fill out OH IT 1040

Filling out the OH IT 1040 form requires careful completion of all relevant sections to ensure accuracy. Begin by entering personal identification details, including your name, address, and tax identification number. Subsequently, report income sources and deductions as specified on the form. It is advisable to cross-check entries with supporting documentation to avoid discrepancies.

About OH IT previous version

What is OH IT 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OH IT previous version

What is OH IT 1040?

OH IT 1040 is the tax form used by residents of Ohio to report their state taxes. This form captures essential financial information for tax liability calculation and compliance with state tax obligations.

What is the purpose of this form?

The purpose of the OH IT 1040 form is to assist Ohio taxpayers in reporting income, calculating state taxes owed, and claiming any applicable credits or deductions. Accurate submission ensures adherence to state tax regulations.

Who needs the form?

Ohio residents who earn income and are subject to state income tax must complete the OH IT 1040 form. This includes individuals, couples, and certain businesses who need to report their earnings within the state.

When am I exempt from filling out this form?

You may be exempt from filing the OH IT 1040 form if your income falls below the threshold set by the Ohio Department of Taxation. Additionally, if you have no taxable income or are a dependent of another taxpayer, you may not be required to file.

Components of the form

The OH IT 1040 form comprises various sections that require detailed entries, including personal information, income details, and deductions. It also includes spaces to report any tax credits that may lower your overall liability. Understanding each component is crucial for accurate completion.

Due date

The due date for submitting the OH IT 1040 form typically aligns with the federal tax return due date, which is usually April 15 each year. It is crucial to adhere to this deadline to avoid penalties and interest charges.

What payments and purchases are reported?

The OH IT 1040 form requires reporting of all taxable income, including wages, interest, and dividends. Additionally, any relevant deductions or credits associated with purchases made during the tax year must also be entered to provide a full picture of financial activity.

How many copies of the form should I complete?

Generally, you should complete one copy of the OH IT 1040 form for each tax filing. However, retaining copies for your records is recommended in case of future inquiries or audits.

What are the penalties for not issuing the form?

Failing to submit the OH IT 1040 form by the due date can lead to penalties imposed by the Ohio Department of Taxation. These penalties may include fines or interest on any taxes owed, and persistent failure to file may result in further legal repercussions.

What information do you need when you file the form?

When filing the OH IT 1040, you will need your Social Security number, income documentation (such as W-2s and 1099s), information regarding deductions or credits, and any prior year tax return details. Having these documents ready will facilitate a smooth filing process.

Is the form accompanied by other forms?

In some cases, the OH IT 1040 may need to be accompanied by additional schedules or forms, especially if you are claiming specific credits or deductions. Be sure to check the instructions accompanying the OH IT 1040 for any necessary supplemental information required for your filing.

Where do I send the form?

The completed OH IT 1040 form should be sent to the address specified in the instructions for the form. This may vary based on whether you are submitting a payment or filing electronically, so it is vital to review the relevant guidelines presented with the tax form.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

love learning everything. Problem with sending multiple pages in one email to have signed. Problems with getting the signature from the recepient because the codes don't work consistently.

I am selling my own piece of real estate and this has been awesome for the necessary forms.

See what our users say